ASX 200 kicked another 49 points to 8809 (0.6%) as resources continue to soar, banks joined in too with the iron ore majors recovering. Some selling on the close knocked it off highs. CBA was up 0.5% with NAB flying 1.9% higher and the Big Bank Basket up to $272.19 (0.9%). Other financials and insurers also rallying, except GQG which fell 8.6% on latest FUM results. REITS also firm, GMG up 1.1% and SCG rising 1.2%. Industrials and healthcare were a little weaker, retail stocks under pressure, JBH down 3.0%, COL sliding 1.8% and TPW off another 2.7%. MYR dropped 5.1% and BAP continued lower. Tech stocks continued to ease, WTC eased 0.3%, XRO up 0.4%, but TNE down 0.8%. Resources were the drivers again, BHP up 2.3% with RIO bouncing back 2.2%. Gold miners were firm, EVN up 2.0% and NST up 3.6% with lithium stocks also doing well and rare earths in focus. LYC up 1.9% despite news that the popular CEO is retiring. Uranium stocks better and oil and gas weak, WDS down 1.7%.

In corporate news, EDV fell 2.9% as it forecast pre-tax profits of between $400-411m. FBU reported a modest improvement in the outlook and ZIP dropped 7.6% on US credit card moves from Trump. 4DX in a trading halt with a placement at 380c.

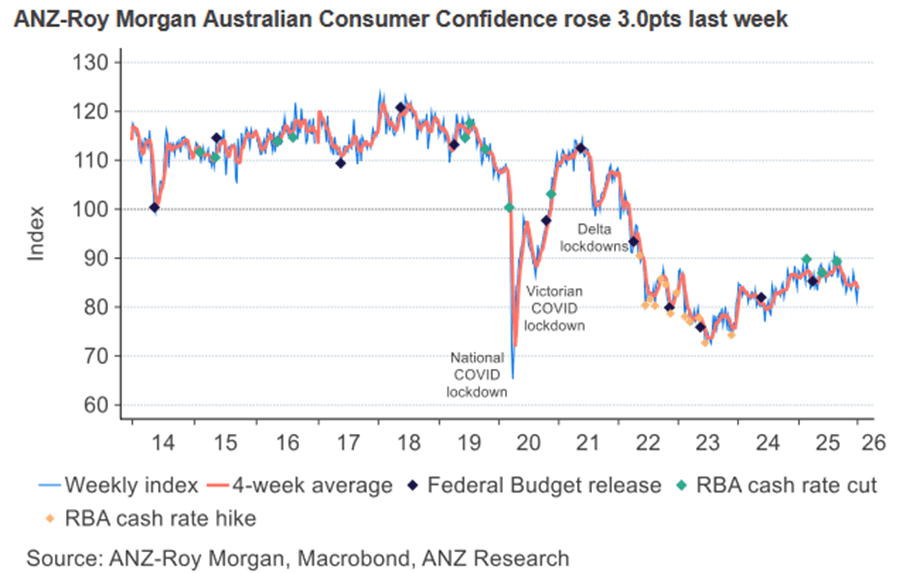

On the economic front, the ANZ-Roy Morgan survey on consumer sentiment was the weakest start to the new year in 15 years.

Asian markets firmed, Japan jumped 3.4% on a potential snap election, China up 0.1% and HK up 1.1%. US futures down slightly.

10-year yields steady at 4.70%.

HIGHLIGHTS

- Winners: NMG, EOS, MEI, ELV, SRL, LRV, ASB, SKC

- Losers: GQG, QOR, ARU, ZIP, CAT, MYR

- Positive Sectors: Iron ore. Lithium. Gold. Uranium. Copper. Banks. REITs.

- Negative Sectors: Healthcare. Supermarkets. Retail.

- ASX 200 Hi 8556 Lo 8783

- Big Bank Basket: Up to $272.19(0.9%)

- All-Tech Index: down 0.7%

- Gold: Flies to $6851

- Bitcoin: Slips to US$91330

- AUD: Higher at 67.10c.

- Asian markets: Japan closed for ‘coming of age’ day China up 1.6% and HK up 0.9%.

- 10-year yields steady at 4.71%

- Dow Futures slightly lower.

MARKET MOVERS

- NMG +21.6% drill results.

- EOS +10.3% media coverage.

- SRL +7.0% bounces back hard.

- LRV +7.0% critical metals exposure.

- INR +4.9% lithium exposure.

- DTR +4.6% rally continues.

- PIQ +18.8% huge run continues. US lab CAP accredited.

- GQG -8.6% FUM results.

- ZIP -7.6% US credit card interest rate fears.

- ARU -7.8% profit taking.

- QOR -8.3% tech sell off continues.

- FND-28.7% reverses rally. Strategic investment update.

- MKR -6.3% profit taking.

- Speculative Stock of the Day: NSB +43.5% clinical results success.

ECONOMIC AND OTHER NEWS

- Consumer confidence has had its weakest New Year’s release in more than 15 years as it rose 3 points last week to 84.5, ANZ-Roy Morgan data shows.

- The four-week average slipped 0.7 points to 83.8 as the “time to buy a major household item” subindex jumped 5.9 points, marking its third-highest reading since early last year.

- Macquarie said spodumene, lithium hydroxide and lithium carbonate prices have all jumped since the start of FY26 – up 190 per cent, 150 per cent and 130 per cent respectively. It says spot spodumene prices are now sitting roughly 100 per cent above Macquarie’s calendar 2026 forecasts.

- The CME will change the way it sets margins for gold, silver, platinum and palladium futures after a surge in prices and volatile trading.

- China is scrutinising how Jane Street Group and other foreign firms participate in its $US859 billion ($1.28 billion) exchange-traded fund market.

- Trump announces 25% tariff on countries ‘doing business’ with Iran.

- Aluminum traded near its highest level since early 2022, and tin extended a blistering rally. Tin has been the standout performer on the London Metal Exchange so far this year, nearing a record high above $51,000 a ton after it surged almost 40% in 2025.

- Japanese market soars on election potential. Yields on the 10-year Japan government bond rose over 5 basis points to 2.15%, while yields on the 20-year surged over 8 basis points to 3.137%.

- BlackRock Inc. is cutting hundreds of jobs across the company, becoming the latest Wall Street firm to rein in headcount in recent weeks. The cuts total about 1% of BlackRock’s global headcount and include members of its investment and sales teams.

And finally…

What do you call a fish

with no eye?

FSH

Clarence

XXXXX