The ASX 200 pulled back another 59 points today to 8816 as Greenland risks dominated. Quarterly reports also starting to hit with BHP falling 2.0% on a cost blowout again at Jansen. The banking sector eased back on tariff woes, CBA down 1.8% with the Big Bank Basket falling to $267.87 (-1.5%). MQG dipped1.8 % and financials sold down. GQG off 2.5% on a Macquarie downgrade. Insurers better as yields rose. REITS were a little weaker, GMG down 1.8% and MGR off 0.5%. Industrials mixed, JBH fell another 1.8% with COL falling 1.1% although WES rose 0.8% and CSL found buyers. Tech stocks tried to find a level, WTC down 0.9% and the All-Tech Index unchanged.

In resources, iron ore miners fell on weaker Asian prices, FMG dropping 0.6% with RIO off 2.0% and rare earths under some pressure, LYC down 6.3% and ILU off 2.8%. Gold miners were mixed, production reports for GMD and BGL with NST out too. Lithium stocks recovering after early losses, LTR unchanged and VUL off 3.3%. Oil and gas remain under pressure, BPT fell 2.7% on a downgrade and uranium stocks mixed. First day for LOTDB up 0.5%.

In corporate news, QOR tumbled 16.3% after reaffirming guidance in the quarterly, ARB stumbled 12.0% lower on a trading update, ORG announced it was keeping Eraring running longer. AMP has a new CEO in Blair Vernon. HUB jumped on FUA news. TLX also doing well on the Chinese drug regulator’s application acceptance.

In Asian economic news, The PBoC has kept its 1-year and 5-year loan prime rates unchanged at 3% and 3.5%, respectively,

Asian markets ease back, Japan down 1.3%, China off 0.5% and HK unchanged.

Dow futures down 450, Nasdaq futures down 287 10-year yields higher at 4.79%.

HIGHLIGHTS

- Winners: CHN, WBT, AUC, N+BGL, CRN, EQR

- Losers: QOR, ARB, 4DX, INR, MEI, LYC, PRN

- Positive Sectors: ‘Old skool’ platforms.

- Negative Sectors: Banks. Big miners. Rare earths.

- ASX 200 Hi 8855 Lo 8809 – Today’s high was yesterday’s low.

- Big Bank Basket: Down to $267.87 (-1.5%)

- All-Tech Index: Unchanged.

- Gold: Steady at $6964

- Bitcoin: Slips to US$92162

- AUD: Better at 67.38c.

- Asian markets ease back, Japan down 1.3%, China off 0.4% and HK unchanged.

- 10-year yields steady at 4.73%

- Dow Futures are significantly lower. US markets reopen and Davos begins.

MARKET MOVERS

- CHN +9.2% kicks on commodity prices.

- WBT +6.7% chips in favour.

- BGL +5.0% quarterly result.

- DRO +4.2% European defence spending.

- EQR +4.6% no news.

- A1G +10.6% no news.

- QOR -16.3% quarterly report disappoints.

- ARB -12.0% trading update disappoints.

- INR -8.9% lithium sell-off.

- 4DX -9.4% profit taking ahead of new shares issued.

- DTR -3.9% profit taking.

- MEI -6.4% profit taking.

- GQG -2.5% Macquarie downgrades.

- BOC -10.4% copper price stalls.

- STM -9.1% quarterly activities.

- CXL -5.6% profit taking.

- Speculative Stock of the Day: OLY +39.7% over 100 intercepts reveal gold potential.

ECONOMIC AND OTHER NEWS

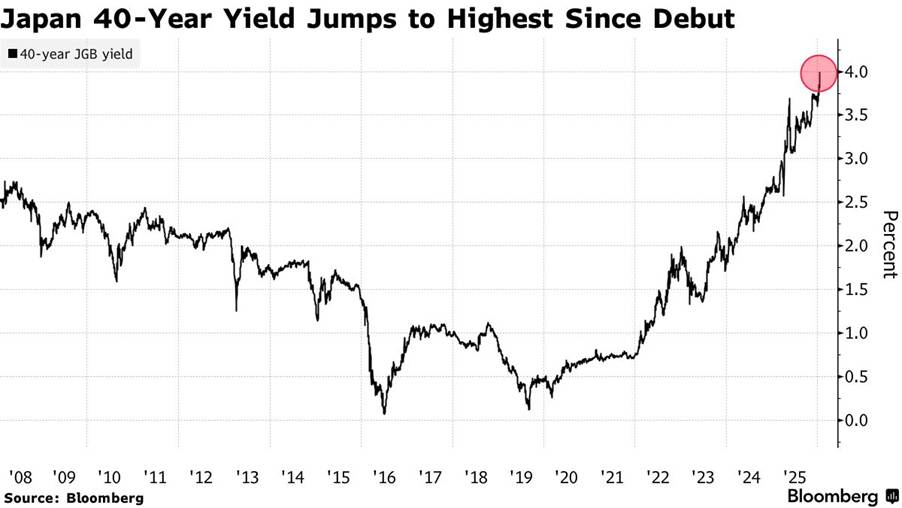

- Japan’s 40-year bond yield hit 4%, the highest since its debut in 2007 and a first for any maturity of the nation’s sovereign debt in more than three decades.

- Citigroup Inc. has downgraded European equities to neutral due to worsening relations between Brussels and Washington.

- The downgrade is a result of the latest step-up in transatlantic tensions and tariff uncertainty, which hurts the earnings outlook for European companies.

- Denmark dispatches additional troops to Greenland as tensions rise.

- Europe’s rightwing parties squirm as Trump threatens tariffs.

- UK government considering social media ban for children.

- UK set to approve Chinese ‘mega’ embassy after inclusion of security measures.

- Germany opens €3bn EV support scheme to Chinese automakers.

And finally…..

Eyelashes are supposed to prevent things from getting into your eyes, but whenever I have something in my eye it’s always an eyelash.

Eyeronic

Clarence

XXXXX