The ASX 200 eased back another 33 points to 8783 (0.4%) as bifurcation continued. Resources good. Rest of the market bad. Plenty of quarterlies too with RIO up 2.6% on its latest. BHP rose 1.3% and lithium stocks bounced back hard, PLS up 4.4% and MIN up 2.3%. Gold miners surged as a combination of good quarterlies, EVN up 9.5% and GMD up 3.0% with NEM up 5.0%. Gold once again hitting records. Silver and base metal stocks also doing well. Uranium stocks rose led by PDN with a very solid quarterly. It rose 13.1%. Also seeing stirrings in coal with WHC up 1.0%. Oil and gas mixed, WDS unchanged and STO down 1%.

Meanwhile in a galaxy far, far away, banks stumbled lower, CBA down 2.2% and ANZ off 2.1% with the Big Bank Basket down to $262.68 (-1.9%). Insurers and financials under pressure again, MQG down 0.5% and REITs falling on rising bond yields. GMG down 1.9% and SCG off 1.4%. Industrials also in the doldrums, WES fell 2.7% with tech dumped again, WTC down 2.4% and XRO off 5.2%. The All-Tech Index fell another 2.4%. Retail dumped as rate rise, JBH off 3.5% and PMV off 3.3%. Healthcare also led down by TLX off 7.7% after a revenue update.

In corporate news, 29M fell 24.9% returning to trade post its capital raise. AFI saw a profit decline of 4.6%. ASM soared on a takeover bid from US Energy Fuels. PDN results were a cracker, LYC had a good quarterly too. TLX not so good and fell another 7.7%.

On the economic front, gold raced past $4800. $7225oz in AUD. Asian markets ease back, Japan down 0.6%, China up 0.3% and HK unchanged.

Dow futures up 104, Nasdaq futures up 75 – 10-year yields higher at 4.79%.

HIGHLIGHTS

- Winners: SBM, EMR, PDN, EQR, INR, SX2, FML

- Losers: 29M, DRO, TLX, QOR, ELS, MTM, RAC

- Positive Sectors: Iron ore. Gold miners. Uranium.

- Negative Sectors: Banks. Tech. Retail. REITs.

- ASX 200 Hi 8795 Lo 8766 – Narrow range really.

- Big Bank Basket: Down to $262.68 (-1.9%)

- All-Tech Index: Down another 2.3%

- Gold: Soars through $7225. Platinum and silver follow.

- Bitcoin: Slips to US$89984

- AUD: Steady at 67.38c.

- Asian markets ease back, Japan down 0.6%, China up 0.3% and HK down 0.2%

- 10-year yields rise to 4.77%

- Dow futures up 100, Nasdaq up 75. Davos the focus.

MARKET MOVERS

- EQR +13.0% kicks on quarterly.

- PDN +13.1% good quarterly.

- NMG +9.7% good quarterly.

- CXO +7.4% lithium bounce.

- INR +12.2% lithium bounce back.

- VUL +7.0% Lionheart update.

- LYC +6.7% good quarterly.

- SVM +26.7% strategic rare earths recovered at Kasiya.

- 29M -24.9% entitlement issue at 40c.

- QOR -7.3% broker downgrades.

- DRO -8.9% profit taking.

- RAC -6.5% sell off continues. Low volume.

- TLX -7.7% disappointing update.

- BVS -4.7% LW article.

- EDU -9.8% National Code amendments to agents comm.

- MPW -1.8% quarterly report.

- Speculative Stock of the Day: ASM +119.3% takeover offer from NYSE company. Cash and stock.

ECONOMIC AND OTHER NEWS

- BHP now just $1bn from taking CBA’s crown.

- HSBC chief economist Paul Bloxham says there is a tangible risk that the Reserve Bank of Australia could raise rates as soon as February, in what would be “a painful” move.

- Global profits for the world’s largest 1600 listed companies reached a projected $US4.85 trillion ($7.19 trillion) in 2025, up 12.2% year-on-year, driven by revenue growth, lower one-off costs, and favourable exchange rates.

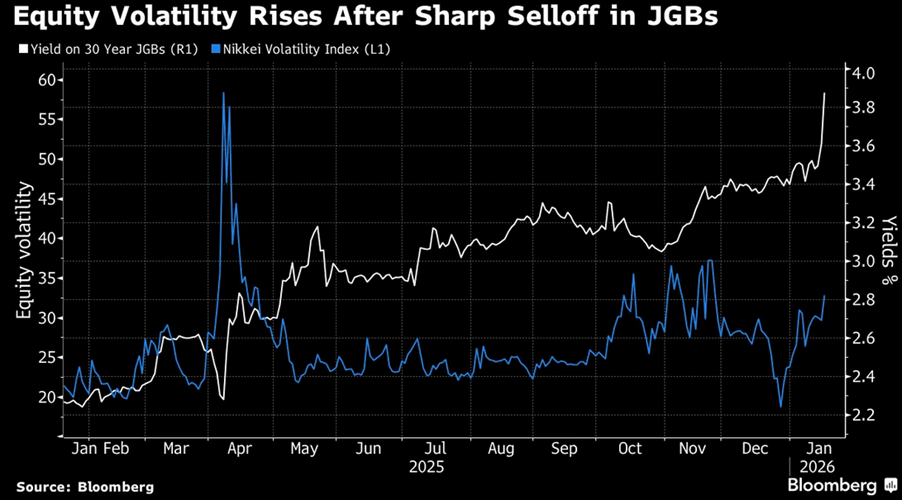

- Japan’s longer maturity bonds rebounded after Finance Minister Satsuki Katayama called for calm among market participants following a rout that pushed yields to all-time highs.

- Yields fell for so-called super-long debt on Wednesday morning, with that on the 40-year tenor down 6.5 basis points after a jump of more than a quarter percentage point Tuesday.

- Almost two-thirds of executives say they are pausing spending until conditions improve, CreditorWatch Pty Ltd.’s Business Sentiment Survey showed Wednesday, while 72% say rising prices are inhibiting growth.

- President Donald Trump on Tuesday said “you’ll find out” in response to a question of how far he’d go in his quest to acquire Greenland.

- Danish pension operator Akademiker Pension said it is exiting U.S. Treasurys over finance concerns tied to America’s budget shortfall. It plans to have closed its position of around $100 million in U.S. Treasurys by the end of the month.

- Russia knocks out Kyiv’s power, heating and water.

- Ukraine offers allies combat data to train AI.And finally

And finally….

Buddy of mine was on a Zoom Call and he started telling jokes. Turns out he wasn’t remotely funny either.

Clarence

XXXX