The ASX 200 kicked higher again. Four days in a row, up 79 to 9086 (0.9%). Up nearly 2% this week. Off record highs as jobs data provides reasons for the RBA to raise rates again. Super Thursday and results dominated, some good, some terrible. Banks firmed yet again, certainty. The Big Bank Basket rose to $308.43 (+1.4%). NAB up 2.4% and WBC up 2.7%. MQG also had a good day up 1.6% with insurers better and financials generally firming, ZIP came undone on disappointing guidance and bad debts. Down 34.4%. MPL also fell 5.6% on some misses on the numbers. REITS slid with GMG down 4.0% on results, Industrials were patchy, WES fell 5.6% with ALL and JBH falling away. Healthcare was better, CSL up 1.0% and RMD up 1.5%. Tech was better again, WTC up 1.9% and XRO rising 0.8%. HSN kicked again on broker calls. MAQ also firmed on a new debt facility. TNE also a good bounce on broker upgrades. The All-Tech Index continued higher, up 1.1%.

Resources were also firm, BHP and RIO pushing ahead, gold miners better, GMD up 1.9% on results, NEM up 1.4% and oil and gas stocks rallied hard on crude pushing up on Iran fears. STO up 5.6% and WDS up 4.5% with uranium stocks better too. PDN up 5.5% and LOT rising 4.3%.

In corporate news, plenty around. HUB surged 14.2% on good numbers. LIC dropped 7.1% after profits fell, TLS gained 3.6% on better numbers and rise in dividends. SHL and NWH also rising on better numbers.

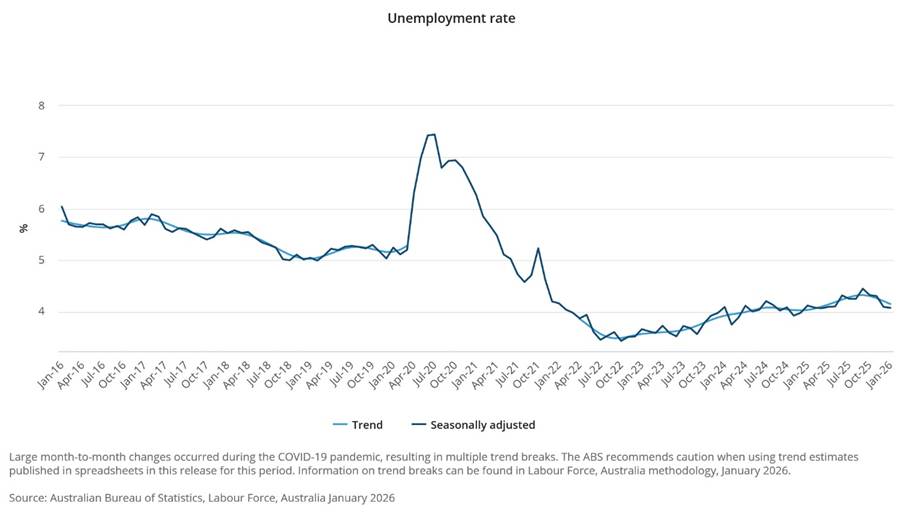

On the economic front, jobs numbers came in as expected but 4.1% headline rate gives RBA reasons to raise again perhaps.

In Asia, South Korean markets hitting new records. China and HK closed. Japan up 0.9%

US Futures up. DJ down slightly Nasdaq up 2 pts!.

HIGHLIGHTS

- Winners: HUB, IPH, FRS, SHL, KAR, RDX, NWH

- Losers: ZIP. LOV, MAF, AFG, EHL, ARU, SRL

- Positive Sectors: Banks. Miners. Tech.

- Negative Sectors: REITs. Retail.

- ASX 200 Hi 9118 Lo 9077. Up 2% so far this week. Narrow range again.

- Big Bank Basket: Rises to $308.43 (+1.4%)

- All-Tech Index: Up 1.1%

- Gold: Rises at $7078

- Bitcoin: Lower at US$66818

- 10-year yields: 4.78%

- AUD: Steady at 70.51c.

- Asian markets – Japan up 0.8% China and HK closed.

- US Futures up. DJ flat Nasdaq up 2

MARKET MOVERS

- SHL +9.9% solid beat to expectations.

- HUB +14.2% results beat.

- KAR +9.8% crude rise.

- NWH +8.7% good results.

- BMN +6.9% uranium back in focus.

- IPH +12.7% results cheer.

- A11 +19.1% trading halt on ASX ‘Please Explain’.

- SKS +14.8% High Jinks.

- ATG +9.7% Results announcement.

- EXR +10.1% outstanding results at Lorelle-3.

- LOV -12.8% results disappointment.

- MAF -9.9% results.

- AFG -9.3% broker comments.

- SRL -7.3% always volatile.

