ASX 200 started strong but wobbled ahead of CPI and ended down 8 points to 8934 (0.1%) after CPI nudged higher. Now a 70% chance of a rate rise next week. Most sector of the market slid, Banks off slightly, ANZ down 0.5% and the Big Bank Basket unchanged at $268.50. MQG dropped 1.1% with insurers also weaker, QBE down 1.2% and ZIP came undone, off 4.0%. REITs also under pressure with GMG off 1.1% and SGP falling 0.9%. Industrials pretty weak across the board, WES down 0.7%, ALL off 2.8% and COL and WOW slipped. Tech was again smashed with WTC off 3.8% and XRO falling again. The All-Tech Index dropped 2.8%. Healthcare also saw sellers, RMD down 2.1% and CSL down 1.2%.

It was a different story in resources, BHP up 1.7% again, RIO doing well too and gold miners finding buyers again as bullion pushed above $5200. Silver miners also in demand, uranium glowing red hot, no fall out here with PDN up 5.4% and BMN soaring 17.1%. STO and WDS showed a clean pair of heels as crude rose. STO the standout up 3.0%.

In corporate news, AUB fell 4.7% after its acquisition and capital raise. ASX dipped slightly after raising expense guidance, BOE soared 10% after cutting cost guidance.

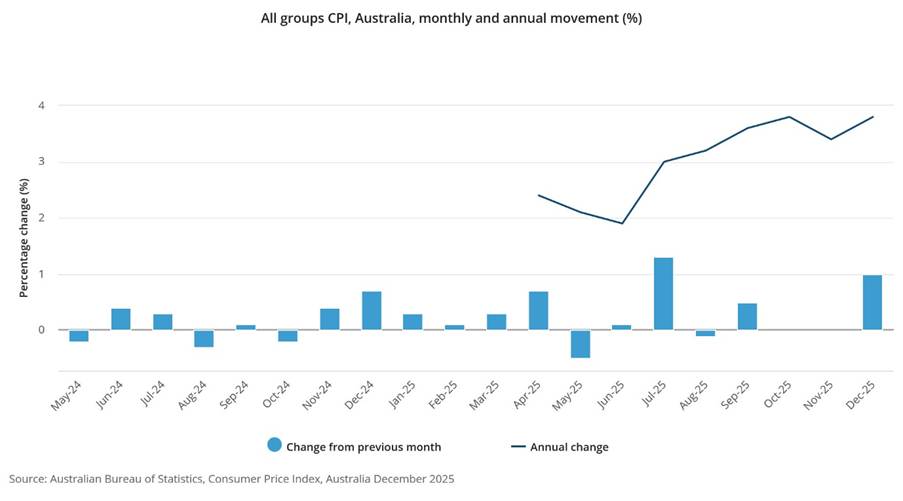

In economic news, inflation picked up to 3.8% in December. Blame the Ashes and the Barmy Army. Every economist is now jumping on the rate hike prediction. 70% chance now next week.

Asian markets mixed with Japan down 0.6%, China up 0.7% with Indonesia crashes on MSCI moves, down around 7%.

US Futures firm, Nasdaq up 150, Dow unchanged – Gold hits record.

10-year yields steady at 4.82%

HIGHLIGHTS

- Winners: BMN, DYL, BOE, EQR, SMI, SVL, SLX

- Losers: ELV, DTR, 4DX, 360, WBT, WC8, CAT

- Positive Sectors: Uranium. Copper. Gold. Oil and gas.

- Negative Sectors: Healthcare. Retail. Tech. REITs. Lithium.

- ASX 200 Hi 8979 Lo 8942 Narrow range.

- Big Bank Basket: Unchanged at $268.50

- All-Tech Index: down 2.9%

- Gold: Flies to $7498!

- Bitcoin: Steady at US$88928

- AUD: Eases on CPI to 69.91c.

- Asian markets firmed, Japan up 0.6% China up 0.3% and HK up 1.1%.

- Dow futures unchanged, Nasdaq up 144.

MARKET MOVERS

- BMN +17.1% uranium jumps.

- EQR +8.6% tungsten exposure.

- BOE +10.0% DYL +10.7% uranium soars.

- SVL +7.8% silver price soars. Quarterly report.

- LOTDB +6.0% uranium surge.

- CSC +4.4% copper play.

- SBM +4.1% Simberi lease extension.

- AZY +13.6% quarterly report.

- BNZ +21.8% delivers shallow high-grade gold discovery.

- DTR -11.0% quarterly.

- 4DX -8.5% falls below issue price.

- WBT -7.2% profit taking.

- 360 -7.6% falls again.

- TPW -6.6% sliding still.

- CAT -6.8% loses another life.

- ZIP -4.0% comes undone.

- DRO -5.5% quarterly report brings sellers.

- Speculative Stock of the Day: CRI +41.7% ASX query response. Positive research coverage from East Coast Research. Good volume too.

ECONOMIC AND OTHER NEWS

- The Consumer Price Index (CPI) rose 3.8% in the 12 months to December 2025, up from a 3.4% rise in the 12 months to November 2025. The largest contributors to annual inflation over the past 12 months were Housing (+5.5%), Food and non-alcoholic beverages (+3.4%), and Recreation and culture (+4.4%). In the month of December, the CPI rose 1.0% in original terms and rose 0.2% in seasonally adjusted terms.

- The CME is raising margins on Comex silver futures after prices surged to a record high this week. Margins will rise to 11% of so-called notional from the current 9% for non-heightened risk profile, the exchange said in a statement on Tuesday.

- Dollar slides as Trump says he is not concerned with its recent decline.

- Amazon sent a notice out to staffers in an apparent error acknowledging “organizational changes” in its cloud unit, according to an email viewed by CNBC. The company is expected to announce widespread layoffs across its corporate workforce as soon as this week.

- Anthropic doubles VC fundraising to $20bn on surging investor demand.

- UPS to cut up to 30,000 jobs and close facilities as Amazon shipments drop.

- Indonesian stocks tumbled after MSCI Inc. raised concerns about their ‘investability’ and warned of a potential downgrade to frontier-market status.

- The benchmark Jakarta Composite Index fell as much as 7%, the biggest one-day slump in more than nine months.

And finally….

If you arrest a mime, do you have to tell him he has the right to remain silent?

Clarence

XXXX