The ASX 200 marched back 77 points to 8639 (0.9%), new highs as jobs numbers opened the doors to an August rate cut. Banks led the charge, nothing new there, with CBA up % and the Big Bank Basket up to $283.65 (+1.5%). MQG rallied 0.9% with other financials doing well, GQG bouncing back 1.8% with IFL up 2.3% and XYZ gaining 5.1%. REITs firmed too on lower rates, GMG up 0.8% and SCG up 1.9%. Healthcare better too, COH up 2.3% and RHC rising 1.7%. Industrials firmed, CPU up 3.0% with ALL rallying 0.6% and the tech stocks better, XRO up 1.7% and WTC rising 0.4%. Retailers better too, HVN up 2.4% and LOV up 1.7%.

In resources, FMG rose 0.3% with RIO up 0.5% as iron ore hit a two-month high. A little bounce in lithium, PLS up 1.9% and LTR rising 1.8% after early losses. Gold miners weakened despite a bullion rise. NEM up 1.6% and NST off 0.5%. Rare earths took a breather. Uranium stocks flat, as was oil and gas.

In corporate news, CAR had a trading update, and the CEO resigned, falling 2.9%. PBH saw another bid from BBT. Some quarterlies in GMD and STO.

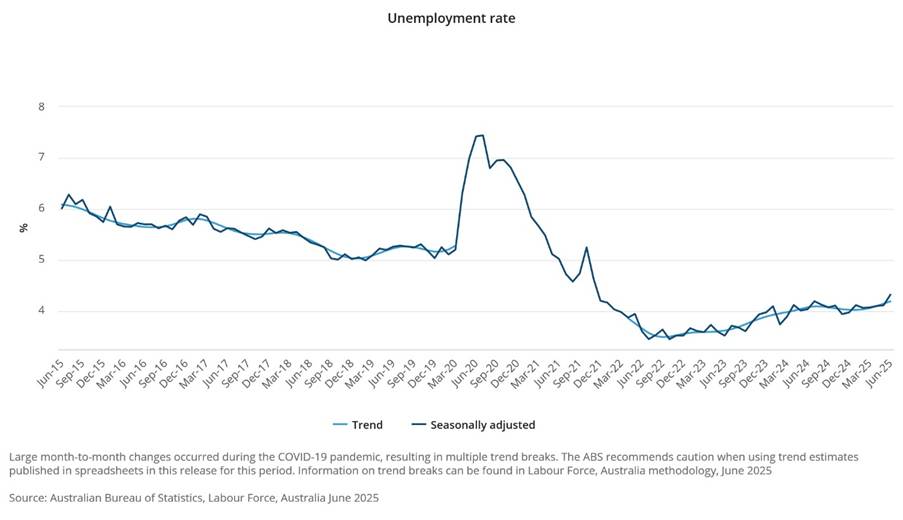

In economic news, Jobs numbers worse that forecasts with only 2k new jobs instead of 20k and unemployment rose to 4.3%.

Asian markets firmed as 10-year yields dipped to 4.35%. Asian markets mixed. Japan up 0.2%, HK up 0.2%, China up 0.4%.

HIGHLIGHTS

- Winners: AEF, XYZ, NXL, QAL, AIA, INA

- Losers: DRO, MLX, ARU, OBM, LIC, WAF, CYL

- Positive Sectors: Banks. Financials. REITs. Tech.

- Negative Sectors: Defence. Rare earths. Gold miners.

- ASX 200 Hi 8635 Lo 8592

- Big Bank Basket: Up to $283.65 (+1.6%)

- All-Tech Index: Up 0.8%

- Gold: Higher at $5139

- Bitcoin: Steady at US$118,443

- 10-year yield falls to 4.35%.

- AUD: Eases to 64.92c. Jobs numbers point to rate cut.

- Asian markets mixed. Japan up 0.2%, HK up 0.2%, China up 0.4%.

- Dow futures up 4, and Nasdaq futures up 631.

- European markets set to open around 0.5% higher.

MARKET MOVERS

- AEF +7.4% FUM gain.

- XYZ +5.1% US tech bounce.

- ATH +18.2% solid bounce.

- NXL +4.9% solid bounce.

- INR +14.3% SPP result.

- BBT +11.1% scrip bid for PBH.

- SXL +14.0% change in substantial holding.

- MGX +6.1% iron ore boost.

- WBT +7.4% chip bounce

- DRO -9.1% profit taking.

- MLX -7.3% profit taking.

- ARU -4.7% rare earths coming off the boil.

- LIC -4.0% down day.

- WAF -3.9% gold under pressure.

- CAR -2.9% trading update and CEO transition.

- ARU -4.7% profit taking.

- ATR -6.3% Donald project water infrastructure.

- Speculative Stock of the Day: Nothing on any volume today.

ECONOMIC AND OTHER NEWS

Unemployment number came in worse than expected opening the doors for a rate cut in August.

In seasonally adjusted terms, in June 2025:

- unemployment rate increased to 4.3%.

- participation rate increased to 67.1%.

- Prime Minister Anthony Albanese has hailed his trip to China as a “very successful visit”.

- Iron ore hits two -month high.

- UBS is holding firm on its call that the Reserve Bank of Australia will cut the cash rate by 25bps in both August and November, bringing the rate down to 3.35% by year-end.

- ANZ economists Aaron Luk and Adam Boyton say June’s labour force data was “soft”, indicating a modest easing in labour market conditions.

- European markets pointing to a 0.5% gain across the board.

- Canada’s Alimentation Couche-Tard has abandoned its $US45.8 bn bid to buy Seven & i Holdings Co.

- Brussels stalls probe into Elon Musk’s X amid US trade talks.

- US justice department fires Epstein prosecutor Maurene Comey.

- Japan’s exports fall for second straight month with no U.S. trade deal.

- TSMC quarterly results.

- US Customs revenue hit record high of US$64bn in Q2. $17bn last year.

And finally…..

Clarence

XXXX