ASX 200 Hits Record Highs

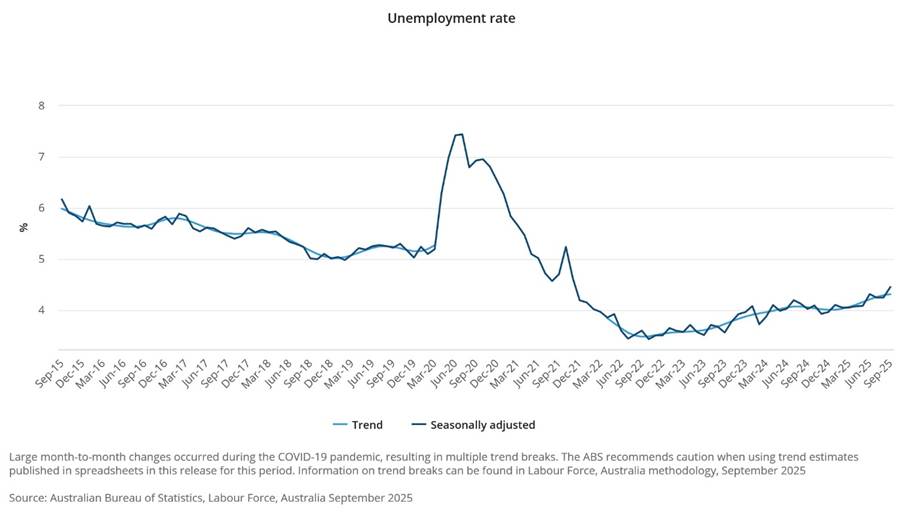

The ASX 200 (XJO) hit record highs today, closing at 9068 up 78 points (0.9%) in a very strong session. Once again, it was banks and industrials doing much of the heavy lifting — along with a solid contribution from the banks. MQG led the charge, jumping over 5% on the back of news it had sold some of its data centre assets — all good news all round. The big kicker came at 11:30 am, with jobs data showing an unemployment rate of 4.5%. That gives the RBA plenty of room to cut rates further on Melbourne Cup Day. At this point, a rate cut looks more certain than any tip I could give you for the race itself. Across the industrials, gains were broad-based: WES up 1.3% up %, WOW up 1.9% , GMG up 4.9% buoyed by enthusiasm for data centre exposure following Macquarie’s sales. CSL added 1.8%. TLS rose 0.4%. The banks were steady if unspectacular, while insurers and wealth managers shone. HUB soared 10.5%. AMP also rallied 8.5% on the back of a positive quarterly update.

The technology sector, however, missed the memo on record highs — WTC and XRO both slipped around 1.4%, continuing their recent stumbles.

The resources sector was busy once again. BHP edged slightly higher, while FMG and RIO eased. The gold miners were the standout as gold hit fresh record highs. NEM up 3.4% and EVN up 3.3%. The rare earths and lithium stocks came under pressure after Scott Bessent talked an extension of tariff relief if China eased export restrictions. LYC fell 5.7%. Other rare earth names also weakened substantially in sympathy.

In corporate news, MYX rose 11.3% after it received court approval for its takeover by Cosette, with no wriggle room left — though FIRB approval is still required. RIO is searching for strategic partners to develop a huge copper deposit in Bougainville. TWE edged 1.8% higher after its AGM, where Chairman John Mullen discussed ongoing challenges and sales developments in China.

On the economic front, the jobs report confirmed unemployment rising to 4.5%, with a steady participation rate. That combination pushed bond yields lower, the Australian dollar weaker, and equity markets higher — a triple treat for investors heading into the weekend.

Asian markets rise, Japan up 1.0% China unchanged and HK down 0.7%.

10-year yields fell to 4.15% on jobs data.

European markets slightly lower.

HIGHLIGHTS

- Winners: BOC, FFM, CU6, MEK, JIN, HUB, L1G, APZ.

- Losers: NVX, NVA, MMI, DTR, ILU, NTU, INR, IPX, LRV

- Positive Sectors: Banks. Healthcare. Gold miners. Industrials.

- Negative Sectors: Rare earths. Lithium. Tech.

- ASX 200 Hi 9110 Lo 8993 – New records!

- Big Bank Basket: Rises to $287.61(+0.7%)

- All-Tech Index: Down 0.5%

- Gold: flies to new record at $6483

- Bitcoin: slips to US$111,238

- AUD: falls to 64.91c on jobs data.

- In Asian markets – Japan up 1.0% China up 0.3% and HK down 0.4%.

- 10-year yields fell to 4.15% on RBA cuts?

- US futures – Dow down 6 Nasdaq down 20.

- European markets set to open slightly higher.

MARKET MOVERS

- MYX +11.3% gets court win. FIRB to come.

- BOC +42.6% strategic partnering report.

- FFM +22.0% great copper intersects.

- MEK +13.6% 22m @3.25g/t Au.

- JIN +13.6% broker upgrades.

- CU6 +15.1% signs copper-67 supply agreement.

- L1G +9.1% rally resumes.

- MQG +5.1% data centre sale.

- BGL +5.9% gold soars again.

- LDX +18.2% wrote up as a buy on Sept 26th.

- CXO +17.4% cleansing statement.

- NVX -24.6% change in substantial holding.

- NVA -19.6% share split of Nasdaq ADs

- DTR -12.5% company address!

- IXR -25.0% supplementary prospectus.

- ARR -17.6% profit taking.

- COB -16.4% profit taking.

- LKY -14.1% Rice Uni tech update.

- INR -7.4% profit taking.

- LRV -7.2% profit taking.

- Speculative Stock of the Day: AW1 +57.1% – Placement, tipped and buying Indium deposit in US.

ECONOMIC AND OTHER NEWS

ABS Jobs data – In seasonally adjusted terms, in September 2025:

- unemployment rate increased to 4.5%.

- participation rate increased to 67.0%.

- The unexpected jobless rate rise to 4.5% – the highest since November 2021– has bolstered the case for the Reserve Bank to cuts its cash rate by 50 basis points by February, according to HSBC chief economist Paul Bloxham.

- Money markets are now pricing in about a 70 per cent chance of the RBA delivering its fourth rate reduction this year, which would take the cash rate to 3.35%.

- UK GDP this morning.

- South Korea’s Kospi index hit a record high Thursday, after the International Monetary Foundation raised its 2025 growth forecast for the country.

- The IMF also raised its growth projection for the global economy, saying the impact of U.S. tariffs was “at the modest end of the range.”

- Japan’s Kato Calls for G-7 Unity Over China’s Rare Earth Curbs.

- Trump says Modi pledged India would stop buying Russian oil.

- Bank of America and BNY sued over financial ties to Jeffrey Epstein.

And finally…..

Did you hear the story about the claustrophobic astronaut?

He just needed some space.

Clarence

XXXX