Tags

ASX 200 finds the Easter Bunny. Up a huge 77 points at 7897 (+1.0%) hitting a record high. Seems appropriate. The end of the quarter and end of the month helped stimulate optimism. Banks took a breather with the Big Bank Basket up slightly to $210.48 (0.3%). MQG rose 0.9% with insurers mixed, REITs once again in demand. When aren’t they. GMG up another 1.9% with SGP rising 1.9%. TGP was a stand out on the sale of its HPI stake, up 17.8%. Industrials shot out of the box, WOW continuing its rally up 0.5% with TLS up 2.1% and WES up 1.2%. Utilities also finding friends, ORG up 1.3%. Retail sales helped the sector getting a boost from the Swift effect. JBH up 0.6%, SUL up 3.2% and BAP up 3.6%. Resources were the stars today, iron ore miners lifting, BHP up 1.4%, RIO up 0.7% and FMG rising 2.0%. Lithium stocks also in favour as auctions from Albemarle and SQM helping sentiment. PLS up 2.1% and LTR up 2.6%. Gold stocks enjoyed another solid day with NST up 1.7% and NEM rising 3.3%. Oil and gas stocks slightly better with old king coal stocks having a strong day, WHC up 5.3%. In corporate news, REA has ditched its deal to buy Dynamic Methods on ACCC concerns. BPT rose 3.7% after announcing savage job cuts. RMS has abandoned its potential takeover bid for Canadian miner Karora. On the economic front, Retail sales were slightly worse than expected despite a Swiftie bounce. Maybe brings rate cuts closer. Asian markets mixed, Japan down 1.7%, China up 1.0% and HK up 1.7%. 10-year yields fell to 3.96%.

HIGHLIGHTS

- Winners: MSB, RSG, STX, LTM, SLX, AWC. PMV

- Losers: ZIP, WC8, WA1, GEM, CU6, FPH, CTT

- Positive sectors: Iron ore. Lithium. Coal. Gold miners. Industrials.

- Negative sectors: Insurers.

- ASX 200 Hi 7901 Lo 7835

- Big Bank Basket: Up to $210.48 (0.3%)

- All-Tech Index: Up 0.5%

- Gold: Higher at $3361.

- Bitcoin: Steady at US$69853

- 10-year yields fell to 3.96%.

- AUD: Steady at 65.31c.

- Asian markets mixed, Japan down 1.3%, China up 1.1% and HK up 1.6%.

- Dow Futures down 1 Nasdaq futures down 4

MAJOR MOVERS

- MSB +12.1% punters piling in and no capital raise!

- RSG +10.3% Annual Report.

- LTM +8.3% lithium bounce.

- AWC +6.0% resource bounce in Alcoa.

- WHC +5.3% a merry old soul as coal remains crucial.

- PMV +5.6% broker upgrades on demerger plans.

- TGP +17.8% Sale of HPI stake.

- AGY +8.0% Rincon project EIA update.

- CPV +8.6% change of director’s interest.

- ZIP -7.3% comes undone.

- FPH -2.8% involuntary recall of limited pre 2017 devices.

- WA1 -3.3% West Arunta assay results.

- CKA -4.4% profit taking.

- BDM -9.3% director resignation.

- Speculative Stock of the Day: Allup Silica (APS) +89.7% good volume too on a presentation and announcement of high-grade silica sand results.

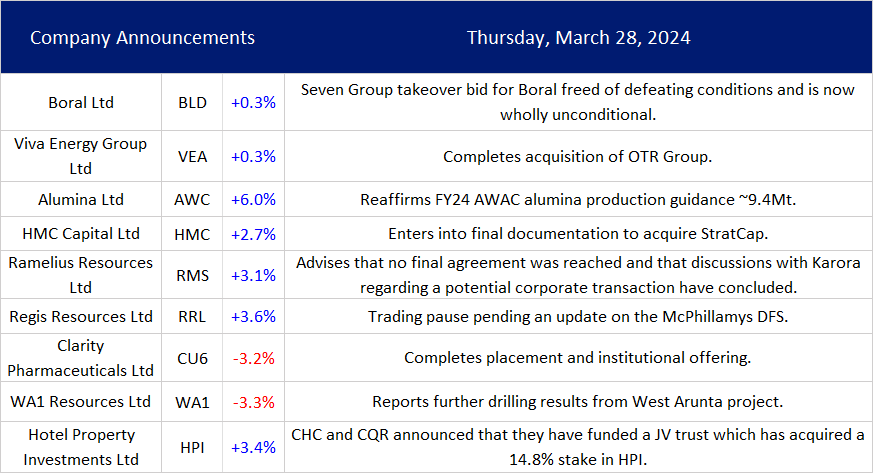

COMPANY NEWS

ECONOMIC AND OTHER HEADLINES

Australian Retail Sales – The Swift Lift!

The February 2024 seasonally adjusted estimate:

- Rose 0.3% month-on-month.

- Rose 1.6% compared with February 2023.

.png)

- The Swifties at Work. ABS says ‘Seven sold-out Taylor Swift concerts in Sydney and Melbourne boosted retail spending this month.’

.png)

- And household wealth rose for the fifth straight quarter (+2.8% or $419bn) in the December quarter 2023.

.png)

- Total job vacancies were 363,800, a decrease of 6.1% from November 2023.

.png)

- China’s economy is ending the first quarter on a “strong” note, according to a business survey published by the China Beige Book.

- China’s official data on retail sales, industrial production and fixed asset investment for January and February beat expectations across the board.

- Top Fed official says ‘no rush’ on rates after ‘disappointing’ data.

- Bank of Japan board members voice caution on interest rate hikes.

- Formula One owner closes in on €4bn deal for MotoGP.

- Economic experts slash growth forecasts for Germany.

- The share of made-in-China vehicles in Europe is expected to rise to 25.3% in 2024 as emerging Chinese brands like BYD expand their footprint in the region. About 19.5% of battery-powered EVs sold in the EU last year were from China.

- JPMorgan says stocks are so crowded they may crack at any time

..png)

Finally, I have just discovered that there is a US Senator called Heidi Heitkamp. How good is that. Hi De Hi.

Have a great Easter. Drive safe. Double Demerit Points apply.

Clarence

XXXX