Did you miss me? Bet you didn’t!

The ASX 200 fought back from earlier steeper losses to close down only 12 points at 8853 (0.1%). Banks held firm with ANZ copping a massive $240m fine from ASIC for dodgy conduct over the years. The Big Bank Basket fairly flat at $284.41 (). Wealth managers eased back, HUB fell 2.8% with NWL down 3.1% and SOL falling 5.2% on its last day of trade before merger. REITs generally firm with SGP up 0.6% and BWP up 2.2%. Healthcare remains in ICU with CSL falling another 1.6% and RMD down 1.4%. Industrials showed a tinge of green, SGH up 1.1% and ALL bouncing 2.2% after losses last week. In tech stocks, WTC rose 2.9% after Richard White disclosed a sale of a small parcel! XRO continued to trend lower again, down 0.6% with the All-Tech Index up 0.1%. In resources, Chinese data came in weaker than expected, BHP fell 0.6% with gold miners seeing some profit taking after a huge run in the last few weeks. EVN down 5.3% and NST falling 1.9%. GOR issued a production downgrade and fell 0.3%. Lithium stocks perked up, MIN up 3.2% and PLS being squeezed higher again, up 9.1%. VUL had a great run as shorts covered too, up 11.7%. Mixed in uranium with PDN up 1.8% and BOE flying up 7.9%. Oil and gas stocks showing limited gains, STO up 0.9%.

In corporate news, EHL raced ahead on bid speculation. BUB has a new Chair.

Nothing on the economic front locally. Chinese data came in weaker than expected prompting hopers of more stimulus. Asian markets pushed higher, Japan up 0.9%, China up 0.4% and HK up 0.3%.

10-year yields at 4.27%.

HIGHLIGHTS

- Winners: DTR, VUL, CVL, PLS, REG, BOE, EHL, IEL

- Losers: OBM, MTM, EVN, SOL, BKW, HMC, PNR, CMM

- Positive Sectors: Lithium. Uranium. Tech.

- Negative Sectors: Gold miners. Healthcare. Wealth managers.

- ASX 200 Hi 8852 Lo 8794.

- Big Bank Basket: Falls to $284.41

- All-Tech Index: Up 0.1%.

- Gold: Eases to $5473

- Bitcoin: Steady at US$116575

- 10-year yield steady at 4.27%.

- AUD: Up to 66.58c.

- Asian markets: , Japan up 0.9%, China up 0.2% and HK unchanged

- US futures – Opening slightly lower. DJ up 51 – Nasdaq up 27

- European markets set to open up slightly.

MARKET MOVERS

- DTR +17.3% rally continues.

- VUL +11.7% lithium power.

- EHL+7.9% takeover talk.

- PLS +9.1% lithium running.

- BOE +7.9% uranium running hot in places.

- IEL +7.0% shorts covering again.

- MI6 +9.1% spied at Denver Gold conference

- AMP +6.5% insurance settlement.

- FXG +12.5% high grade antimony drill intersections.

- SRL +15.5% going well again. Huge run continues. Scandium.

- ATH -4.0% Phase 2 data presentation.

- WWI -6.4% $17.5m placement.

- OBM -10.0% gold profit taking.

- MTM -8.1% profit taking.

- BKW -4.9% last day. SOL -5.2%

- Speculative Stock of the Day: KLR +36.4% good volume too on drilling completed in SA.

ECONOMIC AND OTHER NEWS

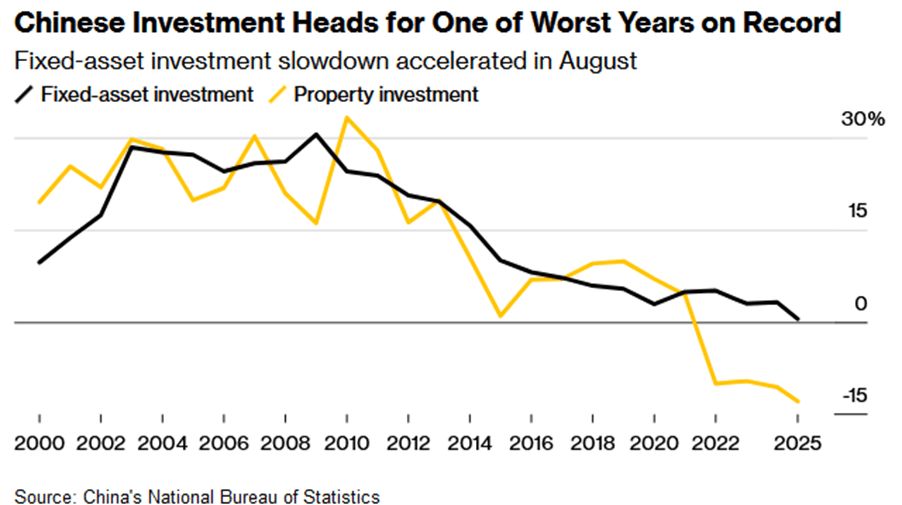

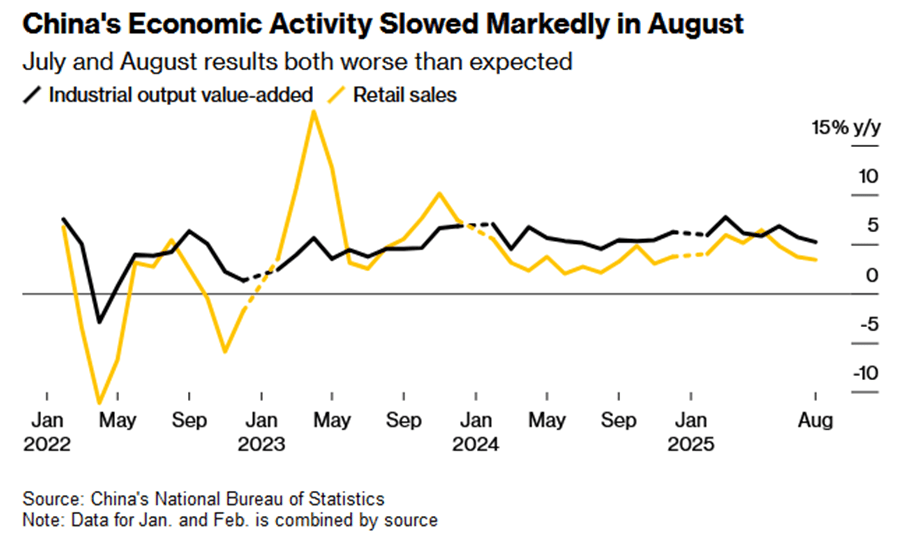

- Industrial output and consumption had their worst month yet this year after a sharp slowdown in July. More stimulus needed.

- Production at Chinese factories and mines expanded 5.2% last month from a year earlier, according to data released by the National Bureau of Statistics on Monday, the smallest gain since August 2024.

- Chinese retail sales grew 3.4% on year in August, down from 3.7% in the previous month. Expansion in fixed-asset investment in the first eight months of the year decelerated sharply to 0.5%.

- Aluminum climbed for a seventh session ahead of this week’s Federal Reserve meeting.

- CATL shares surged as a prominent analyst upgrade and expectations for stronger demand for its energy storage system business fueled bullish bets on the battery maker. JPMorgan raised its earnings estimates for 2025-2026 by roughly 10% to a Street high.

- China’s curbs on defence metal germanium create ‘desperate’ supply squeeze.

- Romania condemns Russian drone violation of its airspace.

- Crypto groups hit out at BoE plan to limit stablecoin ownership.

- Fitch downgrades France to Merde!

And finally…….

Clarence

XXXXX