The ASX 200 rose 52 points to near record highs of 8756 (0.6%) after a benign CPI ensured we should get a rate cut in August. Familiar story, Banks firm with CBA up 1.6% and the Big Bank Basket up to $279.88 (+1.4%). MQG rose0.8 % with financials firm, as insurers rose surprisingly as yields slipped. QBE up 0.8% and SUN up 0.8%. GQG still feeling unloved. REIT boosted by lower rates with SGP up 2.2% and VCX rising 1.7%. Industrials too firm, BXB up 1.9% with JBH doing well as retail firmed, WOW and COL also better by around 2%. Tech mixed. In resources, gold miners were a mixed bag, EVN up 1.4% with PNR rising 1.9% and GMD up 0.8%. Iron ore stocks mixed, FMG better. RIO results after hours, down 1%. Lithium mixed as PLS had a good quarterly up 3.0% but IGO punished on a negative update, down 7.2%. Oil and gas stocks eased, uranium stocks mixed, BOE recovering 3.6%.

In corporate news today, plenty of quarterlies, APX crushed on AI uncertainty, MIN rose 2.3% as it met its FY guidance. PNV rose 7.8% after earnings report.

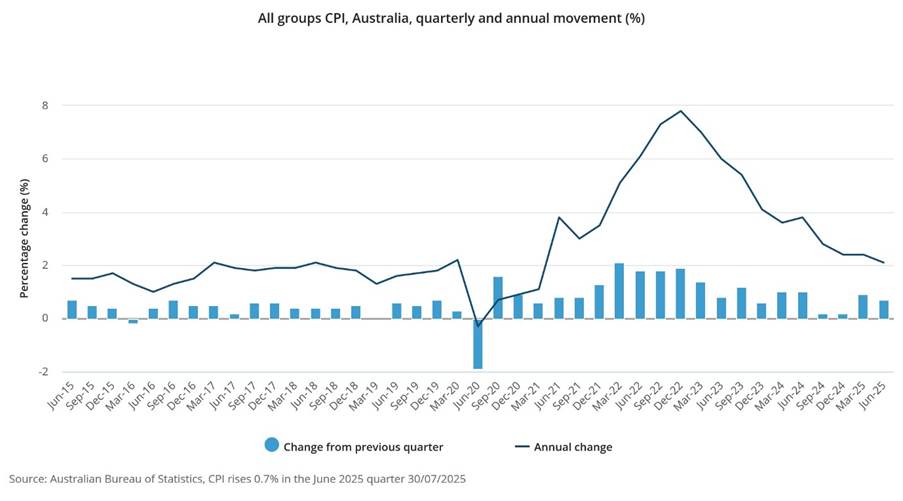

In economic news, CPI came in benign at 2.7% for core, hopes rose for a rate cut on 12th August.

Asian markets mixed, Japan down 0.1%, China up 0.4% and HK down 0.6%.

European market opening slightly higher. Waiting for Fed, tariff news and tech results.

HIGHLIGHTS

- Winners: PNV, OBM, DRO, GGP, CYL, FCL, RSG

- Losers: SLX, IGO, EMR, MLX, SX2, KLS, BPT

- Positive Sectors: Banks. Financials. REITs. Supermarkets.

- Negative Sectors: Tech. Healthcare.

- ASX 200 Hi 8773 Lo 8688

- Big Bank Basket: Up to $279.88(+1.4%)

- All-Tech Index: Down 0.5%

- Gold: Steady at $5107

- Bitcoin: Drifts to US$117957

- 10-year yield falls to 4.25% on CPI.

- AUD: Slips to 65.13c.

- Asian markets: Japan down 0.1%, China unchanged and HK down 1.1%.

- US futures – Dow up 40 Nasdaq up 52

- European markets set to open up 0.4%.

MARKET MOVERS

- PNV +7.8% positive quarterly.

- OBM +7.3% positive broker upgrades.

- DRO +7.1% positive quarterly report.

- GGP +6.1% bounces back.

- PLS +3.0% good quarter.

- DGT +3.4% finding support.

- TOR +15.9% extension of gold mineralisation at Paris.

- CXL +7.0% continues to find friends.

- ALK +6.3% quarterly report.

- SLX -9.4% not so enriched.

- IGO -7.2% quarterly sub-optimal.

- SX2 -4.5% selling off.

- MFG -3.1% falls back after rally.

- MLX -4.8% profit taking.

- APX -12.8% heading to lower end of guidance.

- ATR -9.0% business update.

- MEI -3.6% placement weighs.

- FLN -4.8% gives back Tuesday’s gain.

- WBT -6.5% application for securities quotation.

- Speculative Stock of the Day: BSA +55.6% Good volume. Quarterly report.

ECONOMIC AND OTHER NEWS

- The Consumer Price Index (CPI) rose 0.7% this quarter.

- Over the twelve months to the June 2025 quarter, the CPI rose 2.1%.

- The most significant price rises this quarter were Housing (+1.2%), Food and non–alcoholic beverages (+1.0%) and Health (+1.5%).

- Hawaii and remote parts of California’s coast are bracing for tsunamis to hit within hours. The magnitude-8.8 quake struck at a depth of 21km off Russia’s Kamchatka Peninsula on Wednesday morning.

- UBS posts net profit beat as market volatility boosts trading. It doubled its second-quarter net profit amid hikes at its investment banking and global wealth management operations. Net profitable attributable to shareholders hit $2.395 billion in the second quarter, up from $1.136bn in the same period of last year and beating a mean LSEG analyst forecast of $1.901bn.

- HSBC announces $3bn share buyback after second-quarter profit plunges 29%, missing expectations. It reported profit before tax for the three months ended June of US$6.3bn, down 29% from a year ago.

- Epstein co-conspirator Maxwell asks for clemency in exchange for testimony.

- Mercedes-Benz cuts guidance on Trump tariff impact.

- Starbucks profits plunge as turnaround costs add up.

- L’Oreal missed second-quarter sales forecasts, posting a 2.4% increase, as growth in Europe slowed more than expected.

- Santander posted a record net profit in the second quarter, coming in at EUR3.4bn (US$3.9bn) and topping expectations.

And finally….

I accidentally rubbed ketchup in my eyes. Now I have Heinzsight.

Clarence

XXXXX