Today’s Headlines

- ASX 200 drops after High Court ruling. Down 13 pts to 5903.

- Banks again fall as worries on Royal Commission reignite.

- Volume inflated by options expiry.

- Corporate AGMs in focus.

- High 5938 Low 5875.5.

- 7 points lost in a tumultuous week.

- MQG hits all-time high as Stevens joins board.

- Across the board weakness with few bright spots.

- AUD under pressure after court ruling at 76.42c

- US futures up 3.

- Asian markets drawing strength with Japan up 1.07% and China CSI up 0.39%.

STOCK STUFF

Movers and Shakers

- BHP -0.19% iron ore price falling.

- ILU -0.31% quarterly report.

- BKL +9.89% upgraded by Credit Suisse.

- QAN -5.55% Joyce says tough trading ahead.

- IFL -2.61% cut to a sell by Bell Potter.

- NST -0.38% cut to accumulate by Hartley’s.

- WOR -3.44% AGM address.

- NUF +8.03% insto offer success.

- S32 +4.85% base metals rising.

- MFF +2.02% Chairman’s address gathering support.

- VTG -9.52% CEO presentation.

- Speculative stocks of the day: Bod Australia (BDA) +14.29% significant QoQ surge in revenue to $130,000. Landmark agreement with Linnea.

- Biggest risers – BKL NUF, ORE, RMD, S32, MQG and SM1.

- Biggest fallers – SAR, QAN, MAH, WOR, SRX and AAC.

TODAY

- Macquarie Group (MQG) +3.92% Net profit to $1.25b – 19% higher on the pcp and beating consensus forecast of $1.14b. Says it expects the second half to be softer, but the full year broadly in line with FY17. The bank says it recognises the first half had substantial performance fees. Ex-RBA Governor, Glenn Stevens to join the Macquarie Board.

- Murray Goulburn (MGC) -1.20% Canadian company, Saputo Dairy has won the bid to acquire MGC for A$1.3bn. Saputo Dairy was the winner in the bid for Warrnambool Cheese and Butter in 2014. At its AGM this morning, the company said the deal still needed shareholder and regulatory approval. but has the unanimous support of the MGC board.

- Iluka (ILU) -0.31% Releases 3Q production results. Production volumes for mineral sands were 25% higher YoY, but 8% lower on the 2Q thanks to planned maintenance work carried out at its separation plant. Net debt was reduced to $212m from $305m. The company said favourable market conditions remain, and there has been an uplift in both zircon and rutile prices. Full year production guidance was maintained.

- Tabcorp (TAH) -1.83% AGM today. NPAT down 3.8% to A$178.9m. Revenue up 5.7% to A$578.8m. Core wagering and media division was the standout, with revenue rising 4.5% but Sun Bets disappointed, falling 5.3%. CEO said the company expects to implement its Tatts merger next month.

- AMP (AMP) -1.78% 3Q results. Said its total loan book grew to A$19.2b. Net cash outflows of A$243m. And its Australian Wealth Management Assets rise A$211m in the 3Q, and are set to rise A$125bn.

- Resmed (RMD) +4.93% 1Q results. Revenue increased 13% to $523.7m, led by sales of its masks, software-as-a-service solutions, and devices. Operating cashflow was $94.0m. R&D expenses were 7.1% of revenue at $37.4m – up 9% on the pcp. NPAT was $86.1m, up 13% on the pcp. The company declared a 35c dividend.

- Orocobre (ORE) +5.58% Quarterly results. Production came in at 2,135t of lithium carbonate, and continues to increase as brine concentration and evaporation rates increase. The company says its on track to achive 1,220t for the month, and reconfirmed full year guidance of 14,000t. Sales revenue was US$23.5m. Cash costs were US$4,987/t – higher on the back of an increase in soda ash unit costs and lower production volumes in July and August thanks to bad weather. Gross cash margins remained strong at US$6,203/t.

ECONOMIC NEWS

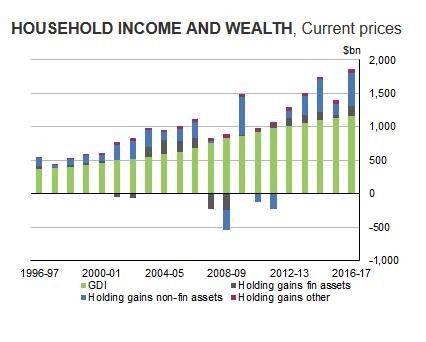

- The Australian economy expanded by 2.0% in chain volume terms in 2016-17. This is the 26th consecutive year of economic growth, but the lowest rate of growth since 2008-09.

- Weak wage growth resulted in compensation of employees rising 2.1%, the weakest annual rise since 1991-92.

- Economic growth in 2016-17 was largely driven by consumption.

- Household expenditure as measured in current price terms of 3.0% is the lowest on record.

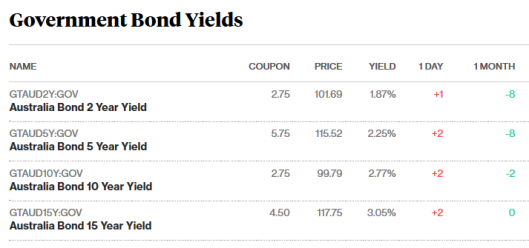

BOND MARKET

ASIAN MARKETS

- Lots of talk about DOW and S&P. Meanwhile the Nikkei

EUROPE AND US MORNING HEADLINES

- US defence secretary Jim Mattis reaffirmed America’s “ironclad commitment” to South Korea on a visit to the North Korea border.

- President Trump has agreed to delay the release of hundreds of sensitive records related to Kennedy’s assassination under pressure from US intelligence agencies who say they need more time to review the information. It has been 54 years clearly more time needed.

- Saudi eyes private stake sale in Aramco as one option available other than an IPO.

- More UK retailers reported falling sales this month than at any point since March 2009. The survey of 49 major retailers found 15% saw sales rise in October compared with the same month of 2016, 35% reported steady business levels, and 50% said sales fell.

- Deutsche Boerse’s chief Carsten Kengeter has resigned amid allegations of insider trading. The investigation is focused on whether EUR4.5m worth of shares he bought in 2015 were purchased amid secret talks with the LSE.

- Big day on Friday as Venezuelan oil company PDVSA is set to make a crucial debt payment.US$ 985m. If it fails it may lose control of its Houston Citgo refinery. Another payment due on November 2nd as well. PDVSA has missed seven interest payments totaling US$586 million this month, though they have 30-day grace periods.

- Is Amazon coming to a pharmacy near you? Or at least in the US. Amazon has received pharmacy-wholesaler licenses in a dozen states. Analysts have speculated that Amazon could soon enter the business of selling prescription drugs, threatening to disrupt retail drugstores, drug wholesalers, and the pharmacy-benefits management business. Not here mind you but in US. Decision due Thanksgiving.

And finally….

ZEN TEACHING

Do not walk behind me, for I may not lead.

Do not walk ahead of me, for I may not follow.

Do not walk beside me for the path is narrow.

In fact, just piss off and leave me alone.

Sex is like air.

It’s not that important unless you aren’t getting any.

No one is listening, until you pass wind.Always remember you’re unique.

Just like everyone else

Never test the depth of the water with both feet.

If you think nobody cares whether you’re alive or dead,

try missing a couple of mortgage payments.

Before you criticize someone, you should walk a mile in their shoes.

That way, when you criticize them,you’re a mile away and you have their shoes.

If at first you don’t succeed, skydiving is not for you.

Give a man a fish and he will eat for a day. Teach him how to fish, and he will sit in a boat and drink beer all day.

Have a great weekend

Clarence

XXX