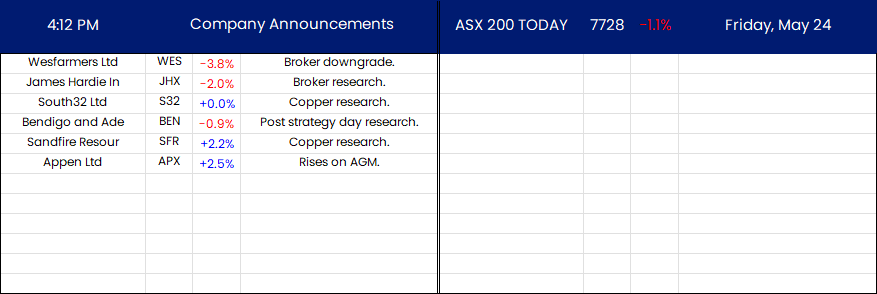

The ASX 200 falls another 84 points to 7728 as US markets and commodities weigh. Down 1% for the week. No recovery from lows either, although it tried once; banks were hit as profit takers moved in, and the Big Bank Basket went down to $207.50 (-1.4%). CBA crashed 1.5% with WBC off 1.2% and MQG down 0.8%. Insurers slid too with QBE down 1.5%. REITS slipped away led lower by GMG off 1.5% and SCG down 1.6%. Industrials were hit with WES continuing its slide down another 3.8%. WOW and COL also in the doghouse today with falls around 1.2%. Tech down as XRO fell 2.7% and WTC off 1.4%. REA and others in the platform space fell, with healthcare seeing sellers ahead of a long US weekend. RMD down 3.2% and SHL falling 3.0%. Resources were a slight surprise, outperforming after the rout yesterday. BHP was down a modest 0.6%, FMG fell 0.8%, and lithium stocks fell hard again. PLS down 1.5% and MIN off 1.9%. Gold miners could have been worse, NEM down only 0.9% and EVN up 0.5%. Oil and gas stocks better, STO up 0.1% and WDS gaining 0.7%. In corporate news, APX rose 2.5% on an update, PPT lifted its stake in SGR to 8.8%. Nothing on the economic front locally. Asian markets all weaker. European markets set to follow the US lower. 10-year yields are relatively steady at 4.31%.

HIGHLIGHTS

- Winners: AX1, CU6, C79, MGX, JMS, NWH, CGF, DRO

- Losers: FBU, APM. EMR, TWE, BCI, IEL, DVP, CHC

- Positive sectors: Nothing.

- Negative sectors: Everything.

- ASX 200 Hi 7798 Lo 7717 Down only 1% for the week.

- Big Bank Basket: Falls to $207.50(-1.4%).

- All-Tech Index: Down 1.3%

- Gold: Falls to $3536

- Bitcoin: Lower at US$67711

- 10-year yields higher at 4.31%.

- AUD: Falls to 66.00c.

- Asian markets mixed Japan down 1%. China down 0.4% and HK off 1.3%.

- Dow futures up 17 NASDAQ Futures up 11 points.

- European markets opening lower. G7 Finance minister meet in Italy. UK retail sales fall hard.

MAJOR MOVERS

- AX1 +5.4% if the shoe fits. Broker upgrades.

- JMS +3.2% manganese price increase.

- CU6 +5.3% rally continues.

- RUL +2.5% update on Buyback.

- KED +55.1% fairness opinion relating to merger.

- AGY +3.9% strategic investment.

- CNB +5.3% streets ahead with substantial shareholder notice.

- PLY +6.3% launches GoT game.

- MDR +9.0% On Ausbiz today.

- DVP -4.2% base metal falls.

- PMT -3.9% cap raising weighs/

- WES -3.8% rout continues.Broker downgrades.

- TWE -4.4% headwinds.

- A1M -9.3% placement.

- DLI -6.3% lithium falls.

- Speculative Stock of the Day: SER +112.5% second day in a row. Was the stock yesterday too.

COMPANIES

ECONOMIC AND OTHER HEADLINES

- European markets set to open significantly lower.

- China’s largest chipmaker SMIC is now the world’s third-largest foundry in terms of revenue in the first quarter with a market share of 6% in the first quarter.

- China consumes nearly 50% of the world’s semiconductors as it is the biggest assembly market for consumer devices.

- Samsung Electronics’ latest high bandwidth memory (HBM) chips have yet to pas the Nvidia tests due to heat and power consumption issues.

- Elon Musk’s SpaceX has initiated discussions about selling existing shares at a price that could value the closely held company at roughly $200bn.

- Janet Yellen says many Americans still struggling with inflation.

- Copper price to rocket to $40,000 a tonne, says top trader Andurand.

- UK Retail sales fall more than expected.

- Starwood Capital limits redemptions in $10bn US property fund.

And finally…..

Clarence

XXX