The ASX 200 touched 8900 (nearly) before profit-taking crept in as jobs data was better than expected. The index closed up 47 points at 8874 (0.5%). ‘Super Thursday’ with results dominating. Banks were mixed as CBA continued to struggle, down % with the Big Bank Basket at $274.63 (+0.6%). WBC results were solid and, given its relative value to CBA, rose 6.3%. Other financials firmed, MQG up 1.7% and insurers doing well, SUN up 3.6% on better-than-expected results. GQG rallied 3.2% with XYZ up 2.4%. REITs firmed, GMG up 1.4% and MGR rising 1.8%. Industrials mixed, CPU rose 1.7% on broker comments, WOW and COL firm, WES up 0.8% and JBH rallying another 1.8%. JHX had a good session, up 4.0%, and REH jumped 4.3%. ORG also did well on better-than-expected results and a guidance upgrade, up 6.3%.

Resources mixed as iron ore players folded, RIO crashed 3.7% with BHP down 0.5% and FMG losing 1.7%. Gold miners were mixed, NST up 1.2% and EVN falling 0.6%. Some buyers appeared in lithium stocks, although LTR were clawed 9.1% lower as the SPP letter was sent out. PLS up 0.9% and MIN up 0.7%. Uranium mixed, PDN up 1.7% and BMN down 1.6%. Coal stocks fell and oil and gas stocks were becalmed.

In corporate news, TPW was a stand-out on the numbers and growth projections, up 8.8%. WBC had its best day in five years, S32 dropped 5.2% on issues with power in Mozambique and a write-off, and PME rose 6.2% after profits came in line with expectations.

On the economic front, unemployment eased slightly and RBA maybe on hold for longer.

Asian markets mixed, Japan saw some profit taking down 1.3%, HK down 0.4% and China up 0.2%.

10-year yields steady at 4.21%

HIGHLIGHTS

- Winners: DTR, TPW, SRV, EOS, ORG, WBC, PME

- Losers: LTR, VGL, PYC, BVS, S32, NEU, TCG

- Positive Sectors: Banks. Financials. Insurers. Tech. Utilities.

- Negative Sectors: Telco. Iron ore.

- ASX 200 Hi 8899 Lo 8863. So close.

- Big Bank Basket: Rises to $274.63 (0.6%)

- All-Tech Index: Up 1.3%.

- Gold: slips to $5129

- Bitcoin: Falls to US$121816

- 10-year yield steady at 4.21%.

- AUD: Rallies to 65.46c.

- Asian markets mixed Japan saw some profit taking down 1.3%, HK down 0.4% and China up 0.2%.

- US futures – Flat.

- European markets set to open slightly mixed. UK GDP much better than expected. Reeves breathes.

MARKET MOVERS

- DTR +21.2% kicking higher again.

- TPW +8.8% results cheer.

- SRV +7.7% results.

- PME +6.2% gets its Mojo working.

- WBC +6.3% solid results.

- CYL +5.5% further intercepts outside Trident envelope.

- EOS +7.3% one way traffic.

- ORG +6.3% Octopus doing well.

- WTM +22.0% good volume.

- ETM +9.0% bouncing back

- TLG +9.1% webinar and presentation.

- LTR -9.1% SPP documents.

- BVS -5.5% broker downgrades.

- S32 -5.2% Mozambique power issues.

- NEU -5.0% profit taking.

- RIO -3.7% easing back on iron ore falls

- CTM -16.7% capital raising.

- KOV -9.1% ex dividend.

- GG8 -8.9% gripped by Comet Vale update.

- Speculative Stock of the Day: ATV +142.1% % – unveils first Australian private cloud superhighway.

ECONOMIC AND OTHER NEWS

- The seasonally adjusted unemployment rate fell to 4.2% in July. Below forecast and brings a rate cut into question next time. Employment rising by 25,000 people and the number of unemployed decreasing by 10,000 people.

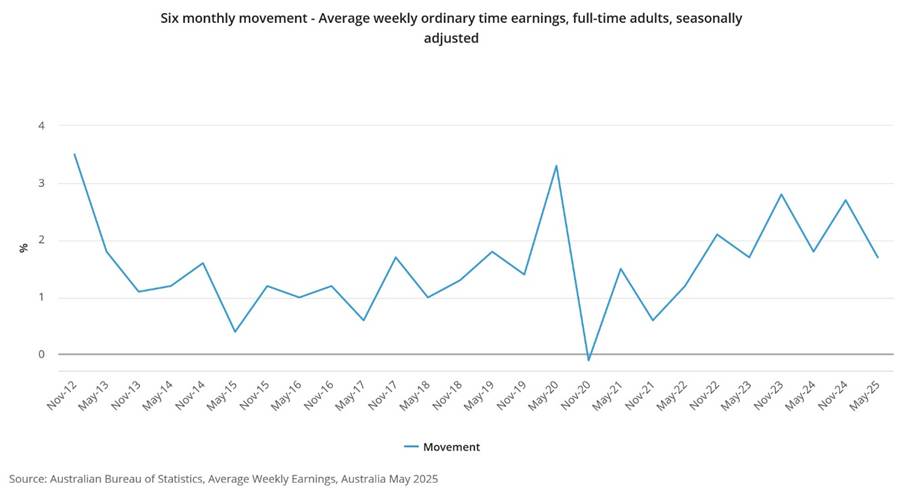

- Estimates for average weekly ordinary time earnings for full-time adults (seasonally adjusted) increased by 4.5% annually to $2,010.00 in May 2025.

- For males were $2,294.10 (public), and $2,070.10 (private). For females were $2,067.00 (public), and $1,777.80 (private).

- UK GDP beats expectations. Carlsberg results out in Europe.

- US Treasury Secretary Scott Bessent said the Bank of Japan is falling behind the curve in addressing inflation.

- UK PM Starmer to Welcome Zelensky to No 10 Ahead of Trump Meeting With Putin.

- DeepSeek’s launch of new AI model delayed by Huawei chip issues.

- French borrowing costs close in on Italy’s as investors fret over debts.

- EU Growth data today.

And finally,

My dad was in a band that opened for The Doors

They were called The Hinges

I have this weird talent where I can identify what’s inside a wrapped present. It’s a gift.

Vale David Stratton

Clarence

XXXX