The ASX 200 rallied another 35 points to 8846 (0.4%). Gold once again the star of the show with good gains again in the sector. NST up 3.2% and GGP up 4.4% some of the stand outs. LYC had a great day following an ASA Presentation up 8.0%. Other critical metal and rare earth stocks also finding friends. ILU up 3.4% and VUL up 3.3%. Iron ore stocks mixed, FMG gave back some of the gains from yesterday down 1.1%. Oil and gas stocks slid, STO down 0.9% with uranium stocks doing better again today, PDN up 2.4% and LOT up 2.3%. Banks were back in demand today, CBA up 0.8% and NAB doing well with the Big Bank Basket up to $283.07 (0.8%). SOLDA put on 2.1% with insurers mixed. Industrials mixed too, CPU dropped 2.1% with QAN down 1.1% and supermarkets also seeing selling. Retail was mixed, MYR dropped 25.0% on results, JBH up 1.2%. Tech uninspiring, WTC and XRO going nowhere fast.

In corporate news, CTT founder has been back buying stock. TLX rallied 9.2% on good news on transitional pass-through payment status. AEL in a trading halt raising $150m.

Nothing on the economic front.

Japan closed for a holiday. HK hit 1.3% and a Typhoon. China down 1.1%.

US futures slightly mixed.

HIGHLIGHTS

- Winners: CHN, DTR, KCN, TLX, MTM, LYC, DRO

- Losers: MYR, CRN, SRL, SYA, VAU, REG, AAC, PMV

- Positive Sectors: Banks. Gold miners. Critical metals.

- Negative Sectors: REITs. Supermarkets.

- ASX 200 Hi 8877 Lo 8810

- Big Bank Basket: Rallies to $283.07(+0.8%)

- All-Tech Index: Down 0.2%.

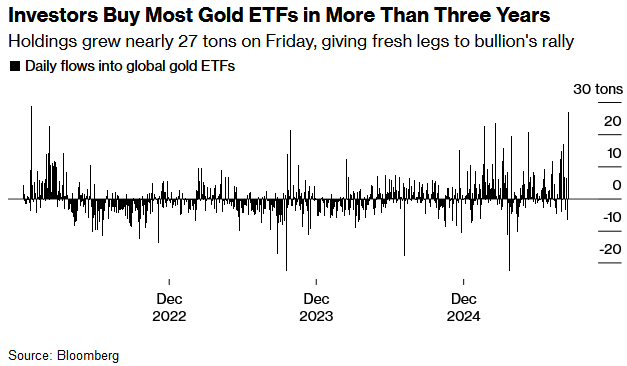

- Gold: rises to $5700

- Bitcoin: slips to US$112,801

- AUD: Steady at 65.88c.

- Asian markets: HK down 1.1%, Japan closed for a holiday and China down 1.1%.

- 10-year yields steady at 4.26%.

- US futures – Opening slightly lower. DJ down 87 – Nasdaq down 40.

- European markets set to open up slightly.

MARKET MOVERS

- DTR +14.3% corporate presentation.

- DRO +7.0% defence stocks back in favour.

- LYC +8.0% ASA Presentation yesterday

- EOS +5.4% begins trading in Frankfurt

- TLX +9.2% US transitional pass-through status.

- KCN +9.9% gold jump.

- CTT +18.8% bargain hunters. CEO buys more.

- SGQ +15.8% broker report.

- FRS +9.1% tenure acquired adjacent to Edna May.

- BML +17.3% response to ‘please explain’

- MYR -25.0% results shocker.

- SRL -6.2% profit taking.

- VAU -4.4% broker downgrades.

- SXE -2.8% ex dividend.

- RWC -2.3% buyback notification.

- FXG -7.1% got carried away yesterday.

- CLV -12.4% Results presentation.

- VR1 -8.3% profit taking.

- BRE -5.3% profit taking.

- Speculative Stock of the Day: CRS +20% – No reason but good volume.

ECONOMIC AND OTHER NEWS

- Merdeka Gold soared by the 25% daily limit in its Jakarta trading debut after the miner wrapped up Indonesia’s largest initial public offering this year.

- Hong Kong faces most damaging typhoon since 2018.

- Santos (STO), Shell, Woodside (WDS) Signal Support for Australian Domestic Gas Reservation.

- Chinese copper production was at record levels during the first half of the year, putting pressure on operations elsewhere in the world. Smelters from the nation account for more than half of global production.

- The US will briefly have enough rare-earth magnet capacity to meet domestic demand around 2028, according to consultancy Adamas Intelligence. US demand for magnets will expand by up to five times from 2024 to 2035, driven by rapid growth from high-tech sectors.

- Argentina’s Milei to meet Trump for talks on US financial lifeline.

- America’s top companies keep talking about AI — but can’t explain the upsides.

- TikTok algorithm to be overseen by Oracle in Trump deal.

And finally…..

Clarence

XXXX