The ASX 200 fell 54 points to 8,827 (-0.6%). Not a bad day considering, CBA was smacked % on a solid but uninspiring result, with valuations already too stretched to be just “in line.” The fall; accounted for around 50 index points. The Big Bank Basket fell to $273.05 (-4.0%) with ANZ outperforming on catch-up. Other financials slid, QBE down 1.5% as IAG dipped 0.1% on a slight beat on results, ASX down 2.4% and GQG slipping 2.3% lower again.

REITs rose slightly, SCG up 0.3% and SGP up 0.5%. Healthcare was better with CSL up 2%, seeing inflows as CBA fell. TLX rose 2.7% in a rare up day recently. Industrials were flat, dominated by results — CPU hit 3.8% on broker downgrades post-results. BXB bounced slightly, SGH held after the rout yesterday.

Retailers were in the green, APE up 3.1% and TPW rising 1.5%. LNW had a good day, up 3.0%, and FLT up 1.2%. GYG came under some pressure, currently down another 3.7%.

In resources, lithium stocks saw the shorts return, LTR down 4.4% and PLS off 6.6%. Iron ore stocks firmed again — BHP up 1.1% and FMG up 1.4%. LYC rose 3.2% and EVN up 3.9% on better-than-expected results and an increase in dividend. Other golds did OK too, NST up 1.1% and GMD rising 3.2%. Oil and gas stocks slipped, BPT down 7.6% and KAR off 3.8%. Uranium drifted lower and coal off slightly.

In corporate news, BVS missed expectations losing 16.5%, TWE firmed despite some concerns, AGL ran out of power, down 13.1% on bad numbers, guidance underwhelms. TYR boomed 11.4% on takeover talk and ANG disclosed an accounting error.

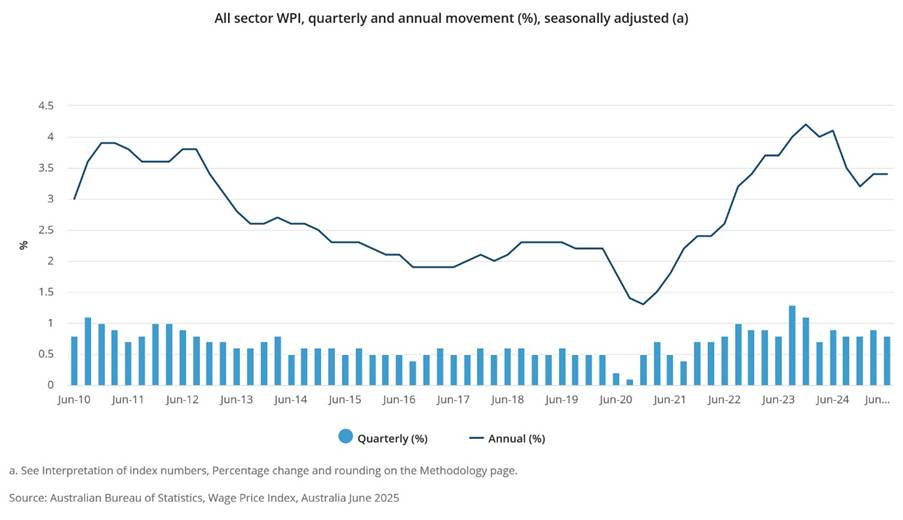

On the economic front, wage increase and lending data. Looks like wage pressure has stabilised. Asian markets continued to march to records, Japan up 1.3%, HK up 2% and China up 0.9%.

10-year yields steady at 4.22%.

HIGHLIGHTS

- Winners: C79, TYR, AAI, FFM, TCG, QAN, 360, CU6

- Losers: BVS, AGL, BPT, PLS, CBA, EQT, MIN, LTR, KAR

- Positive Sectors: Healthcare. Iron ore. Gold.

- Negative Sectors: Banks. Insurers. Tech.

- ASX 200 Hi 8891 Lo 8816

- Big Bank Basket: falls hard to $273.05(-4.0%)

- All-Tech Index: Down 0.2%.

- Gold: slips to $5138

- Bitcoin: Falls to US$119175

- 10-year yield steady at 4.22%.

- AUD: Rallies to 65.30c.

- Asian markets better, Japan up 1.3%, HK up 2% and China up 0.9%.

- US futures – Flat.

- European markets set to open slightly firmer.

MARKET MOVERS

- TYR +11.4% bid talk.

- FFM +6.5% solid bounce.

- 360 +5.5% broker upgrades.

- QAN +5.6% flying.

- DTL +5.1% broker upgrade.

- NCK +4.9% research.

- AAI +7.0% follows US higher.

- STN +20.0% high-grade at Apollo Hill.

- AVH +13.8% placement at 132c.

- BVS -16.5% results miss.

- AGL -13.1% results miss.

- BPT -7.6% sinking again.

- PLS -6.6% profit taking continues.

- LTR -4.4% profit taking continues.

- CBA -5.4% results solid – Valuation extreme.

- MIN -4.6% profit taking.

- GYG -3.7% under pressure.

- ETM-8.2% coming off the boil

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

Australia Wage Price Index

- The seasonally adjusted Wage Price Index (WPI) rose 0.8% this quarter.

- Over the twelve months to the June 2025 quarter, the WPI rose 3.4%.

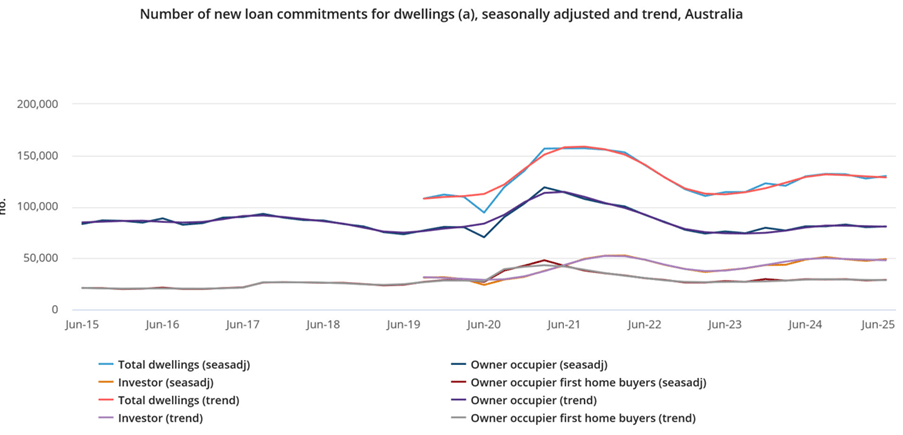

- Lending data – The total number of new loan commitments for dwellings rose 1.9% in the June quarter 2025 while the value rose 2.0%. The number of new owner occupier loan commitments for dwellings rose 0.9% in the quarter while the value rose 2.4%.

- Scott Bessent dismissed the possibility that Chinese investments in the US could be part of any trade pact.

- OpenAI’s Altman is raising money for a company to connect human brains to computers.

- France, Germany and UK willing to reimpose sanctions on Iran.

- White House downplays expectations for Trump-Putin Alaska summit. A hearing and listening mission now.

- The Nikkei 225 extended its gains and hit a fresh record high Wednesday.

- European markets showing slight gains in store. US futures flat. Three Fed heads to speak.

And finally….

A Pizza is basically a real-time pie chart of how much pizza is left

Once upon a time there was a king who was only twelve inches tall. He was a terrible king, but he made a great ruler.

Clarence

XXXX