The ASX 200 fought back from early losses to close down only 14 points to 8743 (0.2%). Banks back with CBA up 0.5% and NAB rising 1.1% with the Big Bank Basket up to $281.36 (+0.5%). Financials firmed, HUB up 1.6% and QBE firing 0.5% ahead. REITS better, GMG rising 0.6% in better data centre hopes, Industrials firmed again, BXB up 0.6% and retail doing well, JBH pushing another 1.3% ahead, ALL bounced 2.4% with travel stocks under pressure as FLT downgraded guidance, off 7.3%. WEB fell 2.2% in sympathy. Tech rose as US tech led the way, WTC up 1.0% and TNE ahead by 1.9%. The All–Tech Index up 1.2%. Resources under pressure again as iron ore slid under $100 in Asian trade on Chinese PMI. BHP down 2.4% and RIO copping a drubbing down 3.6% as FMG fell 2.3%. Gold miners were also under pressure, NST down another 2.2% with EVN off 3.0% and NEM falling 1.6%. Lithium too unwinding in a hurry, PLS down 7.0% and LTR falling 4.9%. IGO continued to drop off 4.5% and LYC succumbed off 2.5%. Uranium shorts got stuck in again, BOE falling another 6.7% with PDN off 2.7% and oil and gas flat, BPT whacked on a quarterly update, off 9.3%.

In corporate news, plenty of quarterlies out, AGL rose 0.1% on its grid battery project, CTT smashed 23.5% on tax changes on small parcels in the US, MIN crashed 7.1% on broker downgrades.

In economic news, building approvals and retail sales. In China PMI came in below forecasts. 10-year yields steady at 4.27%

Asian markets mixed again, Japan up 1.1%, China down 1.6% and HK down 1.5%.

European futures up slightly. US Futures Dow up 141 and Nasdaq up 315.

HIGHLIGHTS

- Winners: DRO, QOR, EOS, NEU, SLC, BKI, TUA, 360

- Losers: CIA, OBM, BPT, VUL, KCN, FLT, MIN, SMR, PLS

- Positive Sectors: Banks. Tech. Financials. Retail.

- Negative Sectors: Iron ore. Gold miners. Lithium. Uranium. Critical Metals. Travel.

- ASX 200 Hi 8752 Lo 8701

- Big Bank Basket: Up to $281.36 (+0.5%)

- All-Tech Index: Up1.2%

- Gold: Steady at $5100

- Bitcoin: Drifts to US$118493

- 10-year yield steady at 4.27%.

- AUD: Slips to 64.70c.

- Asian markets: Japan up 1.1%, China down 1.6% and HK down 1.5%.

- US futures – Dow up 141 and Nasdaq up 315.

- European markets set to open up 0.1%.

MARKET MOVERS

- DRO +18.3% broker upgrades. Bought it yesterday.

- EOS +5.3% defence is the new black.

- QOR +5.3% tech bounce.

- NEU +4.0% FDA chief sounded positive.

- 360+3.2% tech doing well.

- MP1 +3.2% tech in focus.

- SRL +24.8% sun did come up today.

- WBT +19.2% quarterly.

- ART +16.1% quarterly.

- CIA -13.1% broker downgrades.

- BPT -9.3% quarterly disappoints.

- MIN -7.1% downgrades.

- PLS -7.0% downgrades.

- FLT -7.3% guidance drops.

- CTT -23.5% US tariff changes.

- MTM -12.3% Cleansing notice.

- SS1 -12.9% silver falls. Antimony assays at Maverick Springs.

- MEI -11.1% quarterly report

- PMT -8.5% board changes.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

Retail Trade

- Rose 1.2% month-on-month. Rose 4.9% compared with June 2024.

- Iron ore has retreated to nearly $US100 per tonne after China’s factory activity unexpectedly worsened in July.

- CBA’s Vivek Dhar says China’s crackdown on illegal lithium mining is the key driver behind a sharp rebound in prices, not a lift in demand from battery or EV makers. Spodumene prices have jumped 34% since early July to $US840.

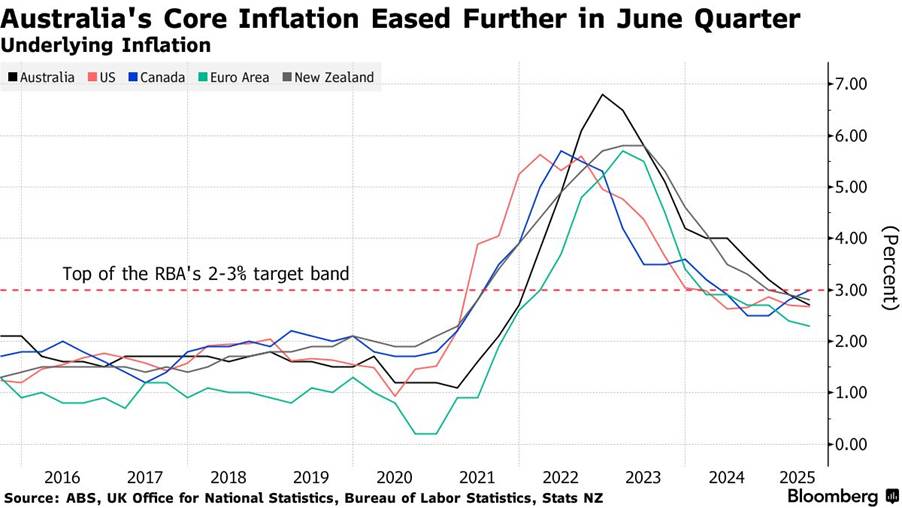

- Andrew Hauser (Deputy Dawd) said today at a forum “the data yesterday was very welcome,” adding that the 2.7% annual trimmed mean number was “very much as we had expected.”

- Bank of Japan raises inflation forecasts as food prices bite. Keeps rate on hold.

And finally…..

A man goes to the doctor with a carrot up his nose, and a parsnip in his ear, the doc said, “clearly you’re not eating properly.”

Clarence

XXXX