A nasty start to the day accelerated to a loss of 167 points (-1.9%) on the ASX 200 as RBA minutes and US futures took us down. The big three sectors were hit hard with the iron ore miners smacked. BHP off 3.7% on UK court ruling and RIO off 2.7% with FMG falling 2.0%. Energy stocks also slipped, WDS down 1.9% with STO off 0.6% and uranium stocks under pressure. Gold miners too sold off as bullion slipped, NST down 5.6% and EVN down 5.2% with lithium the only sector that saw any green. PLS up 3.3% and LTR up 2.1%. Banks were also sold down hard, WBC fell 3.0% and CBA down 1.7% with the Big Bank Basket falling to $267.54 (-1.8%). Financials also in the seller’s sights, NWL fell 6.2% and MQG off 1.7%. Insurers fell, QBE down 1.4% and REITS under pressure too. GMG off 3.0% as a tech play on data centres.

Industrials saw across the board selling, WES fell 1.2% and REA off 2.4% with CAR falling 3.2% as TLS down 0.2%. Tech stocks were decimated after TNE disappointed, off 17.2% despite a special dividend. WTC fell 4.6% and XRO tumbled 3.3% with the All-Tech Index down 4.3%.

In corporate news, JHX rallied 9.9% on better-than-expected results, AGM’s dominated. BSL fell 1.7% on EBIT to land at the bottom of guidance range. CAT tested a life with a 11.7% fall on a growth rate of 19%. ALQ fell 2.9% on better numbers. PLT was a rare bright spot after a jump in first half profits, up 6.8%.

On the economic front, RBA minutes took rate cuts off the table. Australian consumer confidence rose 0.7% too.

Asian markets weaker with Japan down 2.9%, China down 0.3% and HK off 1.6%.

European markets set to open weaker.

HIGHLIGHTS

- Winners: JHX, GQG, PLS, LFS, LTR, BFL, A2M

- Losers: TNE, CAT, SLC, AYA, NVA, RAC, IPX, DTR

- Positive Sectors: Lithium.

- Negative Sectors: Everything else.

- ASX 200 Hi 8551 Lo 8446 – Second worst day of 2025. Six-month low.

- Big Bank Basket: Down to $267.54 (-1.8%)

- All-Tech Index: Down 4.5%

- Gold: Slips to $6195

- Bitcoin: Falls to US$90214

- AUD: Eases to 64.66c.

- Asian markets weaker. Japan down 2.8%, China down 0.2% and HK off 1.5%.

- US Futures: Dow down 225 Nasdaq down 231

- 10-year yields steady at 4.47%

MARKET MOVERS

- JHX +9.9% results beat expectations.

- GQG +3.5% bucks trend.

- PLS +3.3% lithium stocks remain firm.

- WGN +0.9% broker comments.

- ELV +1.0% lithium play.

- A11 +22.2% lithium jump.

- CLV +5.3% AGM results.

- PLT +6.8% results beat estimates.

- RIO -2.7% to cut aluminium production in Gladstone.

- TNE -17.2% that don’t impress me much.

- CAT -11.7% results underwhelm.

- NVA -10.9% volatility continues.

- DTR -8.9% wide gold intercepts at Colosseum.

- IPX -9.4% short seller report weighs.

- USL -23.0% AGM presentation.

- EUR -12.5% critical metals falls.

- CXL -4.4% reverses some of Monday’s gains.

- NYR -11.5% volatility continues.

- G50 -10.0% results of meeting.

- Speculative Stock of the Day: MML +36.4% resource upgrade to 529Mt.

ECONOMIC AND OTHER NEWS

- RBA Board Minutes – Inflation in the September quarter came in significantly higher than expected — headline and trimmed mean inflation stood at or above 3%. Underlying inflation pressures may be slightly stronger than previously thought, including inflation in new dwelling costs and market services. No rate cuts on the cards for a long while.

- The RBA expects the unemployment rate to stay near 4.5% and inflation to remain above 3% until the second half of 2026.

- Australian consumer confidence rose 0.7 % last week to 84.2%, ANZ-Roy Morgan data shows, with the four-week average steady at 84.5%.

- Australia recorded 12,257 personal insolvencies in 2024-25, up 5.3% from the previous year and the third consecutive annual increase. Nearly half of all new debtors had BNPL debts, and among debtors aged 29 or younger, that was 65.2%.

- Bitcoin drops below $90k briefly. Holds for now.

- Xiaomi Corp. has gone from market darling to the worst-performing Chinese technology stock in a few short months. Rising memory-chip prices are expected to cut into Xiaomi’s margins on smartphones, and price hikes are difficult amid sluggish Chinese consumption.

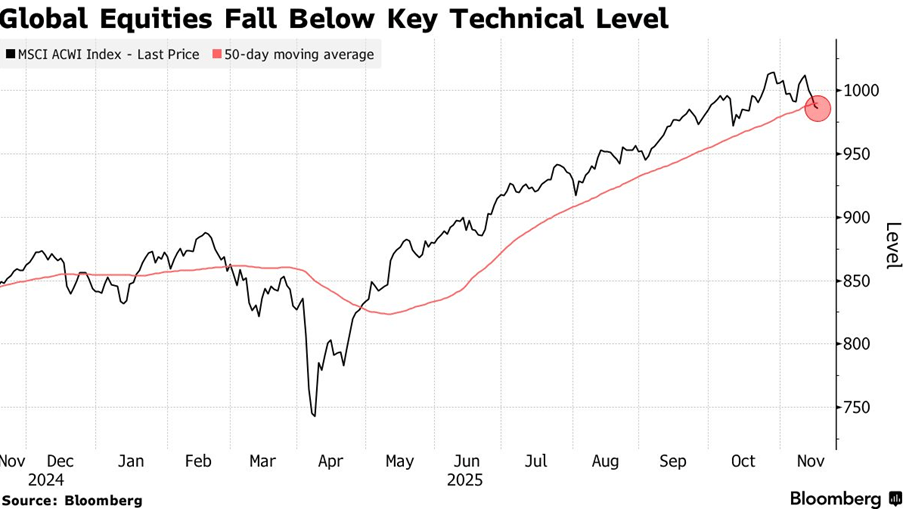

- The Nasdaq index is flashing some ugly signals. More of the index’s 3300 stocks are trading at 52-week lows than highs.

- Larry Summers steps back from public commitments over Epstein fallout.

- India imported gold worth of $14.7 billion, up nearly 200% from October last year.

- UK to ban resale of tickets above face value for live events.

And finally….

I bought my daughter a handbag from Iraq. She said, “thanks for the Baghdad”.

My friend David lost his ID.

Now I call him Dav.

Clarence

XXXXXX