The ASX managed to cling to small gains today, up 26 points to 8828 (0.3%). NAB fell 3.3% after results saw some profit-taking on low growth, WBC down 1.2% as it went ex-dividend. Insurers were better, with QBE up 1.7% and MPL up 0.8%, while other financials remained sloppy and weak. Industrials generally firmed — TLS up 0.6%, TCL up 0.8%, and ALL rising 1.3%, with WES slipping 1.2% again, and JBH falling 3.1%. Travel stocks also fell, WEB down 2.7% and FLT losing altitude, off 1.4%. One bright spot was LNW, up 8.2% on a better-than-expected quarterly. DMP also gained 4.7% as shorts covered, just in case. Tech was slightly firmer as WTC rallied 0.6% and XRO up 0.5%, with the All-Tech Index up %.

Resources firmed — BHP up 1.6% despite iron ore falling again, RIO also doing well. Gold miners were better on a bullion price increase, NST up 2.8% and NEM rising 2.8%. Rare earths were still under some pressure, as was the uranium space, while oil and gas firmed, WDS up 1.6%.

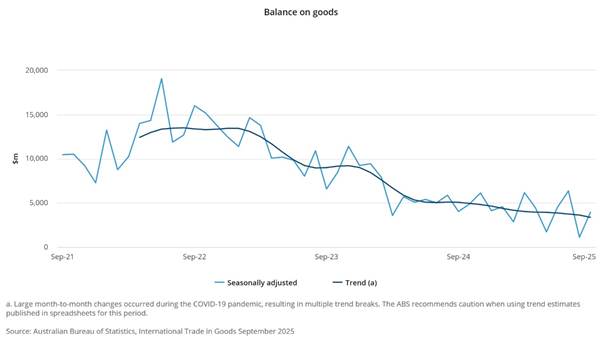

In corporate news, ZIP fell 4.2% after its AGM reaffirmed guidance — perhaps the market was looking for another upgrade. JHX tumbled again, down 12.7%, as it went into a trading halt and blamed index rebalancing for the earlier sell-off. TAH dropped 3.0% as Aware Super sold down, and AMC rallied 5.0% on first-quarter results. On the economic front, Balance of Payments data was released today, showing the seasonally adjusted balance on goods increased by $2.827bn in September.

Asian markets – HK up 1.6% China up 1.3% and Japan bouncing 1.6% 10-year yields squeezed to 4.36%.

US Futures off lows, Nasdaq down 17. Dow down 19 Tesla vote tonight.

European markets set for a flat opening.

HIGHLIGHTS

- Winners: FML, MI6, LNW, SMI, MEK, EMR, RMS, ALK

- Losers: JHX. DRO, NEU, SX2, EOS, GEM, IPH

- Positive Sectors: Iron ore. Banks. Gold miners. Oil and gas. Insurers.

- Negative Sectors: Old ‘skool’ platforms.

- ASX 200 Hi 8857 Lo 8807

- Big Bank Basket: Rises to $298.34 (+0.1%) WBC Ex Dividend.

- All-Tech Index: Down 0.4%

- Gold: steady at $6120

- Bitcoin: Bounces to US$103288

- AUD: Rises to 65.08c.

- In Asian markets – HK up 1.6% China up 1.3% and Japan bouncing 1.6%

- 10-year yields steady at 4.36%.

- US futures – Dow up 15 Nasdaq down 19

- European markets set to open flat.

MARKET MOVERS

- FML +14.0% kicks higher again.

- MI6 +10.7% good volume kick.

- LNW +8.2% quarterly results.

- RMS +5.6% gold bulls return.

- TRE +18.9% Mali operation update.

- EQR +15.8%Barruecopardo mine sets record production.

- JHX -12.5% trading halt and MSCI news.

- DRO -11.7% EOS -6.2% defence slips again.

- NEU -10.4% DayBue results didn’t impress.

- GEM -5.7% sell off continues.

- IPH -5.4% CEO retires.

- PDN -4.5% uranium under pressure.

- ILA -9.9% gives it back.

- ANG -4.7% just gets worse.

- Speculative Stock of the Day: Nothing in any volume.

ECONOMIC AND OTHER NEWS

Balance of Payments

- The seasonally adjusted balance on goods increased $2,827m in September.

- Goods credits (exports) increased $3,256m (7.9%) driven by Non-monetary gold.

- Goods debits (imports) increased $429m (1.1%) driven by Capital goods.

- Iron ore headed for its longest run of daily losses since August as China’s steel industry goes into the low season and optimism around the US-China trade truce faded.

- Deloitte Access Economics’ latest Investment Monitor shows Australia’s project pipeline reaching just under $1.2 trillion in September, up 7% from a year ago, driven largely by structural growth opportunities.

- Deloitte expects business investment to remain modest through the end of 2025, with a gradual recovery in 2026 as confidence improves.

- Nvidia’s Jensen Huang says China ‘will win’ AI race with US.

- MSCI added 69 companies to its all-country world index in its quarterly review, including CoreWeave, Nebius and Insmed.

- The index compiler also added several firms to its MSCI Emerging Markets Index, with the largest by market value including PT Barito Renewables Energy, Zijin Gold International and GF Securities.

- MSCI also removed 64 companies from its all-world index.

- Chinese autonomous driving firm Pony.ai sees shares drop 14% in Hong Kong debut.

- US to cut flights 10% at 40 airports because of government shutdown.

- Pfizer matches Novo bid for obesity biotech Metsera as takeover battle rages.

- President Donald Trump said it would be “devastating for our country” if SCOTUS denied POTUS his tariffs.

And finally…

If a drummer comes out of retirement will there be repercussions?

NASA is launching a satellite to say sorry to the aliens. They’re calling it the Apollo G.

I read that most auto accidents happen within five miles of the home, so we moved.

Clarence

XXXX