ASX 200 fell slightly off record highs to 8831 off 12 (0.2%). A mixed session with banks slipping a little, CBA down 0.5% and the Big Bank Basket at $281.90 (). Financials dragged lower, MQG down 0.8% and ASX falling hard, off 8.6%, on cost blow outs on CHESS and other issues, AMP rose 4.8% after a broker call rethink on results. REITs firm, SCG up 0.8% and SGP up 0.9% with industrials mixed, BXB down 3.3% and QAN off 1.1% as retail stocks firmed, JBH up 1.8% and ALL up 1.5%. Travel stocks better, FLT up 3.1% and WEB rising 2.3%. LNW fell 2.0% on plans to end Nasdaq listing. Tech better, WTC up 0.9% and TNE pushing on another 0.8%. Resources were a mixed lolly bag, iron ore weaker, gold miners better on a post Diggers glow. NST up 1.5% and NEM up 1.0% with WGX raising guidance and rising 5.1%. Lithium major PLS up 3.8% with LTR in a halt as it raises around $266m at 73c. Rare earth stocks still in demand. Oil and gas, becalmed, uranium stocks firmed with BOE starting to recover. PDN up 3.4% and coal stocks moving higher. In corporate news, the government has invested $50m in LTR, NEU hitting highs on Daybue sales in the US.

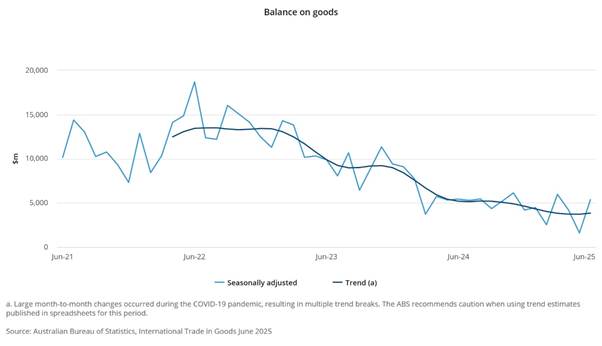

On the economic front, reciprocal tariffs are now in. Local BoP figures showed a rebound to a $5.4bn surplus on stronger coal and gold exports.

Asian markets firmed, Japan up 0.6%, HK up 0.6% and China unchanged. 10-year yields steady at 4.24%

HIGHLIGHTS

- Winners: EOS, PDI, ALK, MAH, WGX, HLS, AMP, CMW

- Losers: SLX, ASX, CU6, GQG, PYC, NWS, VUL, DJW

- Positive Sectors: Gold. Uranium. Tech. Insurance.

- Negative Sectors: Healthcare. Financials.

- ASX 200 Hi 8845 Lo 8820

- Big Bank Basket: Down to $281.90

- All-Tech Index: Flat.

- Gold: eases to $5176

- Bitcoin: Steady at US$114370

- 10-year yield steady at 4.24%.

- AUD: Steady at 65.17c.

- Asian markets: Japan up 0.6%, China up 0.8% and HK up 0.6%.

- US futures – Dow up 71 and Nasdaq up 74

- European markets set to open slightly firmer. BOE expected to cut rates. Results in focus.

MARKET MOVERS

- EOS +11.1% keeps on kicking.

- AMP +4.8% positive broker comments on results.

- WGX +5.1% positive guidance.

- PLS +3.8% squeezed higher.

- ALK +7.1% change of director’s interest.

- BOE +4.1% solid bounce.

- ERD +31.9% NZ road tax changes.

- 4DX +20.3% PME deal still bringing buyers.

- ELS +10.0% Defence spending.

- FAL +9.2% nice move higher.

- SLX -15.8% cap raising.

- DHG -that’s all folks.

- DTR -7.7% slipping again.

- TMG -14.6% response to ASX please explain.

- ASX -8.6% increased spending on governance and CHESS.

- NWS -3.9% broker comments.

- GQG -4.7% sold off.

- ASB -2.3% profit taking.

- Speculative Stock of the Day: Nothing apart from ERD.

ECONOMIC AND OTHER NEWS

- The local trade surplus rebounded to $5.4bn in June, up from a revised $1.6bn in May, driven by stronger coal and gold exports and a pullback in imports.

- Futures for an active contract traded in Singapore were up 0.2% to $US101.95 per tonne on Thursday afternoon.

- Chinese exports climbed 7.2% in July in U.S. dollar terms from a year earlier, exceeding Reuters-polled economists’ estimates of a 5.4% rise. Imports rose 4.1% last month from a year earlier, marking the biggest jump since July 2024. On a year-to-date basis, China’s overall exports jumped 6.1% from a year earlier, while imports fell 2.7%.

- Rheinmetall H1 sales up 24%.

- Toyota Motor June-quarter profit beats estimates, but drops 11% as U.S. tariffs bite.

- BoE Meeting tonight. 25bps cut expected.

- Reciprocal tariffs kick off.

- Positive open in store for European markets.

- Siemens, Allianz, Zurich, Uniper set to report.

And finally….

Did you hear that ducks want to get into boxing? They will be in the featherweight division.

Clarence

XXXX