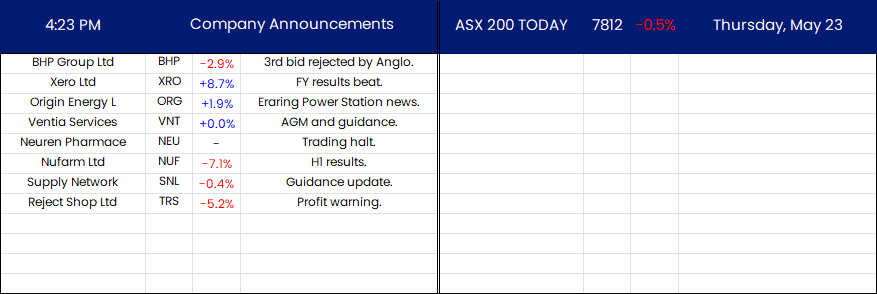

The ASX 200 falls 36 points to 7812 (0.5%) off the session lows as defensives rallied hard. NASDAQ futures improved helped by Nvidia results a positive. Healthcare and supermarkets did well. CSL up 1.4% with RMD rallying 1.0% and COH up 1.6%. WOW and COL also bucking the trend with WES continuing to fall. TLS managed a 1.2% rally after the recent drubbing. BXB put on 1.0% and SVW up 1.0%. Utilities doing ok, ORG up 1.9% on the power station news, and Tech better led by XRO with some good results rallying 8.7%. The All–Tech Index up 0.9%. In the banks, a little sloppy today The Big Four off around 1% and the Basket down to $210.38 (0.8%). Insurers better with QBE up 1.1% but MQG down 1.0%. REITS dipped with SCG off 0.9% and GPT down 1.1%. Resources were the problem today, BHP dropped 2.9% on its third and ‘final’ bid for Anglo being 9% higher and rejected again. RIO was dumped down 2.0% and FMG off 1.1%. Lithium and base metal stocks fell hard. Uranium was smacked down, PDN down 5.0% with BOE off 5.3%. PLS fell 1.5% and gold miners also on the seller’s lists. NST down 3.3% and NEM off 3.8%. AWC had a nasty day down 3.3%. Oil and gas unchanged. In corporate news, NUF sank 7.1% on falling profits and TRS fell 5.2% on a profit warning. NEU in a trading halt pending news on a drug trial. Nothing on the economic front today. Asian markets mixed with Japan up 0.6%. China down 1.3% and HK off 1.7%. 10-year yields steady at 4.26%.

HIGHLIGHTS

- Winners: XRO, FBU, CMW, COE, QAL, TWE, APM

- Losers: LRS, INR, RRL, NUF, BGL, CSC, SFR, GMD

- Positive sectors: Healthcare. Supermarkets. Defensives.

- Negative sectors: Resources. Banks.

- ASX 200 Hi 7818 Lo 7765. Rallies off lows on Nvidia hopes.

- Big Bank Basket: Falls to $210.38 (-0.8%).

- All-Tech Index: Up 0.9%

- Gold: Falls to $3569

- Bitcoin: Lower at US$69384

- 10-year yields steady at 4.25%.

- AUD: Falls to 66.24 c.

- Asian markets mixed Japan up 1.2%. China down 1.2% and HK off 1.7%.

- Dow futures up 45 NASDAQ Futures up 165 points.

- European markets opening slightly firmer.

MAJOR MOVERS

- XRO +8.7% results cheer.

- CMW +8.1% sells European fund management platform.

- APM +4.0% maybe some bid news.

- TWE +4.1% change in substantial holding.

- AGC +19.2% charging ahead again. Achilles gold results.

- ALA +4.8% company presentation.

- LRS -8.9% metal rout.

- NUF -7.1% half-yearly results.

- SFR -6.4% copper falls.

- PDN -5.0% NXG -5.2% uranium falls hard.

- ARR -10.0% stumbles as commodities fall.

- PEN -8.3% letter to shareholders.

- Speculative Stock of the Day: Strategic Energy Resources (SER) +33.3% raises $2m for South Cobar exploration.

COMPANIES

ECONOMIC AND OTHER HEADLINES

- JPMorgan Chase’s chairman and CEO Jamie Dimon says the U.S. economy could see a “hard landing.” He said interest rates could still go up “a little bit.”

- China is holding drills around Taiwan as ‘strong punishment’.

- EU seeks to stop Russia’s imports of western luxury cars via Belarus.

- Rishi Sunak calls July 4 UK election.

- Spain hits tourism record in race to catch France.

- Biggest US retailers cut prices as inflation hits shoppers.

And finally….

Clarence

XXXXX