Tags

abbott, anz, asx, Asx 200, ASX200, aussie dollar, australia, Australian Sharemarket, bank of england, banks, ben, Ben Bernanke, Bernanke, BHP, BHP Billiton Limited, billabong, boe, BOJ, BRU, cba, Charlie aitken, china, commonwealth bank, Commonwealth Bank of Australia, copper, CPU, crash, cyprus, diggers and dealers, dollar, dow, draghi, ECB, economy, essex Lion, eu, euro, europe, eurozone, fairfax, fed, finance, fmg, fomc, Fortescue, Fortescue Metals Group Ltd, Fortescue mining, france, gold, greece, igr, insurance, Interest Rates, iron ore, iron ore falls, italy, Japan, Macquarie Group Limited, Mario Draghi, marmota, meu, Mo farrah, NAB, National Australia Bank Limited, National Bank, nev power, Newcrest Mining Limited, oroton.qbe, qbe, RasPutin, RBA, Reserve Bank, results preview, RIO, Russia, SGP, shares, silver, Sirius Resources, slr, stevens, stock, stocks, super mario, telstra, Telstra Corporation Limited, ten, tinkler, TLS, twiggy, uk, Ukraine, wbc, WHC, Whitehaven Tinkler coal bid cash, Woodside Petroleum Limited, woolworths, wow, yellen, zombieland

A snapshot of today:

What happened today?

ASX 200 rises 73.6 points to 5071. Relief rally on low volumes, but the range is intact. Late closing rally helped. China behaves and US futures down 47.

A much brighter day today as once again we bounced off the 5000 level. Somewhat unconvincing but we will take it none the less. A very much defensive bias to the rally with REITS, Telco and Healthcare shining. Some bargain hunting emerged at these levels with no disasters overnight on overseas markets helping. The mood though is still uncertain and conviction is lacking. Volumes remain low as school holidays keeps some players sidelined only $4.5bn.

- Banks and financials led the rally with the big four up around 1.3%.

- REITS were especially in demand on a perceived safe haven appeal. Scentre Group (SCG) +3.19% and Federation Centres (FDC) +3.82% were two of the best.

- In resources BHP +0.22% continues to be under a cloud although a closing rally helped them close higher. Not FMG -1.38% though on forecasts of lower iron ore prices. BHP is being especially targeted given it progressive dividend policy and the offshoring of some franking credits to the UK to ensure they can pay dividends there. There are also comments that their credit rating may be affected by continuing weakness in commodity prices.

- Base metal stocks continued their recent weakness with Independence Group (IGO)-3.46% , Iluka Resources (ILU)- 4.08%, Sandfire Resources (SFR)-1.48% and Western Areas (WSA) -1.76%.

- Energy stocks were better except for Santos (STO) -0.62% despite good news on impending LNG shipments from Gladstone. Gold stocks did have a good day though as the AUD Gold price did well overnight. Newcrest (NCM) +3.35% and Northern Star (NST) +7.69%.

- In Industrials TPG (TPM) + 3.15% continued its run after the numbers. Telstra (TLS) + 1.78% were dragged along for the ride as were M2 Group (MTU) +1.78%

- Sydney Airports (SYD) + 1.83% continues their stellar run, as did others in the infrastructure sector QUBE Holdings (QUB) +1.47% Auckland International (AIA) +0.67%.

- Consumer stocks picked up as sentiment improved. Wesfarmers (WES) + 2.51% and Woolworths (WOW) +1.56% bounced hard as did some gaming groups Tatts Group (TTS) +3.42%, Aristocrat Leisure (ALL) +1.22% and Echo Entertainment (EGP) +2.12%.

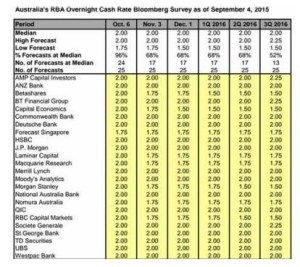

ANZ have turned bearish on the local economy and are calling for two rate cuts to 1.5% by mid year 2016.

Looking at the rest of the economists forecasts.

In Corporate News

- Brickworks (BKW) -0.85% announced their results today. In the year ended 31 July, Brickworks reported an 8 % rise in revenue to $723.6 million. It also said east coast home building boom shows no sign of slowing down as impairments dragged its full-year profit down 24% $78.1 million. Underlying profit for the 2014-15 year rose 18.8 % to $120.3 million.

- Senex (SXY) +24% announced a positive move in relation to a gas deal with Santos. The deal will hand Senex $42 million in cash plus a host of technical data that will speed a final investment decision on the project, in exchange for a gas-rich exploration permit that sits in the middle of the GLNG venture’s Roma coal seam gas acreage.

- Macquarie Group (MQG) +0.73 % as Peter Warne was appointed as new Chairman from March next year.

- G8 Education (GEM) -3.24% Chair Jenny Hutson has resigned following the failed attempt to take over their rival Affinity Education (AFJ) +0.56%.

- Pro Medicus (PME) +14.25% signed an $11m deal with Allegheny Health Network for the analysis of medical images using the Pro Medicus Visage 7 technology. This is a five year deal and does has some upside.

- Fonterra (FSF) +5.96% has lifted its milk payout for its New Zealand farmers after a slight recovery in global commodity products in past months, and is promising further increases this season. The New Zealand Dairy co-operative raised the price by NZ75c to $NZ4.60 a kilogram milk solids. It is forecasting the final payout for the season of $NZ5-5.10 a kilogram milk solids.

- US fund manager, BlackRock, who was previously the largest shareholder in BHP +0.22% announced they have sold out and no longer held over 5%. BlackRock still owns 57 million shares, 1.78% of the BHP, down from 155 million at the end of Q2 – so there has been a bit of selling over the past months.

In Asia, Japan was back on line today with a modest 2.3% loss and China up around 0.6% as some more positive broker comments on the Chinese economy helped.

Chinese shares have bounced higher at the start of trade, and HSBC reckons any further losses will now be limited after leveraged traders cut $US218bn of positions. The outstanding balance of margin loans on the Shanghai and Shenzhen bourses has tumbled by 60% to $US147bn since the June peak. Borrowed funds now account for 2.8% of overall market capitalisation, a 10-month low and down from a record 4.5% earlier this year. The figures don’t include unofficial debt.

Japanese car stocks were hit hard as fallout from the Volkswagen scandal spreads. Mazda Motors dropped 7% whilst spark plug supplier to VW, NGK fell 11%.

Early European market calls

- FTSE 6017 down 15

- DAX 9591 down 22

- CAC 4424 down 9

And finally Janet Yellen is speaking tonight but do not expect too much out of the Fed chief as she will not even answer questions. Think there may be a few though.

Clarence

xxxx

Get a Global take on things at http://www.ntmarkets.com