The ASX 200 rallied 37 points after a weaker start to 9032 (0.4%) as banks broke on through. With CBA up 2.6% and NAB rising 1.4% and the Big Bank Basket up to $292.49 (+1.9%). Insurers bounced back from Friday’s heavy losses, QBE up 3.7% and IAG rising 2.2% with financials also doing well, CGF up 1.1% and ZIP up 4.3% on quarterly numbers. REITS back in favour, GMG up 0.7% and SCG rising 1.5%. Industrials too were back in demand, BXB rallied 2.0% with REA up 1.2% and WES rising 1.0%. Tech stocks a little better for a change, WTC up 0.9% and XRO putting on 0.3%. Resources were generally weaker, gold miners under pressure again on profit taking, NST down 3.6% and EVN falling 4.9%. Iron ore miners eased, but rare earths were back in vogue. LYC up 6.6% and ARU leading, UP 18.5%. PLS rose 2.2% with DTR up 7.5% on Colosseum news. A better day for oil and gas, STO up 2.6% and WDS gaining 0.7%. Uranium stocks slipped, PDN down 4.9% and DYL in deep red, off 18.8% as the CEO quit!

In corporate news, DRO lost 2.6% as quarterly showed a big revenue jump as expected, ZIP were better than forecast and extended the buyback, BAP crashed 17.7% on operational issues and impairments and a downgrade.

On the economic front, NZ inflation rose to 3%, Chinese GDP came in a 4.8% as expected.

Asian markets bouncing back hard, Japan up 2.9% on political resolution perhaps, China up 0.7% and HK up 2.2%.

10-year yields rise to 4.14%.

European markets opening around 0.3% higher. Results in focus this week.

HIGHLIGHTS

- Winners: ARU, AFG, DTR, MEI, NVX, LYC, MAD

- Losers: EUR, DYL, BAP, BOC, CRN, SX2, EMR, CHN

- Positive Sectors: Banks. Insurers. REITS. Tech, Industrials.

- Negative Sectors: Gold miners.

- ASX 200 Hi 9034 Lo 8964

- Big Bank Basket: Rises to $292.49 (+1.9%)

- All-Tech Index: Up 0.7%

- Gold: better at $6544

- Bitcoin: rises to US$110365

- AUD: rises to 65.02c.

- In Asian markets – Japan up 2.9% on political resolution perhaps, China up 0.7% and HK up 2.2%

- 10-year yields rise to 4.14%.

- US futures – Dow up 130 Nasdaq up 130

- European markets set to open higher.

MARKET MOVERS

- ARU +18.5% rare earths back in fashion – in places.

- AFG +8.8% broker upgrade.

- DTR +7.5% Colosseum work.

- MEI +7.0% back baby!

- NEU +4.2% FDA fast track for NNZ 2591.

- LRV +4.0% Scrip bid from United States Antimony Company.

- LYC +6.6% Albo meets Trump?

- LKY +16.3% delivers 100% US made antimony ingot.

- LDX +19.4% kicks again.

- HAS +24.5% bounces back with Yangibana project rare earth exposure.

- BOC -16.7% profit taking.

- INR -8.7% quarterly.

- CHN -9.0% platinum price falls.

- EUR -28.0% option dates again.

- DYL -18.8% CEO resigns.

- BAP -17.7% impairment and guidance downgrade.

- ASM -13.7% presentation.

- AEE -15.2% MD resigns.

- SX2 -10.1% profit taking.

- SPD -8.8% peeled back on placement for PGM project.

- Speculative Stock of the Day: RML +33.7% strategic placement to Tribeca Investment.

ECONOMIC AND OTHER NEWS

- Dalian iron ore futures prices fell on Monday to their lowest in seven weeks, as a batch of downbeat data in top consumer China drove concerns over demand.

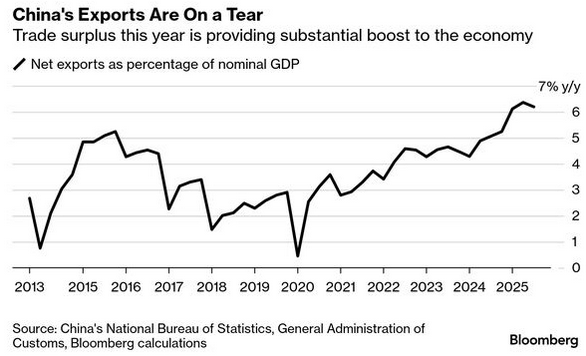

- China’s gross domestic product expanded by 4.8% in the third quarter from a year ago, a slowdown from 5.2% in the second quarter. Fixed-asset investment, which includes real estate, unexpectedly fell by 0.5% in the first nine months of the year.

- Industrial production grew by 6.5% year-on-year in September, faster than the 5% forecast and 5.2% growth in the prior month.

- Conservative Sanae Takaichi is almost certain to become Japan’s first female prime minister on Tuesday, after the right-wing opposition Japan Innovation Party, known as Ishin, said it was ready to back her premiership.

- NZ Inflation rose to 3%.

Clarence

XXXXXX