Cracking day with the ASX 200 up 107 points to 8770 (1.2%) as banks, tech and resources fired simultaneously. US markets were the catalyst, but local enthusiasm was the fuel. The banks roared ahead with CBA up 1.4% and the Big Bank Basket up to $280.63 (+1.0%). Financials generally firm, QBE up 2.4% and MPL rising 1.6% with XYZ up 3.0%. REITs too firm, GMG up 1.5% and SCG rising 0.8%, rate cut hopes helping the whole sector. Industrials also finding buyers, retail firmed, JBH up 1.8% and WES up 2.8% with SGH up 1.3% and FLT bouncing 1.5%. Tech stocks better too, WTC up 0.8% and XRO rallying 0.7%. Utilities were also form, ORG up 1.4%. In resource land, gold miners popped some corks, NST up 1.0% and NEM rising 4.1%. Rare earth stocks got a boost from media reports that a floor price would be put in place for product, LYC up 5.2% and ILU charging 8.7% ahead. MIN had a good day too. The iron ore sector was modestly higher, FMG up 0.5%. Oil and gas saw some buyers, BPT up 3.0% and WDS up 1.4% with uranium stocks slightly firmer.

In corporate news, EOS went crazy on a big EU laser order, up 43.4% CCP defied the gloom and knocked the lights out, up 16.2% and ASB got a government tick pushing 7.9% higher. TPG announced that shareholders will be given cash back following the recent sale of its fibre business. TLX smashed 8.5% on higher operating costs.

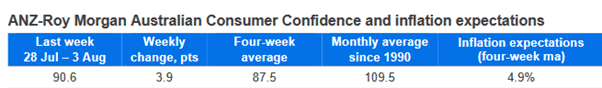

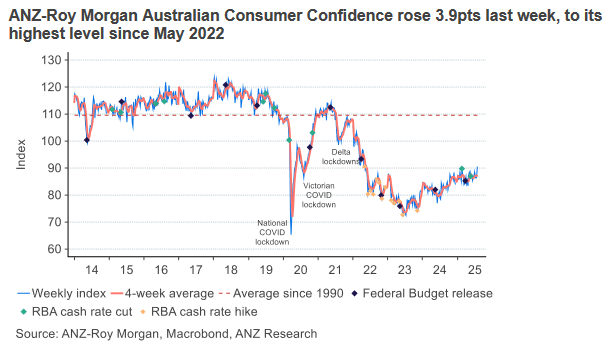

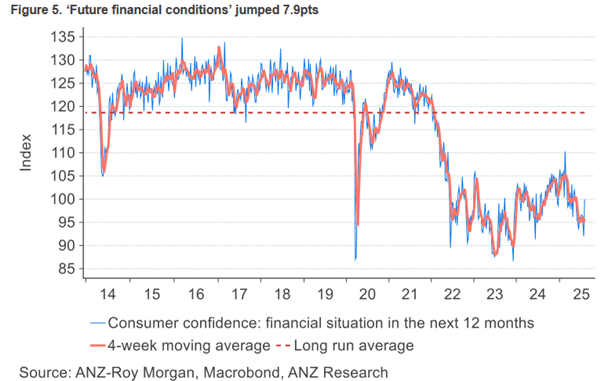

On the economic front, ANZ– Roy Morgan consumer numbers were very positive. Asian markets firmed, 10-year yields fell to 4.22%.

US futures slightly firmer.

HIGHLIGHTS

- Winners: EOS, CCP, ILU, IEL, ASB, KCN, MIN, CDA

- Losers: TLX, MAH, FFM, MAF, AFI, EDV

- Positive Sectors: Everything.

- Negative Sectors: Nothing.

- ASX 200 Hi 8774 Lo 8729

- Big Bank Basket: Up to $280.63 (+1.0%)

- All-Tech Index: Up 1.1%

- Gold: Better at $5222

- Bitcoin: Drifts to US$114370

- 10-year yield falls to 4.22%.

- AUD: Steady at 64.59c.

- Asian markets: Japan up 0.6%, China up 0.8% and HK up 0.6%.

- US futures – Dow up 71 and Nasdaq up 74

- European markets set to open slightly firmer.

MARKET MOVERS

- EOS +43.4% laser order from EU country.

- CCP +16.2% positive results.

- ILU +8.7% rumours of local price support.

- IEL +8.0% short squeeze.

- DRO +6.1% coat tails EOS.

- ASB +7.9% earnings guidance update.

- CDA +6.6% defence exposure.

- SLX +6.2% short squeeze.

- MIN +7.1% becoming a substantial shareholder.

- BGD +10.3% drilling results.

- ARU +8.6% Diggers and Dealers presentation.

- TOR +8.5% DHEM conductor plates identified at Paris.

- TLX -8.5% OPEX costs higher. Well of lows.

- FFM -3.4% Green Bay EA and met results.

- QOR -3.3% block trade of 155m shares at 62c.

- Speculative Stock of the Day: Nothing apart from EOS.

ECONOMIC AND OTHER NEWS

- Household spending rose 0.5% in June, according to seasonally adjusted figures.

- ANZ – Roy Morgan Consumer Sentiment

- Trump’s reciprocal tariffs will not apply to any products loaded onto a vessel for transport into the US before 12:01 a.m. New York time on Thursday.

- Japan won a multi-billion dollar deal to build a fleet of advanced naval frigates for Australia. The replacement program has a budget of between $7bn and $11bn. MHI shares gained as much as 4.5% in Tokyo on Tuesday after the news of the deal.

- Deutsche Bank chief approved controversial trade he was later asked to probe.

- Brazil’s supreme court orders Bolsonaro under house arrest.

- Sandoz targets 70% price cut for weight-loss drugs in Canada.

- Futures data from IG suggests a broadly positive open for European indexes. BP and Saudi Aramco results out today.

And finally….

Students were asked to write an essay on “THIEVES”.

This is what one student wrote:

Thieves are an important part of a nation’s economy. They play a significant role in providing employment and contributing to the nation’s development.

Safes, locks, lockers, cupboards, etc., are made only because of thieves. Many factories and workshops involved in making these items provide employment thanks to this profession.

Even in homes, masons and workers get work installing latches, locks, grills on windows and doors.

Then, to protect houses, shops, schools, colleges, offices, and factories, security guards and watchmen are essential.

Companies that manufacture CCTV cameras, metal detectors, and security systems also generate jobs.

Because of thieves, police officers, court staff, judges, lawyers, and others are employed.

Purchases of barricades, weapons, bullets, batons, uniforms, vehicles, and motorcycles for the police help boost the economy.

Thanks to thieves – jails, jailers, and prison staff have jobs.

When items like mobiles, laptops, cars, motorcycles, electrical appliances, purses, or lipsticks are stolen, people have to buy them again, which boosts business.

Famous and notorious thieves often enter politics, where even bigger thefts take place. Much more could be said, but overall, the contribution of thieves to a nation’s economy is noteworthy.”

The teacher awarded this research-rich essay full marks. Perspective Matters

Clarence

XXX