The ASX 200 closed up 22 points at 8970 (0.3%) in somewhat lacklustre trade. Banks slid led by CBA down 1.3% and the Big Bank Basket down to $284.98 (0.9%). NAB also down 1.4% with other financials firming. REITS slipped slightly, GMG down 0.5% and SCG off 0.3%. Industrials mixed and uninteresting, QAN rose 1.1% and TLS gained 0.8% with REA bouncing 1.2%. WOW and COL also better. Healthcare mixed, SIG up 3.1% and RMD down 1.2%.

In resources, copper stocks on a roll, BHP up 2.9% and RIO up 1.6%. Rare earth stocks also in demand on Chinese moves again, LYC up 5.3% and ILU up 2.5%. S32 continues to power ahead up 5.7% and IGO rose 2.4%. Gold miners were mixed, EVN up 0.8% and CMM rising 0.9%. SFR in the copper space rose 5.3%. Uranium stocks slipped slightly, PDN rose 1.1% as the SPP closes today. Oil and gas flat.

In corporate news, GYG announced a $100m buyback. ELD drooped 1.0% on a downbeat trading update. BRE jumped 8.6% on an agreement to supply specialist Carester. Nothing on the economic front.

Asian markets back in full flight, Japan up 1.4%, China up 1.6% and HK up 0.3%

10-year yields ease to 4.35%

HIGHLIGHTS

- Winners: L1G, INR, RAC, LIN, ELV, MLX, CHN

- Losers: ASB, SRL, MYR, AEL, MTM, MP1, RRL, PYC.

- Positive Sectors: Copper. Iron ore. Telcos. Rare earths.

- Negative Sectors: Banks. Tech. REITs.

- ASX 200 Hi 8997 Lo 8956. Narrow range.

- Big Bank Basket: down at $284.98 (-0.9%)

- All-Tech Index: Down 0.1%

- Gold: slips to $6112

- Bitcoin: steady atUS$122447

- AUD: rises to 66.08c.

- In Asian markets – Japan up 1.4%, China up 1.6% and HK unchanged.

- 10-year yields ease to 4.33%.

- US futures – Dow down 26. Nasdaq up 9.

- European markets set to open flat.

MARKET MOVERS

- INR +18.6% US Boron and lithium exposure.

- L1G +22.6% FUM – Old PTM.

- 29M +9.3% bounce continues.

- CHN +10.3% platinum moving higher.

- MLX +10.4% broker upgrade.

- BRE +8.6% offtake agreement.

- EUR +18.2% offtake agreement.

- STK +29.0% gravity survey highlights new porphyry targets.

- MEI +14.3% broker upgrade.

- GYG +2.3% trading update. $100m buyback.

- MTM -4.0% off the boil.

- CBO -2.3% thin volume.

- ASB -9.6% profit taking.

- SRL -5.3% profit taking.

- FND -21.2 % Revolut enters Indian market.

- HAS -5.3% profit taking.

- Speculative Stock of the Day: I88 +226% Strong volume too 15m shares traded. Extensive downhole uranium intersected at Portland Creek.

ECONOMIC AND OTHER NEWS

- Australian retail investors have sharply regained confidence in the economy, property market and their portfolios, according to eToro’s latest Retail Investor Beat survey.

- Half of local retail investors (50%) are now confident in the Australian economy, up from 36% in the previous quarter and the highest reading since early 2023.

- Younger Australians remain the most optimistic.

- Hamas and Israel agree to the first phase of a peace deal.

- Kudos to Trump for this move. Maybe he does deserve the Peace Prize?

- China’s stock market opened higher Thursday after a weeklong break. Gold and chip stocks were among the top drivers of Thursday’s onshore gains.

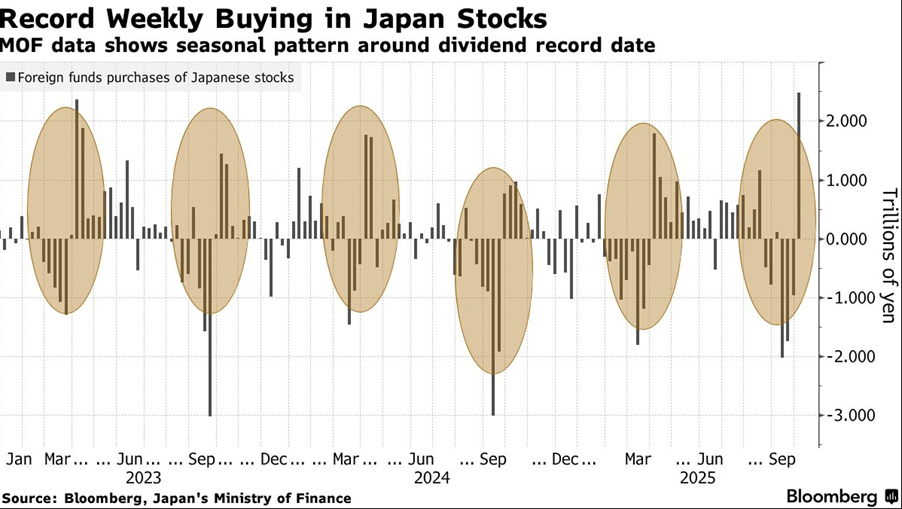

- Foreign investors scooped up a record ¥2.48 trillion ($16.3 billion) of Japanese stocks last week.

- HSBC plans to take Hang Seng Bank Ltd. private in a deal that values the lender at $37bn.

- China has tightened curbs on rare earths to include items manufactured abroad. Overseas exporters of items that use rare earths sourced from China will need to obtain an export license from the country’s Ministry of Commerce.

- First Brands creditor warns as much as $2.3bn has ‘simply vanished’.

- NATO weighs armed response to Vladimir Putin’s hybrid war.

- Emmanuel Macron to name a new French PM by Friday.

- IMF and BoE warn AI boom risks ‘abrupt’ stock market correction.

- Powell speaks tonight.

And finally…

Volkswagen should bring back the Beetle as an electric car. They can call it the Lightning Bug.

Halloween is coming, if you want to scare me, I’m afraid of

$100 bills.

Apparently to start a zoo you need at least two pandas, a grizzly and three polars.

It’s the bear minimum

Clarence

XXXX