The ASX 200 rose 25 points in quiet trade to 8878 (0.3%) ahead of the Fed. Banks were mixed again, CBA down 0.3% and NAB and WBC up again. The Big Bank Basket flat at $284.23 (-0.1%). Wealth managers bounced slightly, MQG up 1.0% and NWL rising 1.5%. First day of trade for SOLDA the new look SOL/BKW entity. REITS slipped slightly, SCG down 0.5% and VCX off 0.8%. Industrials were mixed, retail better except SUL as its CEO was sacked, down 4.3%. CPU rallied 2.3% and REH rose 2.8%. Tech rose again, although WTC down 1.6% and XRO resumed the downtrend, off 0.6%. A long way down from the recent cap raise price. The All-Tech Index rose 0.7%. Resources remain the place to be. Iron ore miners rose, RIO up 1.9% with gold miners finding support, GMD up 0.7% and NEM up 0.9%. Lithium also in demand, MIN up 1.1% and LTR up 3.0%. Uranium stocks were roaring ahead, DYL up 9.2% and NXG rising 8.7%. PDN in a trading halt as it seeks to raise $300m in a placement and SPP. Oil stocks rose slightly in the second liners. Coal stocks also in demand, NHC rose 5.1% on good results, WHC up 1.9%.

In corporate news, CSL fell another 1.3% as it announced a potential acquisition, SIG rallied 0.3% on Richard Murray’s appointment as CFO.

Nothing on the economic front locally.

Asian markets better, Japan hitting new records up 0.5%, China down 0.4% and HK unchanged.

10-year yields falling to 4.21%.

HIGHLIGHTS

- Winners: BMN, MTM, CRN, DYL, NXG, BOE, CU6, BGL

- Losers: OBL, OBM, DTR, SUL, DRO, BAP, PGC, CVL

- Positive Sectors: Lithium. Uranium. Tech. Gold. Coal.

- Negative Sectors: Tech. Healthcare.

- ASX 200 Hi 8888 Lo 8766. Narrow range.

- Big Bank Basket: Falls to $284.23 (-0.1%)

- All-Tech Index: Up 0.7%.

- Gold: runs to $5522

- Bitcoin: Steady at US$115895

- 10-year yield steady at 4.22%.

- AUD: Up to 66.66c.

- Asian markets: Japan hitting new records up 0.5%, China down 0.4% and HK unchanged.

- US futures – Opening slightly lower. DJ up 43 – Nasdaq up 48.

- European markets set to open up slightly.

MARKET MOVERS

- MTM +10.9% solid bounce.

- BMN +11.6% NXG +8.7% uranium surge.

- BGL +6.3% change in substantial holding.

- NHC +5.1% presentation of FY25 results.

- REG +4.5% increase to AN-ACC supplement

- SRL +29.9% LOI from US EXIM.

- AVH +28.5% CE mark for RECELL GO.

- RAC +27.8% breakthrough of Matter IP discovery.

- LKY +26.5% antimony play.

- FXG +19.1% antimony.

- SS1 +8.6% silver exposure, commences US listing process.

- DUG +16.1% 1st year purchase order with upgrade to contract value.

- OBM -5.3% downgraded and sinks again.

- SUL -4.3% CEO sacked.

- IEL -2.7% profit taking. Change of director’s interest.

- FAL -18.2% latest drilling results underwhelm.

- NMG -6.5% profit taking.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

- Fed meeting kicks off. Stephen Miran gets confirmed and Lisa Cook keeps her job. For now.

- TikTok has been saved for young Americans.

- OpenAI has hired former xAI finance chief Mike Liberatore as business finance officer, he left xAI in July after just three months on the job, begins Tuesday.

- Japan’s benchmark Nikkei 225 breaches 45,000 mark to hit a fresh high.

- A Chinese biotech firm has skyrocketed more than 4,500% in the three months since its Hong Kong debut, stoking worries of speculative buying. TransThera Sciences is the top performer on the Hang Seng Healthcare Index this year.

- Donald Trump files $15bn defamation lawsuit against New York Times.

- Top sensor maker Hesai warns world not ready for fully driverless cars.

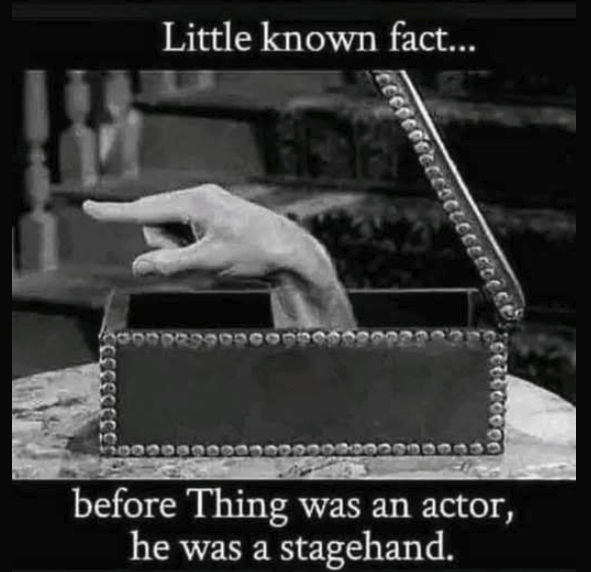

And finally…..

Clarence

XXXXXX