The ASX 200 fell 39 points to 8586 (0.5%) after the RBA kept rates on hold as forecast. The index was down a similar amount before the 2.30pm announcement. Banks drifted lower, CBA down 0.6% and WBC off 0.6% with insurers staging a modest recovery, QBE up 1.2% and MPL rising 2.7%. MQG dropped another 0.9% with PNI falling 1.1%. REITs mixed, GMG down % with the rest of the sector better. Healthcare eased, CSL down 2.0% and RMD falling 2.3%. Retail stocks fell on the rates news, JBH off 1.9% and APE dropping 2.2% as SUL fell in sympathy with BAP, down 21.3% on another nasty trading update. Telcos slid lower, TLS down 0.6% and TPG with some issues fell 1.6%. Tech once again on the nose, XRO off 0.7% and TNE down 1.6% with 360 falling hard.

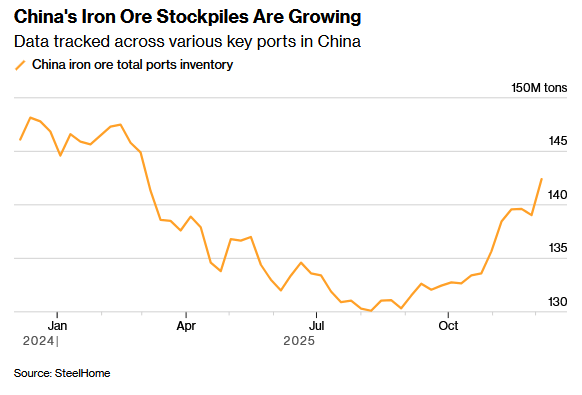

In resources, iron ore stocks firmed, FMG up 1.7% and RIO flat. Gold miners drifted lower, PRU off 1.5% and NST falling %. Oil and gas stocks eased, uranium mixed, PDN and DYL to the good, LOT down to the bad. Lithium stocks holding, up but rare earths sliding back to earth.

In corporate news, LTR dropped 2.3% on a new offtake deal, WAF fell 0.7% on drilling results.

On the economic front, the RBA left rates unchanged. The board does not seem to be in a hurry to raise them either.

Meanwhile in Asia, Japan up 0.2%, HK down 0.8% and China down 0.1%.

10-year yields higher at 4.75%.

US Futures – DJ up 9 points and Nasdaq up 10.

HIGHLIGHTS

- Winners: SRL, 4DX, ELV, CKF, AYA, ASB, EOS, MSB

- Losers: BAP, DTR, NWH, MI6, VUL, LRV, AIS

- Positive Sectors: Insurers.

- Negative Sectors: Everything else.

- ASX 200 Hi 8624 Lo 8580. Narrow range again.

- Big Bank Basket: Higher at $268.73 (-0.2%)

- All-Tech Index: Down 0.8%.

- Gold: Eases to $6311

- Bitcoin: Slips to US$89955

- AUD: Steady at 66.41c.

- Asian markets, Japan up 0.2%, HK down 0.8% and China down 0.1%.

- 10-year yields are higher at 4.75%.

MARKET MOVERS

- ELV +5.2% lithium move.

- SRL +7.4% volatility continues.

- 4DX +5.3% buyers back.

- CKF +4.4% did someone say KFC?

- DYL +3.3% uranium slightly better.

- IMM +25.5% US$369m global partnership with Dr Reddy’s

- EDU +13.2% becoming a substantial shareholder.

- BAP -21.3% another trading downgrade.

- DTR -12.2% amended presentation and media speculation.

- SUL -4.6% follows BAP.

- FAL -9.2% slipping away.

- 3DA -6.7% no reason.

- VUL -6.4% slips below entitlement price.

- AIS -5.6% profit taking.

- Speculative Stock of the Day: OD6 +21.3% Response to ASX ‘please explain’.

ECONOMIC AND OTHER NEWS

- RBA leaves rates on hold. Seems reluctant to raise. Extended hold seems likely for now.

- Fed meeting kicks off. Cut expected.

- Iron ore fell to the lowest in a month ahead of a key meeting of Chinese officials that will provide details on policy priorities for next year.

- Trump greenlights Nvidia H200 AI chip sales to China if U.S. gets 25% cut.

- Japan is threatening China militarily which is “completely unacceptable”, Chinese Foreign Minister Wang Yi told his German counterpart, after Japan said that Chinese fighter jets had aimed their radar at Japanese military aircraft.

- Trump ban on wind power projects overturned by federal judge.

- Google’s ‘TPU’ chip puts OpenAI on alert and shakes Nvidia investors.

- Blair out of running for Gaza ‘board of peace’.

And finally…

I went for a job interview at UPS. I said, “Sorry I’m late, I went to the wrong address” – and they made me regional manager.

Clarence

XXXX