The ASX 200 jumped early, then fell back to close up only 5 points at 8972 as the great rotation continues. Unleash the resource bulls! Banks and industrials sold off as commodity stocks rallied hard.

The Big Bank Basket fell to $283.70 (-1.5%) with insurers also under siege on rate-cut hopes, QBE down 2.1% and SUN off 2.9%. REITs picked up the slack, pushing ahead, GPT up 1.1% and CHC up 1.6%. Financials were also better, AMP up 1.4% and ZIP basking in a warm embrace from broker calls, rallying another 7.5%.

Defensives in consumer land slid, WES down 2.6% with WOW off 1.5% and COL down 0.6%. CPU fell 5.2% on lower rates, and QAN came in for a landing, down 1.3%. Tech also came under a little pressure, XRO continues to slide lower after the U.S. acquisition and cap raise. Retail and travel stocks were slightly better on rate-cut news — TPW rallied 5.4%, and LOV was up 2.9%. GYG found some support, up 7.8%, and FLT rose 1.1%.

In resources, the big iron ore miners had a strong day, BHP, RIO, and FMG all up around 2.6%. Lithium stocks were better — PLS results today were cheered, with the stock rising 2.4%. IGO up 3.7%, and LTR rallying 4.2%. Gold miners were firm, EVN up 3.5% and NST up 2.8%, with copper stocks also in demand, SFR up 5.3%. Uranium stocks are finding new friends, PDN up 5.3% and NXG rising 5.3%.

In corporate news, REH got smashed 16.4% by the Victorian economy, ABB beat forecasts and is going “buddyless.” BEN delivered an FY loss but rallied 1.1%, with STO extending the ADNOC deadline by a month. NHF rose 2.7% on better-than-expected results. ANN bounced 10.3% on upgraded guidance, and SXL surged 26.5% after a good set of numbers.

Nothing much on the economic front.

Asian markets up again, Japan up 0.4%, HK up 1.8% and China up 1.1%

European markets opening flat. US Dow futures down 28 Nasdaq down 9.

HIGHLIGHTS

- Winners: ABB, MP1, DGT, WA1, ANN, RRL, AX1, PNV

- Losers: REH, EVT, RSG, SMR, CCL, CPU, NXL

- Positive Sectors: iron ore. Copper. Lithium. Uranium. Gold.

- Negative Sectors: Banks. Tech. Consumer staples.

- ASX 200 Hi 9055 Lo 8966. Same low as Friday.

- Big Bank Basket: Falls to $283.70(-1.5%)

- All-Tech Index: Flat.

- Gold: Steady at $5181

- Bitcoin: Falls to US$112354

- 10-year yield steady at 4.28%.

- AUD: Up to 64.93c.

- Asian markets mixed again, Japan flat, China up 1.1% and HK up 0.2%

- US futures – Opening slightly lower. DJ up 18 – Nasdaq down 20

- European markets set to open up slightly. UK closed for bank holiday.

MARKET MOVERS

- ABB +20.2% results beat expectations.

- DGT +10.9% solid bounce.

- MP1 +13.2% broker upgrades.

- NGI +8.3% good results.

- ANN +10.3% beat expectations.

- AX1 +9.2% bargain hunters.

- PNV +9.1% better results.

- ZIP +7.5% broker upgrades.

- SFR +5.3% copper exposure.

- VUL +6.6% lithium rally.

- SXL +26.5% good results.

- FAL +13.0% commodity rally.

- 29M +11.8% commodity rally.

- DUG +10.0% results and broker upgrade.

- MTM +9.0% REE processing strategy.

- REH -16.4% sinks on results.

- EVT -14.7% results.

- MFG -4.8% ex dividend.

- NXL -5.1% results underwhelm.

- CCL -5.2% profit taking.

- RPL -3.0% results weigh.

- MEI -14.8% trouble in Brazil.

- STP -5.8% ex dividend.

- AQZ -6.2% meeting date. Thin liquidity.

- LAU -10.2% investor presentation.

- MHJ -5.1% results weigh.

- Speculative Stock of the Day: LKY +42.2% antimony fast track partnership.

ECONOMIC AND OTHER NEWS

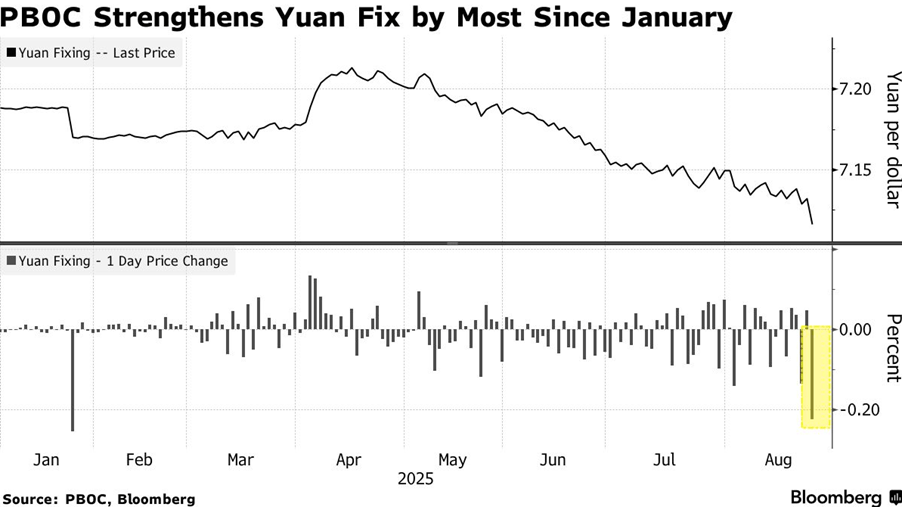

- China strengthened its yuan fixing by the most since January.

- Hong Kong’s Hang Seng Tech index jumped over 3%, as tech stocks rallied.

- Mainland China’s CSI 300 extended its gains for the fourth consecutive session, climbing 1.39% and reaching a 37-month high earlier in the day.

- France summons US ambassador over antisemitism claims.

- Keurig Dr Pepper nears $18bn deal to buy European coffee group JDE Peet’s.

- Dongfeng Motor Group skyrocketed after its parent company announced on Friday plans to take the automaker private. The Hong Kong-listed stock surged 69%, before paring gains to trade at over 57% higher, with Reuters reporting the take-private deal values the company at about $7bn.

- Private equity fundraising slides as sector’s downturn deepens.

And finally…

I carry a donor card in my wallet. I haven’t signed it though. It means if I die somebody else can use it

Clarence

XXX