The ASX 200 dropped another 81 points to 8814 (0.9%) as the RBA kept rates unchanged as expected. Banks and iron ore miners synchronised falls, with the Big Bank Basket down to $295.15 (-0.4%). WBC saw buyers up 1.5% on broker comments post the result. CBA down 0.8%. Insurers and financials slid, MQG down 0.8% and QBE off 0.7%, with SOL continuing to flounder off another 1.7%. REITs under pressure again, GMG off 1.9% and SGP falling 1.1%. Industrials weaker with some exceptions, DMP, LNW and PWH in the green. WES lost another 0.8% with JBH off 1.9% and SUL falling 2.8%. Tech eased back again, XRO down another 1.6% and WTC falling 1.5%.

In resources, iron ore miners under pressure with prices off in Asia. BHP down 1.9% and FMG dropping 2.7%. Lithium and rare earths seeing profit taking, LYC down 1.2% and MIN off 2.3%. Gold miners were generally steady. Oil and gas eased, WDS down 0.7%, and uranium stocks fell back to earth.

In corporate news, GEM fell 13.0% on an earnings update, LNW to delist from Nasdaq, CCX jumped 8.8% on positive momentum in trade. NVX crashed 10.6% as Stellantis pulled out of its agreement.

On the economic front, the RBA left rates unchanged. Capital Economics believes the Reserve Bank will still lower interest rates twice next year, with the first reduction coming in the third quarter.

Asian markets mixed, HK up 0.2%, China down 0.4% and Japan down 0.5%.

10-year yields 4.34%. US Futures easing back, Dow off 189 and Nasdaq falling 218.

HIGHLIGHTS

- Winners: SRL, WGN, C79, GNG, DRO, NGI, KCN

- Losers: GEM, WBT, NXG, SLX, BOE, APE

- Positive Sectors: None.

- Negative Sectors: Pretty much everything.

- ASX 200 Hi 8885 Lo 8802 – RBA leaves rates unchanged.

- Big Bank Basket: Falls to $295.15 (-0.4%)

- All-Tech Index: Down 0.9%

- Gold: steady at $6109

- Bitcoin: falls to US$107078

- AUD: Eases to 65.31c.

- In Asian markets – HK up 0.2% China down 0.4% and Japan down 0.5%

- 10-year yields higher at 4.34%.

- US futures – Dow down 189 Nasdaq down 218.

- European markets set to open lower.

MARKET MOVERS

- SRL +13.0% volatility continues.

- WGN +10.3% broker upgrade.

- PPM +3.8% RAMs glow.

- DRO +8.6% Latin American order.

- NYR +15.6% rally continues.

- TM1 +3.3% change in substantial shareholding.

- GEM -13.0% trading update.

- WBT -10.5% profit taking.

- NXG -7.0% uranium sell off.

- SLX -6.0% uranium sell-down.

- WLE -6.5% ex-dividend.

- NVA -22.1% cleansing statement.

- NVX -10.6% Stellantis agreement over.

- TMG -10.0% CSAMT – Large scale antimony system.

- Speculative Stock of the Day: FRX +108% Not huge volume. No announcements.

ECONOMIC AND OTHER NEWS

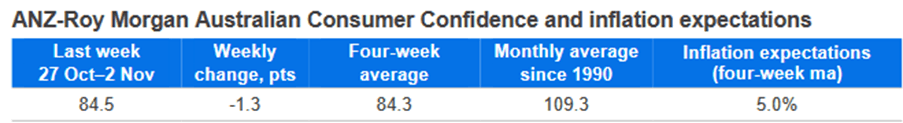

- Consumer confidence fell 1.3pts last week to 84.5pts. The four-week moving average ticked down 0.1pts to 84.3pts.

- ‘Weekly inflation expectations’ lifted 0.4ppt to 5.2%, while the four-week moving average was at 5.0%.

- ‘Current financial conditions’ (over the last year) decreased 0.3pts, while ‘future financial conditions’ (next 12 months) declined 3.9pts.

- RBA leaves rates unchanged. Inflation has ticked up again. Trimmed mean inflation rose to 1.0% in Q3 and 3.0% over the year, higher than expected. Headline inflation hit 3.2%, partly due to the end of electricity rebates.

- The RBA sees some temporary factors at play. The Board believes part of the Q3 rise reflects short-term effects rather than a sustained trend.

- Starbucks will form a joint venture with Boyu Capital to operate the company’s locations in China. The company will retain a 40% stake in the joint venture.

- China offers tech giants cheap power to boost domestic AI chips.

- Palantir lifts 2025 sales outlook after posting strong quarterly growth.

- China called on the US to avoid four sensitive issues so a trade truce can hold.

- Hooters emerges from bankruptcy with a promise to “re-Hooterisation”.

- NY Mayoral vote tonight. Tariff court case tomorrow.

And finally…..

My friend’s grandfather came back from WWII with one leg…he never did find out who it belonged to.

Two guys walk into a bar.. The third guy ducks…

Clarence

XXXXX