The ASX 200 soared today as CBA delivered in spades, the index rising 147 points to 9015 (+1.7%). How things have changed around since ‘shambolic’ Friday last week. Up over 300 points since then! CBA beat forecasts and drove the banking sector higher. Not often that you see a 6.8% rise in CBA. NAB up 3.4% and the Big Bank Basket up to $292.52 (+5%). Insurers bounced back a little, SUN up 0.6% and MQG jumped 2.7% on broker comments. REITs under a little pressure with GMG down 1.0% and SCG off 0.5%. Healthcare in ICU today as CSL managed to top its shambolic CEO news with a bad set of numbers and dropped 4.6%. Some bargain hunters saving it from a worse fate. RMD dropped 4.7% as it went Ex-Dividend. Industrials were better, retail rose, JBH up 1.3% and WES up 1.0% with SGH also up 3.6% on better than expected numbers. Utilities better and ABB soared 14.8% on its deal with AGL. JHX also beat expectations and rose 10.9%.

In resource land, BHP up 1.6% and FMG doing well, up 2.3%. Gold miners started slow but ended up, EVN produced a good set of numbers and strong cash generation. Up 8.9%. NEM rose 2.4% and SBM up 10.5%. Lithium stocks improved slightly and uranium stocks off the bottom. Rare earths bounced, three-year highs in the underlying starting to feed into the sentiment.

In corporate news, results featured strongly, ASX CEO has quit, DMP has a new pizzaiolo. GQG slipped again on fresh FUM.

On the economic front, all eyes on US NFP, here we saw first home buyers loans jump the most since 2023!

US futures Dow up 141 and Nasdaq up 111.

HIGHLIGHTS

- Winners: EQR, ABB, AGL, JHX, SBM, EVN, 4DX

- Losers: CUV, MTM, BVS, AEL, AAR, MEI, RMD

- Positive Sectors: Banks. Financials. Insurers. Gold miners. Iron ore.

- Negative Sectors: Healthcare. REITs. ‘Old Skool’ Platforms.

- ASX 200 Hi 9013 Lo 8899 – What a difference a few days makes! Up 300 pts this week!

- Big Bank Basket: Skyrockets to $292.52 (+5%). New record high!

- All-Tech Index: Unchanged. Missed the memo.

- Gold: Slips to $7100.

- Bitcoin: Falls to US$67573

- AUD: Higher at 71.15c.

- Asian markets – Japan up 2.3% – HK up 0.4% and China down 0.2%

- European markets set for gains.

- US futures Dow up 141 and Nasdaq up 111.

MARKET MOVERS

- CBA +6.8% beats forecasts.

- EQR +19.1% tungsten play continues higher.

- ABB +14.8% acquisition of AGL telecom.

- JHX +10.9% good results beat.

- AGL +11.8% good results beat.

- SBM +10.5% Nova Scotia target pipeline.

- BRE +8.0% process delivers 97% rare earths.

- EVN +8.7% good results – swimming in cash.

- SPL +18.1% no idea but I like it.

- BET +12.2% pause in trading.

- BML +5.3% going well.

- KPG +5.8% HY results.

- MYX +3.9% nice to see.

- AT4 +3.2% kicks another day.

- CSL -4.6% results dump.

- BVS -5.4% profit taking.

- RMD -4.7% ex dividend.

- CUV -6.4% profit taking.

- Speculative Stock of the Day: GR8 +143% Placement commitments.

ECONOMIC AND OTHER NEWS

- AUD hits 71c. First time in three years.

- The number of new first-home buyer loans rose 6.8% to 31,783 in the December quarter 2025, according to data by the Australian Bureau of Statistics.

- House lawmakers could vote as soon as Wednesday on whether to reject some of President Donald Trump’s tariff policies, ahead of a midterm election focused heavily on anxiety over the US cost of living.

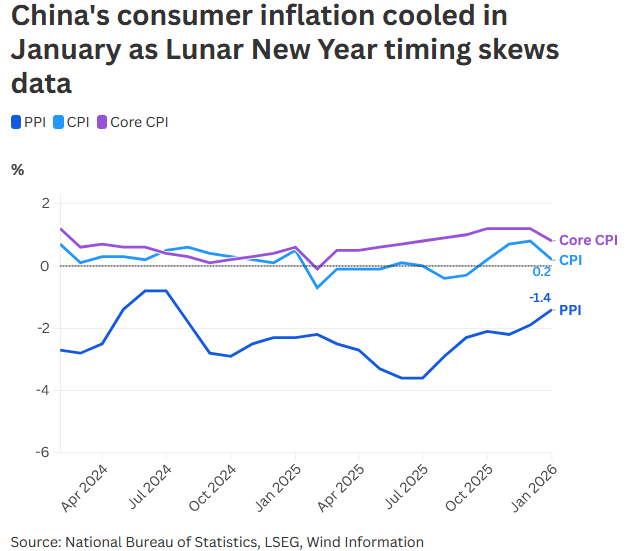

- China’s factory deflation eased more than expected in January, as downward pressure on prices moderates thanks to higher commodity costs and a crackdown on excessive competition among companies.

- Producer prices fell 1.4% last month from a year earlier, their smallest decline since July 2024. The consumer-price index rose just 0.2% in January from a year earlier — a slowdown caused largely by base effects — after a 0.8% rise in December.

- Howard Lutnick says he met Jeffrey Epstein only three times.

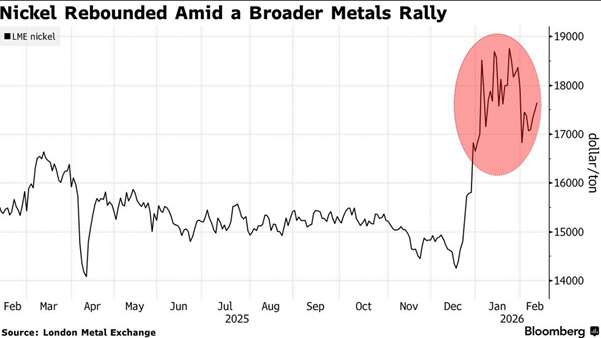

- Nickel prices are on a roll as Indonesia reaffirmed that it would cut output sharply.

- US Non-farm payrolls tonight. A gain of 55k is the consensus. Unemployment rate of 4.4%.

- Co-founders of Musk’s xAI join exodus from start-up’s tech team.

- Trump threatens to block opening of new border bridge with Canada.

And finally…..

Clarence

XXX