The ASX 200 fell 115 points to 8629 (1.3%) as oil prices spiked higher on tankers hit in the Gulf. Another $50bn in value knocked off the ASX 200. Broad based losses with the banks falling, ANZ leading the big four down off 2.5% with the Big Bank Basket down to $295.56 (-1.2%). MQG dipped 2.7% as financials falling across the sector. SOL down 1.1% with NWL off 5.5% and CGF down 2.8%. Industrials sagged, WES off another 0.7%, retail falling on potential rate rises next week. JBH down 0.5% and LOV crashing 7.0%. MYR also under pressure, down 10.6% and NCK down 4.6%. Travel stocks fell again, FLT down 2.8%. Tech resumed the position of weakness, WTC down 2.6% and XRO off 4.2%. NXT fell 2.3% and 360 dropped 4.8%. REITs eased back, GMG down 3.3% and healthcare under pressure, RMD down again, off 3.1%. CSL falling 1.1%.

In resources, BHP fell 1.9% and RIO off 1.4%. Gold miners eased back, EVN down 1.3% and GMD falling 2.1%. Lithium eased, PLS off 2.5% and profit taking in rare earths after a strong run yesterday. AAI was a winner on higher aluminium prices, up 4.4%. Oil and gas stocks better, STO up 1.5% and WDS gaining 2.1% with uranium stocks slipping and coal stocks firming, YAL up 10.5% and WHC rallying 6.7%.

In corporate news, ALX fell after toll news in the US. LTR fell 0.6% after reporting a loss of $184m. CKF delivered with a 5.2% rise on German store openings.

On the economic front, everyone seems to be in lockstep now on a rate rise next week. Household spending has fallen for the first time since September 2024

10-year yields push to 4.95%.

Asian market weaker on oil prices, Japan down 1.5%, HK down 1.4% and China down 1.1%. Korea KOSPI down 1.3%

US Futures: DJ down 502, Nasdaq off 210.

HIGHLIGHTS

- Winners: YAL, WHC, CKF, KAR, AAI, TLX, NHC, BPT

- Losers: IPX, MYR, FRS, WA1, AIS, BRE, WBT, WC8

- Positive Sectors: Oil and gas. Coal.

- Negative Sectors: Everything else.

- ASX 200 Hi 8661 Lo 8596

- Big Bank Basket: Falls to $295.56 (-1.2%)

- All-Tech Index: Down 2.7%

- Gold: Falls to $7221 on stronger AUD.

- Bitcoin: Steady at US$69,333

- 10-year yields: Jumps to 4.95%

- AUD: Falls to 71.25c as USD picks up on haven buying.

- Dow down 552 Nasdaq down 270

MARKET MOVERS

- YAL +10.5% coal stocks doing well.

- CKF +5.2% trading update and German moves.

- KAR +4.8% oil price rise.

- TLX +4.4% no new news.

- TER +8.0% kicking again.

- IPX -14.3% half year accounts.

- FRS -9.5% half yearly accounts.

- MMS -7.8% ex dividend and some.

- CAT -7.8% loses another life.

- SDR -8.1% LW article.

- MYX -9.4% good day yesterday bad day today.

- Speculative Stock of the Day: LSR +33% – visible copper sulphides in Maiden drill holes at Three Saints in Chile.

ECONOMIC AND OTHER NEWS

- Australian household spending has fallen for the first time since September 2024, marking a significant shift after more than a year of steady growth, according to the Household Spending Insights Index by the Commonwealth Bank.

- The Index declined 0.5% in February, with spending falling across half of the 12 categories measured. Annual growth also slowed to 4.9%, the weakest pace since August 2025.

