ASX 200 slipped 29 points lower to 8875 today on worries over Trump’s move on Greenland. US futures turned lower, US physical markets closed tonight. Across the board losses led by the banks, CBA down 0.7% and NAB dropping 1.1% with the Big Bank Basket down to $271.82(-0.7%). MQG dropped 0.5% and other financials saw profit taking. Insurers also fell, IAG down 1.2%. REITs were mixed, GMG dropped 1.2% on tech worries. The All-Tech Index continues to be smashed, WTC down 4.4% and XRO heading that way. Off another 2.6%. Retail and industrials sold off too after the run last week. WES down 0.7% with JBH off 0.4% and TLS falling 0.8%. Utilities saw defensive buyers return, ORG up 1.0% and AGL pushing 0.8% better.

In resources, gold hit close to AUD$7000 amidst geo-political risk. NST up 3.2% and EVN rising 3.1% with GMD rising 3.7% on broker upgrades. Rare earth stocks doing well again, MEI up 9.3% and LYC rising 5.2%. Copper stocks eased but found a level, iron ore majors were mixed, BHP down 0.5% and RIO up 0.8%. Uranium stocks were glowing red hot on short covering, PDN up 6.6% and BOE roaring 13.6% ahead.

In corporate news, CCX had a trading update and rose 3.6%, NWH announced new contracts, down 2.7%, PNV reported H1 sales up 26%. A2M in a trading halt after a big move on Chinese birth rate diving. Down 10.6% before halt.

On the economic front, Chinese GDP data came in as expected, 5%. What a surprise. Strong exports helped to compensate for weak consumer spending.

Asian markets ease back, Japan down 0.9%, China off 0.2% and HK down 1%.

Dow futures down 361, Nasdaq futures down 298 10-year yields higher at 4.73%.

HIGHLIGHTS

- Winners: BOE, LOT, SLX, MEI, SRL, MAD, SBM

- Losers: A2M, 360, PME, OCL, QOR, AYA, BVS, 4DX

- Positive Sectors: Gold miners. Uranium. Utilities.

- Negative Sectors: Banks. Tech. Industrials.

- ASX 200 Hi 8901 Lo 8856

- Big Bank Basket: Down to $271.82(-0.7%)

- All-Tech Index: Down 2.3%

- Gold: Jumps to $6971

- Bitcoin: Slips to US$92756.

- AUD: Steady at 66.91c.

- Asian markets: Japan down 0.9%, China off 0.2% and HK down 1%.

- 10-year yields steady at 4.73%

- Dow Futures are lower. US markets closed tonight.

MARKET MOVERS

- BOE +13.6% broker upgrade and short squeeze.

- SLX +9.5% uranium focus.

- MEI +9.3% USA and Brazil deal on Rare earths?

- MAD +7.9% broker upgrade.

- PDN +6.6% uranium sector soars.

- CXL +15.1% rerating continues.

- EUR +9.3% Greenland exposure.

- COV +13.8% rally continues. Biotech Basket Number 2.

- A2M -10.6% trading halt. Results date.

- 360 -7.5% tech rout continues.

- PME -6.8% high PE stocks sold down.

- LDX -8.8% secures follow on contract with Aptatek.

- CCX +3.6% Trading update.

- NWH -2.7% new contracts.

- SYR -unchanged – more on Tesla offtake deal.

- TWE +0.7% Olivier Goudet upped his stake to 6.13%

- Speculative Stock of the Day: DAL +34% – Late surge. Follows rally Friday. Greenland rare earths.

ECONOMIC AND OTHER NEWS

- US markets closed tonight for Dr. Martin Luther King Day.

- Davos beckons.

- China 2025 GDP grows 5% year-on-year, hitting target. Posts first annual decline in investment in decades

- December retail sales rise 0.9% on year; industrial output fares well. Birthrate hits lowest since 1949; population shrinks.

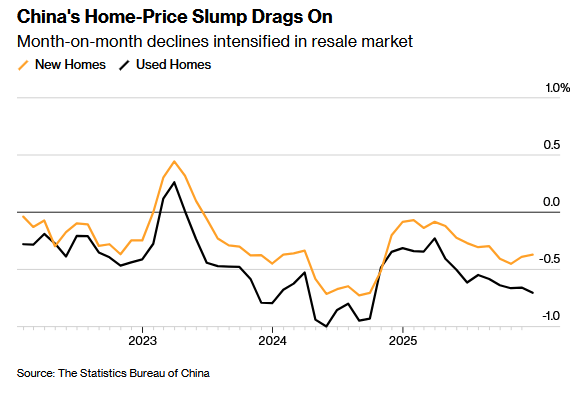

- China’s home prices fell in December, with new-home prices dropping 0.37% from November and resale home values sliding 0.7%.

- Treasury Secretary Scott Bessent said it’s unlikely the Supreme Court will overturn President Donald Trump’s tariffs imposed under the International Emergency Economic Powers Act.

- EU readies €93bn tariffs in retaliation for Trump’s Greenland threat.

- US justice department says it is not investigating ICE agent over shooting.

- Brazil and US eye rare earths deal.

And finally

The whole salad dressing industry exists because people really just don’t like the taste of salad.

I accidentally used dog shampoo today. I’m feeling like such a good boy.

Clarence

XXXX