The ASX 200 rallied 66 points to 8849 (0.8%) on Greenland relief despite firmer than expected jobs data putting a Feb rate rise on the table. The reverse of yesterday’s moves as banks and industrials bounced back with resources sold off. Some disappointing quarterlies in the gold sector plus some overbought saw profit taking. Bullion prices also eased on the TACO man’s latest back flip with pike. Banks were firm, CBA up % and WBC rising % with the Big Bank Basket up to $268.35 (+2.2%). MQG had a good day and other financials also doing well, GDG the exception on quarterly FUM numbers. REITs also doing well despite the unemployment number coming in at 4.1% and the AUD rallying hard. 10-year yields back up to 4.80%. Industrials firmed, retail bounced, WES up 2.5% and CSL rose 1.3% with RMD up 1.9%. Tech still a troubled sector, WTC dropped 0.5% and XRO down 1.2%. The All-Tech Index up 0.6%.

In resources, it was reverse all engines. BHP down 0.8% and FMG dropping 5.1% on production disappointment. The gold miners were savaged today, yesterday they were all the rage. EVN gave 4.6% back and NST had another bad quarterly and downgrade leading to a fiery analyst briefing. Off 8.4%. Oil and gas better as was lithium and rare earths. Uranium stocks eked out gains, PDN managed to hold on to gains. Oil and gas stocks better on crude and natural gas pricing. STO up 5.3% on first shipments from Barossa and WDS up 2.9%.

In corporate news, S32 maintained its guidance, rising 5.3%, NWL down 3.8% despite second consecutive quarter of FUA growth. DYL up 0.9% on a Tumas update.

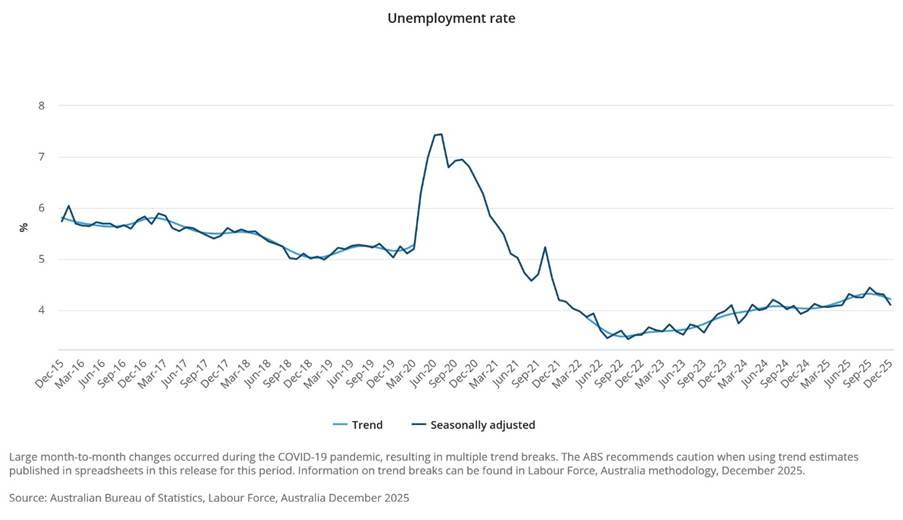

On the economic front, the jobless rate dropped to 4.1% setting up a rate rise in Feb. Every man and his economist now jumping on the rate rise bandwagon. None got the jobless rate even close.

Asian markets mixed, Japan up 2%, China down 0.5% and HK unchanged. Korea hit a record.

Dow futures up 104, Nasdaq futures up 75 – 10-year yields higher at 4.80%. AUD cracks 68c.

HIGHLIGHTS

- Winners: WBT, EQR, CU6, PMV, DRO, ELS, BCI, NXL

- Losers: PNR, VAU, EMR, NST, MEK, BRE, RRL

- Positive Sectors: Banks. Tech. Retail. REITs

- Negative Sectors: Gold miners. Tech.

- ASX 200 Hi 8865 Lo 8825 – Narrow range really. Jobs number in focus.

- Big Bank Basket: Up to $268.35 (+2.2%)

- All-Tech Index: Up 0.6%

- Gold: Falls to $7047 – AUD didn’t help.

- Bitcoin: Slips to US$89943

- AUD: Rampant at 68.04c.

- Asian markets mixed, Japan up 2%, China down 0.5% and HK unchanged. Korea hit a record.

- 10-year yields rise to 4.80%

- Dow futures up 94, Nasdaq up 102. TACO Man strikes again!

MARKET MOVERS

- EQR +11.5% kicks yet again.

- WBT +13.0% chips in favour.

- PMV +9.9% retailer bounce.

- DRO +9.5% broker PT upgrade.

- EOS +7.0% more defence spending.

- PNR -11.2% quarterly results.

- VAU -9.9% quarterly results.

- NST -8.4% another downgrade with quarterly.

- RRL -7.8% quarterly results

- 4DX -7.0% change of directors interest.

- KSN -18.5% quarterly results.

- HGO -12.5% quarterly results.

- Speculative Stock of the Day: AAJ +31.8% – acquires a high-grade copper sulphide project.

ECONOMIC AND OTHER NEWS

- Unemployment drops to 4.1%. RBA now being tipped to raise rates in February. AUD climbs above 68c. 70c?

- HSBC economist Paul Bloxham says December’s stronger-than-expected labour market figures have shifted the Reserve Bank of Australia’s rate outlook, making a February rise likely.

- Employment rose 65,000, well above the 27,000 expected.

- TACO man is back – Framework on Greenland. Not sure what a framework is. Gold dips.

- Goldman Sachs is now tipping gold prices will hit $US5400 an ounce by the end of this year, up from its prior forecast of $US4900 an ounce.

- Japan’s December exports growth drops to 5.1%, missing expectations, as shipments to U.S. plunge. Shipments to mainland China, Japan’s largest trading partner, climbed 5.6%, while exports to Hong Kong surged 31.1%.

- South Korea’s stock benchmark advanced to cross the 5,000 target set by President Lee Jae Myung, fueled by AI‑driven demand in the tech‑heavy market.

- The Kospi Index climbed as much as 2.2% to 5,019.54, lifted by gains in Samsung Electronics Co., and SK Hynix Inc.

- BofA’s Moynihan left off invite list for Trump reception at Davos. Bit petty really!

- Trump coin price plunges 94% in a year as memecoin frenzy fades.

- Berkshire Hathaway considers selling $7.7bn stake in Kraft Heinz.

And finally….

If the right side of the brain controls the left side of the body, then left handers are the only ones in their right mind.

I always wanted to learn to procrastinate… just never got around to it.

Clarence

XXXXX