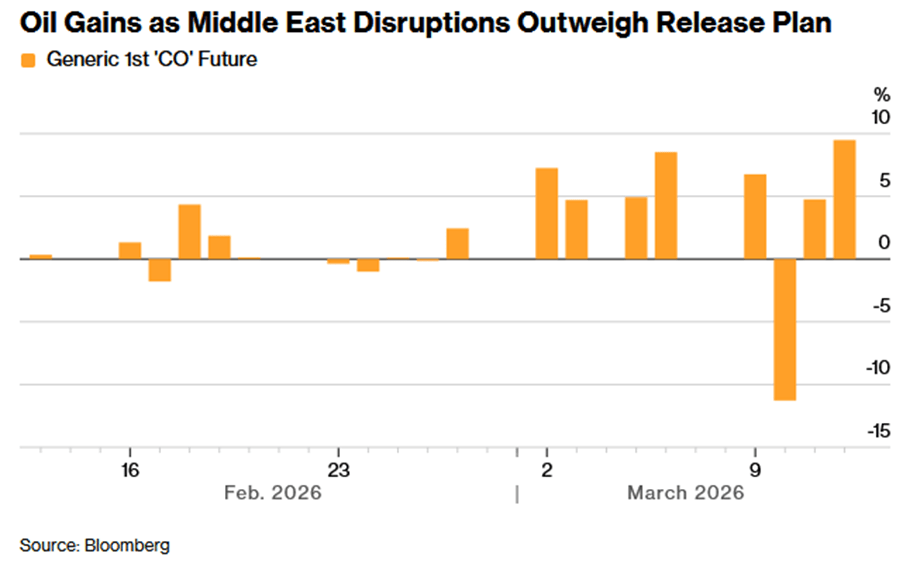

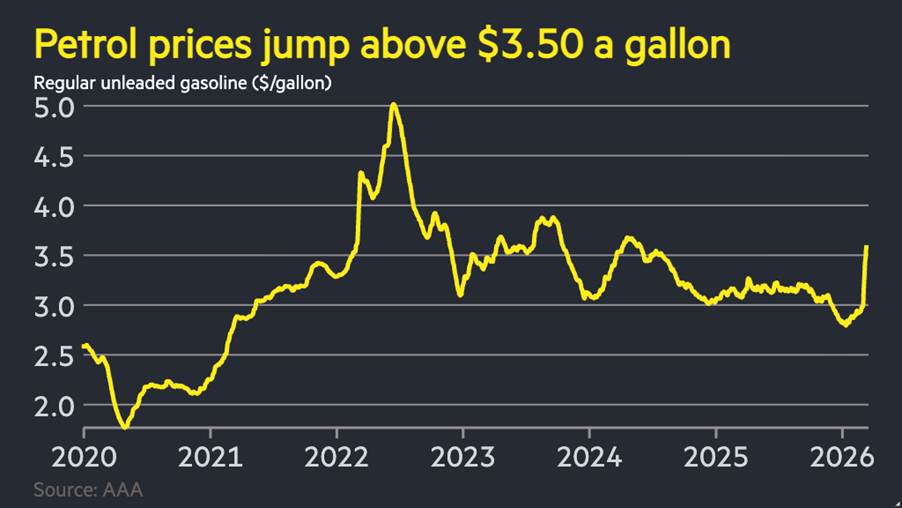

- Oil surges above $100. Oman key export terminal evacuated. ANZ senior commodity strategist said markets were underestimating the risk that early logistical disruptions would evolve into sustained production losses.

- A 10% increase in energy prices that persists for a year would push global inflation up by 40 basis points and slow economic growth by 0.1-0.2%, according to the International Monetary Fund.

- UBS has raised its near-term price forecasts for aluminium and thermal coal, citing supply disruptions from the Middle East conflict.

- The Trump administration has also started investigating trade practices of 16 trading partners under Section 301.

- Cliffwater caps payouts at credit fund as redemption requests surge.

- Goldman executive says private markets clients ‘glad’ about Iran war ‘distraction’ Yes he said that with his outside voice!

- Oracle prepares for lay-offs as it hails efficiencies from AI coding tools.

- Google said its fibre internet unit called GFiber is combining with Astound Broadband and forming an independent provider, with Google remaining as a minority shareholder.

- Atlassian lays off 1600 people as AI gobbles jobs.

- Iran to pull out of Men’s football World Cup.

And finally…..

I just read that alligators can grow up to 15 feet. But I haven’t seen any with more than 4.

Clarence

XXXXX