The ASX 200 gave up its strong start to close up 70 points to 8607 as the better-than-expected CPI number took the top off things. It was a monthly number so can be more volatile, but 3.8% was above RBA and economist’s expectations. Banks were mixed with CBA steady as NAB and WBC down. The Big Bank Basket rose to $266.89 (+0.1%). MQG had a good day, up 2.8% and wealth managers also pushed ahead, HUB up 1.9% and NWL up 1.3%. Insurers mildly positive, SUN up 0.8% with REITs mixed, GMG up 1.3% but elsewhere losses as bond yields pushed higher. SCG off 0.5% and CHC down 0.4%. Industrials were firm, WES up 1.9% with retail surprisingly strong, JBH up 1.0% and APE rising 1.4% with TPW crashing 32.3% on a trading update. Fast food also better, GYG and DMP doing well, Travel stocks also better, WEB up 3.4% and FLT gaining 2.3%. Tech stocks continue to stumble around, WTC down 1.2% and XRO off 0.1% with TNE falling 2.8%. The All-Tech Index steady.

In resources, iron ore stocks pushed higher, BHP up 2.0% and FMG up 2.4% with gold miners shrugging off early weakness to push higher, VAUDA did well, up 6.5% after the hedge book news, lithium stocks exploded, PLS up 7.2%and MIN up 3.0% with oil and gas better and small gains in uranium.

In corporate news, Brookfield lobbed a bid for NSR at 286c. That is three bids this week. Debutante SEA rose 12.5% after a $20m IPO. EOS jumped 3.6% after a court penalty and DRO was up 8.5% again after its recent order.

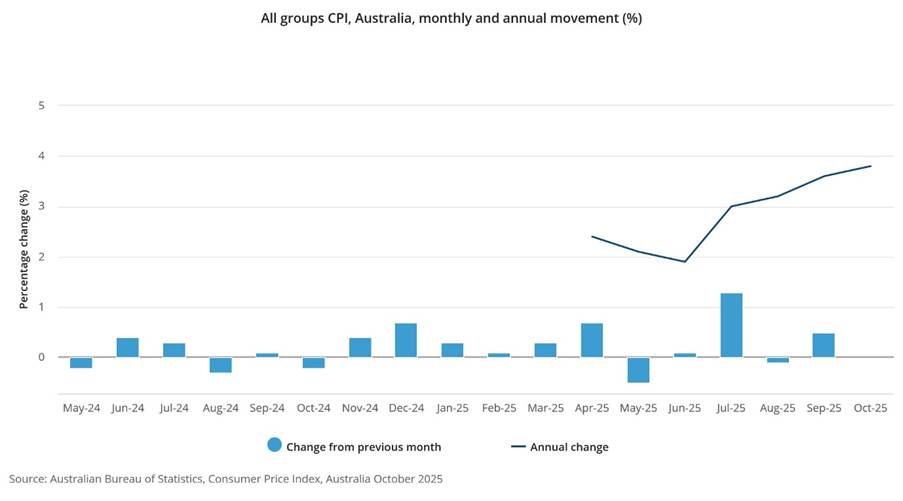

On the economic front, the CPI was higher than expected at 3.8%. Chalmers and Bullock not happy.

Asian markets were firm, although Taiwan in focus on fears of further Chinese aggression.

10-year yields rose to 4.53% on CPI. AUD rose too.

UK Budget today. European markets opening higher.

HIGHLIGHTS

- Winners: NSR, MSB, ASK, GTK, SRL, DRO, AX1, DMP

- Losers: TPW, WAF, C79, GGP, 360, TNE, ASB

- Positive Sectors: Iron ore. Retail. Gold miners. Lithium. Financials.

- Negative Sectors: Tech. REITs.

- ASX 200 Hi 8638 Lo 8591

- Big Bank Basket: Drifts to $266.89 (+0.1%)

- All-Tech Index: Unchanged.

- Gold: Falls to $6399

- Bitcoin: Steady at US$87623

- AUD: Better at 65.01c on CPI.

- Asian markets: Japan up 1.8% China up 0.8% and HK up 0.5%.

- US Futures: Dow down 49 Nasdaq down 13

- 10-year yields higher at 4.52%.

MARKET MOVERS

- MSB +14.3% Ryoncil revenue growth.

- ASK +9.3% Bid for NSR.

- DMP +7.9% change in substantial holding.

- DRO +8.5% continues to push.

- PLS +7.2% LTR +3.2% lithium finds friends.

- GTK +8.8% no news.

- ZIP +6.7% US retail sales.

- CXL +10.6% buyers return.

- AGY +15.2% lithium bump.

- TPW -32.3% trading update.

- WAF -9.5% November investor call.

- C79 -7.1% CSIRO sells down.

- GGP -5.5% broker downgrade.

- IVZ -32.1% AMOG JV and partnership update.

- VMM -29.8% investor presentation.

- RAC -0.3% Lung cancer trial gets ethics approval.

- TNE -2.8% sell off continues.

- 360 -4.4% SEC form 704

- IPO of the Day – SEA +12.5% on debut.

- Speculative Stock of the Day: AEU +40.9% Transformational merger and investor webinar.

ECONOMIC AND OTHER NEWS

- No rate cuts – Australian Monthly CPI rises to 3.8%. The largest contributors to annual inflation were Housing (+5.9%), Food and non-alcoholic beverages (+3.2%), and Recreation and culture (+3.2%).

- Trimmed mean inflation was 3.3% in the 12 months to October 2025, up from 3.2% in the 12 months to September 2025.

- Big trouble in Little China as Taiwan pledges another US$40bn for defence. The expenditure will be part of a supplementary defence budget.

- Copper Pushes Higher Again on Codelco’s Offer and Sagging Dollar.

- RBNZ cuts rates to three-year low. But that’s it. No more cuts.

- Ministers plan to scrap jury trials in England and Wales except for most serious cases.

- Klarna launches stablecoin to cut cost of cross-border payments.

- UK Budget beckons. Do or die for Reeves.

And finally….

One thing I cannot deal with is a deck of cards glued together.

What has 17 actors, five settings, three writers, and one plot?

643 Hallmark movies.

I’ve always wondered if songbirds get mad at hummingbirds for not knowing the words.

Clarence

XXXX