The ASX 200 started positively to fade to a loss of 21 points to 8454 (0.3%). Banks showed weakness with more slippage as the Big Bank Basket fell to $264.08 (-1.3%) CBA off 1.3% and ANZ down 2.0%. MQG continues to slide, down 1,4% and HUB off 1.1%. GQG is enjoying a rare moment in the sun, up 9.1% as it is pursuing an anti-AI tilt. Insurers eased, REITs were slightly firmer, GMG bouncing back 1.1% and VCX up 2.0%. Industrials were mixed again, ALL up 0.8% and LNW gaining 4.4%. Retailers fell, TPW down another 2.3%. GYG continues to suffer, off 4.3%, DMP down 0.2% as the shorts move back in. Tech found some bargain hunters, WTC up 0.4% and TNE stumbling around. Unchanged in the end.

In resources, we saw a rebound in BHP and FMG, gold miners were back with bullion up to $6280 and EVN up 2.0% with GMD up 2.9%. Lithium stocks paused, rare earth stocks rose, Oil and gas stocks rose, WDS up 1.2% and uranium stocks modestly better.

In corporate news, DRO, down 19.6%, shot out of the air as its US head left in a hurry. WJL got a 90c NBIO offer from Helloworld, NUF soared 10.8% on stronger guidance and KMD rose 2.1% on Q1 sales.

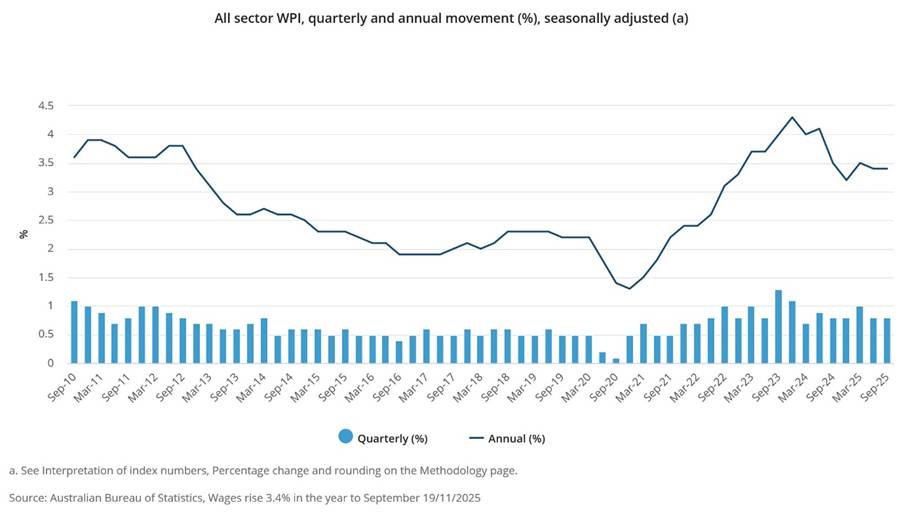

In economic news, wage growth came in as expected at 3.4%.

Asian markets quietly mixed with Japan up 0.1%, China up 0.2% and HK down 0.5%.

European markets set to open weaker.

US Futures: Dow down 58 Nasdaq down 76

HIGHLIGHTS

- Winners: NUF, FML, GQG, PYC, DTR, LYC, MEK, WGX

- Losers: DRO, VUL, CAT, MP1, SRL, CU6, SLC

- Positive Sectors: Gold miners. Rare earth. REITs. Oil and gas.

- Negative Sectors: Banks. Financials.

- ASX 200 Hi 8489 Lo 8448 narrow range. Waiting for Nvidia.

- Big Bank Basket: Down to $264.08 (-1.3%)

- All-Tech Index: Down 0.5%

- Gold: Rallies to $6280

- Bitcoin: Falls to US$91759

- AUD: Eases to 64.80c.

- Asian markets mixed, Japan up 0.1%, China up 0.2% and HK down 0.5%.

- US Futures: Dow down 58 Nasdaq down 76

- 10-year yields lower at 4.41%

MARKET MOVERS

- NUF +10.8% positive results reaction.

- GQG +9.1% having its day in the sun.

- FML +9.9% rally resumes.

- LYC +5.6% broker upgrade.

- MEK +4.9% pops up again.

- ARU +3.8% back to SPP price.

- DTR +5.9% finds friends.

- WJL +16.6% HelloWorld bids 90c in NBIO.

- NYR +12.9% volatility continuers.

- CRD +16.2% Farm Down and Funding for Mako development.

- ATR +8.3% Livewire article.

- DRO -19.6% US CEO resigns.

- VUL -9.2% positive start to Lionheart Phase 1.

- CAT -7.5% broker downgrades.

- MP1 -5.6% tech still on the nose.

- SLC-4.6% tech sell down.

- CSC -4.2% Grasberg restart hits copper short term.

- CXL -11.6% profit taking.

- Speculative Stock of the Day: ALV +52.2% Massive sulphides intercepted in first drillhole at Touro.

ECONOMIC AND OTHER NEWS

- Australian Wage Growth – The seasonally adjusted Wage Price Index (WPI) rose 0.8% this quarter. Annual wage growth to the September quarter 2025 was 3.4%. Annual wage growth remained steady compared to the June quarter 2025 but was slightly lower than this time last year.

- Chilean lithium producer SQM delivered the highest quarterly earnings in two years while signaling the global battery-metal market may finally be emerging from a prolonged glut.

- A member of a key panel advising Japanese Prime Minister Sanae Takaichi said the central bank isn’t likely to raise its benchmark rate before March.

- President Donald Trump said he would formally designate Saudi Arabia as a major non-NATO ally.

- Japan’s 10-year bond yields at highest since global financial crisis.

- Meta wins US case that threatened split with WhatsApp and Instagram.

- Home Depot cites US job and affordability fears as it cuts outlook .

- Nvidia results tonight. Stand by.

And finally…

Cassette tapes had a side A and a side B.

So it’s only logical that their successor would be the CD.

Clarence

XXXX