The ASX 200 started strongly, but wilted in the summer sun, up only 17 points at 8887 (0.2%). Part of the reason was the banks which fell as ANZ Consumer sentiment slid on rate rises last week. WBC and ANZ in trouble with around 2% falls, CBA down 0.7% with the Big Bank Basket down to $278.71 (-1.0%). MQG gave up early strong gains, up just 0.8% on a solid update. Insurers were bashed as OpenAI released a new insurance app in the US. Much like Compare the Market her. Brokers punished, AUB and SDF down significantly. Other financials solid, SOL up 2.2% and ZIP rallying another 6.1%. REITs solid, GMG up 1.2% and Healthcare was solid with CSL up 1.8% ahead of the results. Retail mixed, JBH down another 1.5% again, tech better and showing some signs of life, WTC up 2.6% on a Macquarie report, XRO up 2.2% and the All- Tech Index up 2.2%. Data centres doing better, NXT up 3.4% and MP1 up 2.6%.

In resources, BHP up 1.1% and RIO doing ok, Gold miners were mixed, NEM up 1.6% and GMD rising 2.8%. Lithium stocks better on a PLS price floor deal. Uranium stocks doing well too today, PDN up 5.5% and BMN up 10.9%. Oil and gas flat.

In corporate news, EOS soared 11.8% on a rebuttal to the Grizzly. NEM has flagged a Barrick IPO and TWE came to an agreement on its US distribution arm. CSL’s head honcho to retire immediately. Results tomorrow!

Asian markets – Japan up 2.2%. New record high. China unchanged and HK up 0.5%

US futures Dow up 19 and Nasdaq down 18. 10-year yields ease to 4.85%.

HIGHLIGHTS

- Winners: SRL, EQR, CU6, EOS, SLX, BOE, BMN

- Losers: AEL, SDF, IAG, AUB, SUN, LOT

- Positive Sectors: Iron ore. Gold miners. Uranium.

- Negative Sectors: Banks. Insurers.

- ASX 200 Hi 8926 Lo 8871 Narrow range.

- Big Bank Basket: Falls to $278.71(-1.0%)

- All-Tech Index: Up 2.2%

- Gold: Slips to $7113

- Bitcoin: Falls to US$69845

- AUD: Higher at 70.75c.

- Asian markets – Japan a new record on election landslide.

- European markets set for small gains.

- US futures Dow down 2 and Nasdaq down 23.

MARKET MOVERS

- SRL +19.7% volatility continues.

- EQR +13.5% good bounce.

- EOS +11.8% shrugs off Grizzly attack.

- SLX +8.4% uranium bounce.

- BMN +7.9% DYL +7.1% uranium bounce.

- EUR +18.2% Tanbreez drilling report.

- PEN +14.0% company presentation.

- AT4 +10.7% kicks again.

- AEL -22.1% drilling hits water.

- SDF -9.5% AUB -6.1% Open AI new insurance app.

- CSL -5.0% CEO and MD to retire immediately.

- IAG -6.2% Insurance app.

- AOV -3.8% results underwhelm

- GEM -20.6% update and write offs.

- BOC -8.6% low volume loss.

- PMT -10.8% Canadian cash raise.

- Speculative Stock of the Day: PVT +25%. No volume no real reason.

ECONOMIC AND OTHER NEWS

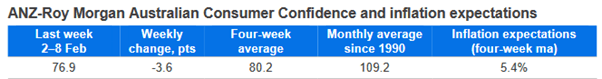

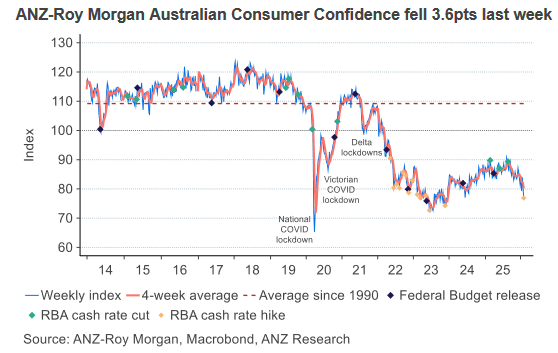

ANZ – Roy Morgan Consumer Confidence Survey.

- Consumer confidence fell 3.6pts last week to 76.9pts. The four-week moving average fell 1.9pts to 80.2pts.

- Weekly inflation expectations dropped 0.5ppt to 5.0%, while the four-week moving

- Average ticked down 0.1ppt to 5.4%.

- SoftBank shares surge 10% after telecom unit lifts outlook, Arm strength bolsters AI narrative.

- Japan’s markets hit new records as the Nikkei looks set to continue riding the “Takaichi trade.”

- Alphabet has added new AI risks to its annual report, including a potential impact on advertising. The company also noted risks of “large, long-duration commercial” contracts for AI infrastructure.

- US plans Big Tech carve-out from next wave of chip tariffs.

- US lawmakers call on Howard Lutnick to step down over ties to Epstein.

- De Beers likely to be sold to consortium, Anglo chief says.

And finally…

Clarence

XXXX