ASX 200 kicked another 82 points higher to 8942 as BHP roared back into #1 spot on the ASX. Up 2.6% today. Fair to say resources were a little mixed, gold miners tried hard to suck the same ‘Koolaid’ as bullion traders, but failed, with EVN down 0.7% and NEM only up 1.4%. Most other were solid but not spectacular. Lithium and rare earth stocks felt a little pain, LYC down 5.0% and PLS off 2.4%. ILU dropped 4.6% with IPX down 3.8%. Copper stocks fared better as RIO jumped 1.7% and even FMG rose 1.7%. Uranium stocks fell with LOTDB falling the hardest down 7.7%. PDN eased 0.6% lower and BOE dropped 3.7%. WDS and STO pushed ahead on LNG pricing with STO up 2.5% as its first Barossa project cargo left port.

Banks were firm, the Big Bank Basket rose to $268.50 (). MQG had a good day in the sun, up 2.3% and insurers did well too, QBE up 1.4% and SUN rising 0.7%. REITs eased back, industrials mixed, WES rose 2.3% and COL and WOW moved higher. BXB fell 1.0% and tech still patchy at best. XRO down 1.4% and WTC up 1.9% with the All-Tech Index up 0.9%.

In corporate news, DRO fell 6.5% on a quarterly update, KAR slightly higher after production report, AUB in a trading halt with a $400m placement pending on a UK acquisition. On the economic front, Australian business sentiment rebounded ahead of the Reserve Bank meeting, with confidence advancing to 3 points in December.

Asian markets firmed, Japan up 0.6% China up 0.3% and HK up 1.1%. Dow futures down 44, Nasdaq up 142.

10-year yields steady at 4.84%.

HIGHLIGHTS

- Winners: EQR, SNL, 29M, DTR, TLX, CSC, SVL, ELS

- Losers: SMI, AAI, 360, NVA, LOTDB, CRN, MEK

- Positive Sectors: Copper. Gold miners. Oil and gas. Banks.

- Negative Sectors: REITs. Lithium. Rare earths.

- ASX 200 Hi 8969 Lo 8918

- Big Bank Basket: Up to $268.50 (0.8%)

- All-Tech Index: Up 0.9%

- Gold: Flies to $7326

- Bitcoin: Slips to US$88761

- AUD: Steady at 69.12c.

- Asian markets firmed, Japan up 0.6% China up 0.3% and HK up 1.1%.

- Dow futures down 44, Nasdaq up 142.

MARKET MOVERS

- EQR +12.9% kicks yet again.

- TLX +8.3% Healthcare conference presentation.

- 29M +10.3% good bounce off issue price.

- CSC +7.5% copper in focus.

- DTR +8.3% drilling results.

- TGN +31.1% new exploration targets identified.

- ORE +16.0% transformational acquisition.

- HCH +9.6% copper exposure.

- LOTDB -7.7% profit taking.

- AAI -8.9% ditched.

- EUR -6.6% acquisition.

- 360 -8.6% sell off resumes.

- ARU -6.9% rare earths under pressure.

- QOR -9.9% LW article.

- ETM -10.5% Greenland out of the news.

- IVZ -56.3% Al Mansour partnership update.

- DLI -10.88% cleansing notice.

- Speculative Stock of the Day: TM1 +66.7% Major high grade platinum group metal discovery at Southwest.

ECONOMIC AND OTHER NEWS

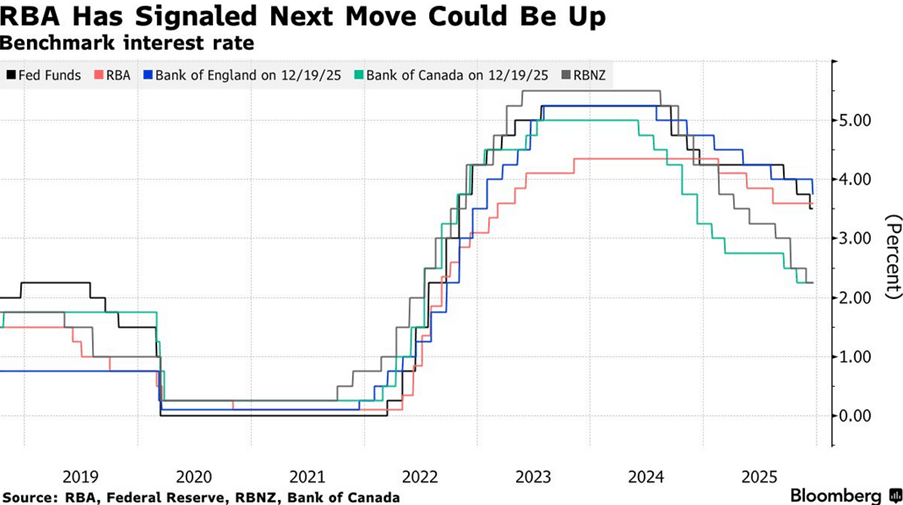

- Australian business sentiment rebounded ahead of the Reserve Bank meeting, with confidence advancing to 3 points in December.

- Business conditions, which track sales, profitability and employment, climbed, rising by 2 points to 9, while capacity utilization edged down to 83.2%

- China logged its first annual rise in industrial profit in four years in 2025, official data showed on Tuesday.

- Profit at industrial firms increased 5.3% in December from the same month a year earlier, reversing a 13.1% on-year fall in November, showed data from the National Bureau of Statistics. For the whole of 2025, profit was up 0.6%, versus a 0.1% increase in the first 11 months. That marked the first annual gain in four years.

- South Korean stocks swung to gains despite fresh US tariff threats. The benchmark Kospi climbed as much as 2%, erasing a morning loss of as much as 1.2%. Samsung Electronics Co., the nation’s largest stock, reversed an early decline and rose, as did Hyundai Motor Co.

- ‘Humanity needs to wake up’ to dangers of AI, says Anthropic chief.

- US health insurer shares fall on proposal to cut rise in Medicare payments.

- US long-term unemployment hits four-year high.

And finally…

Did you hear about the shepherd who drove his sheep through town? He was given a ticket for making a ewe turn.

Clarence

xxxx