- ZIP -34.4% comes undone on disappointing numbers

- CXL -25.8% PLS deal.

- APX -13.8% big volume.

- AR1 -9.0% reinstatement to quotation.

- HRZ -10.5% capital raising.

- Speculative Stock of the Day: MSV +24.1% Good results. Good volume.

ECONOMIC AND OTHER NEWS

- Jobs number today. Unemployment rate stays strong. Full-time employment increased by 50,500 Part-time employment decreased by 32,700 – 4.1% the headline. Pressure still on RBA to raise rates.

- South Korean market jumps to new record high. The Kospi index jumped 2.84% to a fresh record high, with index heavyweights Samsung Electronics and SK Hynix up 4.14% and 1.48%, respectively. The index nearly doubled in 2025.

- Mark Zuckerberg said he reached out to Apple CEO Tim Cook to discuss ‘wellbeing of teens and kids’.

- Indian AI tech summit continues.

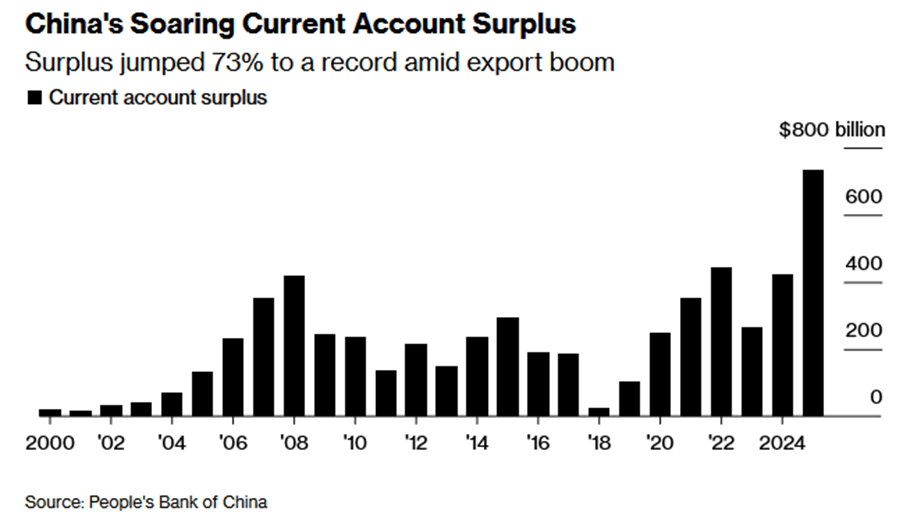

- IMF warns China’s economic policies are causing damage to others.

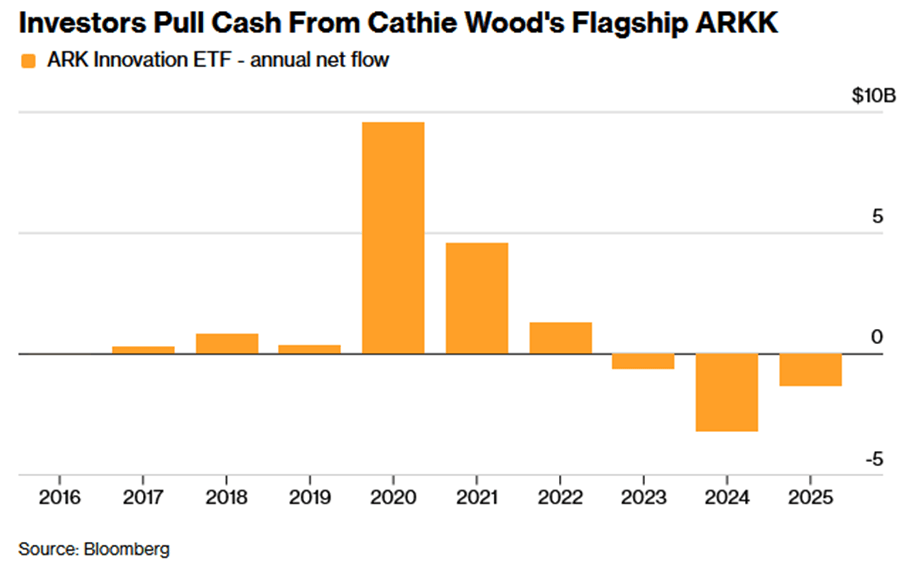

- Cathy Wood’s ARKK down again. Over the past half decade ARKK is down more than 50%, even as the Nasdaq 100 has seen gains of 80%.

- Trump renews attack on Starmer’s plan to cede UK ownership of Chagos Islands.

- UK to require tech firms to remove abusive images within 48 hours.

And finally…..

Went to an antiques auction and 4 people bid on me.

I’ve got an Australian friend who works in IT networking.

He comes from a LAN down under

Clarence

XXXX