The ASX 200 rose only 17 points today to 8899 (0.2%). But that action belies some extraordinary moves in the resources. Rare earths, lithium, critical metals, and strategic metal plays all soared. ARU up 25.4%, ILU up 15.8% and LYC up 5.0% with second liners flying. PLS up 2.7% and LTR rising 6.9%. Gold miners too in demand as bullion hit fresh records, NST up 2.8% and GMD up 5.4%. Big miners also got the memo, BHP up 2.2% and RIO rising 1.8% after production numbers. Uranium too in demand, LOT up 11.4% on a site visit, PDN up 9.6% on production numbers. Oil and gas in the slow lane as usual. The source of funding for all this buying was banks and industrials. CBA down 0.5% with WBC off 1.2% and the Big Bank Basket down to $281.46 (-0.6%). Insurers also fell, although financials tried to garner some support, MQG up 1.2%. Healthcare eased, REITs fell, industrials slid. WES down 1.2% and ALL off 1.2% with retail under pressure following weaker consumer sentiment data. Tech tried hard to hold, TNE up 1.8% and XRO up 0.5%.

In company news, plenty of production and drilling reports to keep things interesting. SRG rose 29.3% on an acquisition of TAMS. ABB fell 3.1% after reporting 22k new subscribers. BRE jumped 6.8% after a cap raise supported by Rinehart. CSC rose 3.4% after a deal to sell a 25% stake in a Cu-Ag project.

On the economic front, RBA minutes together with ANZ Roy Morgan Consumer confidence numbers.

Asian markets fell, Japan back from a holiday off 2.8%, HK down 1.1% and China 0.8%

10-year yields fell to 4.25%. European markets slightly lower

HIGHLIGHTS

- Winners: SRG, ARU, SYR, MEI, MI6, ILU, CYL

- Losers: EOS, CU6, DTR, DRO, 4DX, MYR, EOL

- Positive Sectors: Rare earths. Critical metals. Lithium. Iron ore. Uranium.

- Negative Sectors: Banks. Industrials. Retail. Healthcare.

- ASX 200 Hi 8915 Lo 8844.

- Big Bank Basket: Falls to $281.46 (-0.6%)

- All-Tech Index: Unchanged

- Gold: flying to $6450. Silver cracks US$53!

- Bitcoin: improves to US$113281

- AUD: falls to 64.71c

- In Asian markets – Japan down 2.4% China down 0.2 and HK down 0.8%.

- 10-year yields fell to 4.25%.

- US futures – Dow down 141. Nasdaq down 156. Earnings tonight.

- European markets set to open slightly lower.

MARKET MOVERS

- SRG +29.3% TAMS acquisition briefing.

- ARU +25.4% rare earths.

- MEI +17.1% shooting star!

- SYR +19.8% strategic play.

- MI6 +16.1% Conference presentation.

- ILU +15.8% rare earths theme.

- DYL +13.5% drilling results.

- LOT +11.4% site visit.

- EUR +53.9% investment in CRML.

- ASM +67.7% name says it all.

- HAS +31.0% rare earths.

- LRV +21.6% antimony.

- IXR +26.9% US Strategic investment.

- DTR -8.4% profit taking continues.

- EOS -10.4% defence easing back.

- DRO -6.5% profit taking.

- 4DX -6.4% profit taking.

- ELS -7.8% defence stocks so last month.

- VR1 -5.1% defence stocks ease.

- ATC -9.3% placement.

- Speculative Stock of the Day: COB +100% Legacy Deal – cobalt in focus now too. Plenty happening there.

ECONOMIC AND OTHER NEWS

- NAB business confidence +7. Up from +4 in August.

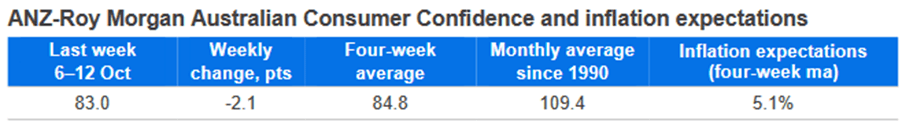

- Consumer confidence tumbled to a 12-month low amid growing concerns about the health of the economy, according to an ANZ-Roy Morgan survey

- Confidence dropped 2.1 percentage points to 83 points, dragging the four-week average to its lowest level since October 2024.

- RBA Minutes – the Board affirmed the importance of being attentive to the data and the evolving assessment of the outlook and risks when making its decisions. Members committed to pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.

- ASX to speed up IPOs and broaden index eligibility as it seeks to encourage more listings.

- Silver prices also touched an all-time high above $US52.50 an ounce, as a historic short squeeze in London added momentum to a rally.

- The US is now collecting tariffs on imported timber, lumber, kitchen cabinets, bathroom vanities and upholstered furniture, duties that threaten to raise the cost of renovations and deter new home purchases.

- Germany to allow retirees to earn €2,000 a month tax-free.

- Trump to meet Zelenskyy in Washington on Friday.

- Samsung on track for highest profit in 3 years.

And finally……

I think this is a MAGA joke…

Clarence

XXXX