The ASX 200 rose just 16 points to 8595 (0.2%) after slightly disappointing GDP numbers boosted hopes for steady rates at least. Banks were stable, ANZ up % with the Big Bank Basket up to $264.60 (0.3%) with MQG bouncing back 1.0%. Other financials were quiet, REITs rallied on the GDP despite yields rising to 4.64%. Industrials eased back, BXB down 1.1%, healthcare slipped, SIG down 1.4% and retails drifted lower, APE down 0.4% and WEB off 1.0%. Tech was mixed, WTC up 4.5% on its Investor Day, XRO fell 0.2% and the All-Tech Index fell 0.1%. Resources were mixed, iron ore miners saw some profit taking as the first cargo from Simandou set sail. Gold miners also mixed with PRU bidding for PDI in shares. Lithium stocks eased, uranium better with PDN up 5.2% and DYL rising 4.7%. Nothing stirring in oil and gas.

In corporate news, 4DX sprinted 16.0% out of the blocks after securing a US$10m CTVQ order from Philips. VUL in a trading halt with a mammoth capital raise to fund Lionheart. XYZ fell 6.0% on a presentation, and BET jumped 12.9% on a deal with Penn Entertainment.

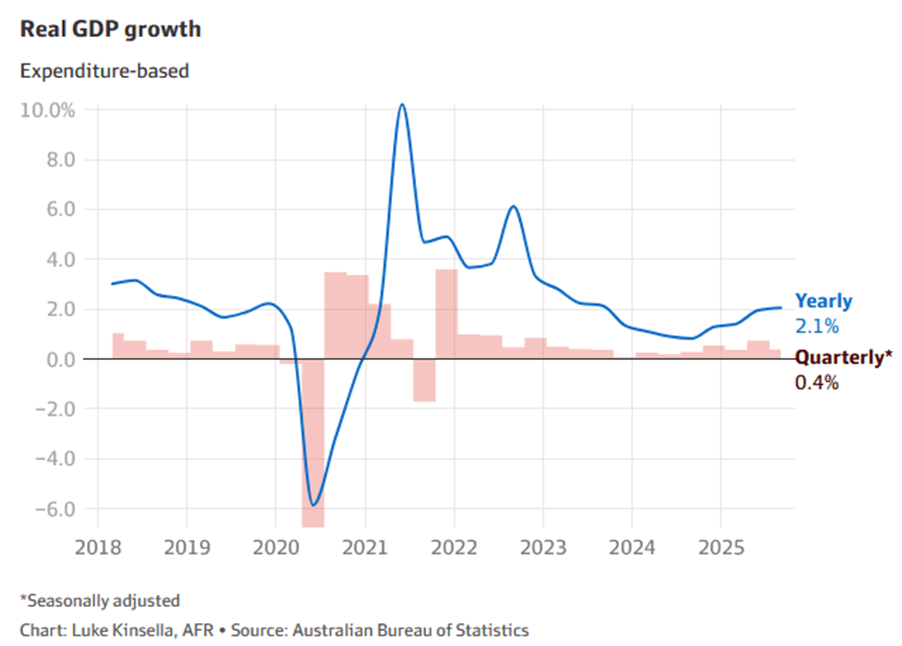

In economic news, GDP came in slightly below expectations at 0.4%, giving the RBA an excuse to pause. In China, service activity weakened.

Asian markets mixed, Japan recovered 1.5% with HK up 0.2% and China flat.

10-year yields pushed higher again to 4.64%.

US Futures heading higher, Dow futures up 121 with Nasdaq up 50

HIGHLIGHTS

- Winners: PDI, 4DX, TCG, CRN, TVN, BOE, BMN

- Losers: A4N, MP1, XYZ, HMC, LIN, WAF, SGR, CKF

- Positive Sectors: Banks. REITs. Tech. Iron ore. Uranium.

- Negative Sectors: Healthcare. Industrials

- ASX 200 Hi 8623 Lo 8576

- Big Bank Basket: Higher at $264.60 (0.3%)

- All-Tech Index: Down 0.1%.

- Gold: Eases to $6415

- Bitcoin: Bounces to US$93059

- AUD: Higher at 65.79c.

- Asian markets, Japan recovered 1.5% with HK up 0.2% and China flat.

- 10-year yields higher at 4.64%.

- US Futures DJ up 120 Nasdaq up 60

MARKET MOVERS

- PDI +16.8% PRU bids in share deal.

- 4DX +16.0% Philips deal.

- MI6 +4.1% bouncing back.

- BOE +7.0% uranium back.

- EUR +18.2% critical metals.

- IVR +14.7% tip sheet recommendation – Silver focus.

- AEU +18.8% exploration target highlights uranium resource growth.

- XYZ -6.0% presentation and update.

- MP1 -6.3% tech falls.

- CKF -4.6% broker downgrades.

- RXR -12.2% PRU outbids for PDI. Evaluates options.

- A11 -11.1% change in substantial holding.

- SPL -6.4% low volume.

- Speculative Stock of the Day: PET +271% back baby. Resumes production in China.

ECONOMIC AND OTHER NEWS

- Australian gross domestic product (GDP) rose 0.4% in the September quarter 2025 and 2.1% compared to a year ago.

- Private investment contributed 0.5% to GDP growth in the September quarter. This was driven by machinery and equipment investment, which rose 7.6%. This rise aligned with an increase in imports of capital goods.

- The search for Malaysia Airlines’s flight 370 will resume later this month, more than 11 years after the aircraft disappeared.

- The first commercial shipment of iron ore from a massive new mine in Guinea is on its way to China. It‘s expected to reach China by mid-January, data showed.

- China’s services activity expanded at the weakest pace in five months, a private survey showed. The RatingDog China services purchasing managers’ index slowed for a third month and fell to 52.1 in November.

- American Eagle lifts outlook as Sydney Sweeney campaign boosts sales.

- Farage tells donors he expects Reform UK will do an election deal with Tories.

- Anthropic reportedly preparing for one of the largest IPOs ever in race with OpenAI.

And finally….

All of my fitness goals are within reach but unfortunately so are the snacks.

The grass may look greener on the other side of the fence…But that could just be a septic tank problem.

Scientists created a dolphin with legs. Animal rights groups want the legs removed. But that would defeet the porpoise.

Clarence

XXXX