The ASX 200 fell 70 points to 8563 after a record yesterday. Banks were weak on proposed RBA charges changes, CBA off % with the Big Bank Basket down to $279.26 (-1.5%) NAB under extra pressure on CEO issues, down 3.4%. Financials generally eased back, MQG off 0.8% and insurers down, QBE off 1.0%. REITs too under pressure with GMG down 0.2% and SCG falling 0.5%. Healthcare mixed, CSL fell 1.3% on US tariff issues on pharmas, PME up 1.7% and FPH slightly firmer. Industrials mostly lower, TCL off 0.7%, ALL down 1.7% and WOW and COL easing back as did TLS. Utilities pulled back as ORG fell 1.1% and AGL down 0.8%. Tech gained, WTC up 0.6%.

In resources, it was all about rare and critical metals. News of Apple’s investment rocked the sector to the core, with good gains across the board. ILU rose 4.3% with LYC flat, even ARU rose 4.9% with MEI up 14.3%. Gold miners fell on NEM news, quarterlies doing nothing to help on profit taking after rises yesterday. NST falling 2.2% EVN down 2.3% and WAF down 3.4%. Lithium stocks held up relatively well. BHP down 0.7% despite iron ore hitting $100 in Singapore. Uranium stocks up again, PDN up 3.3% and BOE up 3.3%. Oil and gas flat.

In corporate news, LLC fell 1.7% on a luxury development news. RIO up 0.2% on quarterly and CEO change.

Nothing locally on the economic front. Asian markets steady and uninspiring.

HIGHLIGHTS

- Winners: NXL, LIC, MP1, BMN, CU6, ARU, ILU

- Losers: NEM, PPM, MAF, IMD, GMD, AAI, NAB

- Positive Sectors: Rare earths. Defence. Tech.

- Negative Sectors: Banks. Gold miners.

- ASX 200 Hi 8578 Lo 8545

- Big Bank Basket: Down to $279.26 (-1.5%)

- All-Tech Index: Up 0.6%

- Gold: Lower at $5113

- Bitcoin: Steady at US$117971

- 10-year yield rises to 4.40%.

- AUD: Eases to 65.27c.

- Asian markets mixed. Japan up 0.1%, HK unchanged, China down 0.3%.

- Dow futures down 109, and Nasdaq futures down 65.

- European markets set to open around 0.5% lower.

MARKET MOVERS

- DRO +3.8% kicks again.

- LIC +6.5% ceasing to be a substantial shareholder.

- ARU +4.9% rare earths in demand.

- IPX +4.0% defence exposure.

- ILU +4.3% rare earth exposure.

- IFT+4.1% index inclusion.

- ARR +26.1% rare earth play.

- MEI +14.3% rare earths and broker write up.

- AL3 +11.1% exercise of options.

- MGX +10.0% Investor presentation on Central Tanami gold project.

- BRE +10.6% rare earths again.

- NEM -5.7% CFO resignation and sale of GG

- PPM -4.7% broker downgrade.

- GMD -3.6% gold falls.

- GEM -3.3% obvious really.

- S32 -3.0% broker downgrades.

- DCC -8.3% Treasury information.

- Speculative Stock of the Day: LDX +144.8% reinstatement following US PHASE deal. Good volumes too.

ECONOMIC AND OTHER NEWS

- European markets set to ease slightly. French PM proposes scrapping national holidays and freezing spending to cut deficit.

- UK inflation above expectations at 3.6% v 3.4% expected.

- US PPI tonight. Dimon warns on Fed independence as Trump piles pressure on Powell.

- Jensen Huang (Nvidia) anticipates getting the first batch of US licenses to export H20 AI chips to China soon.

- At least nine US and international banks raised their forecasts for China’s economic growth this year following better-than-expected data from the second quarter.

- ASML orders in the second quarter beat estimates of EUR4.8bn up to EUR5.5bn.

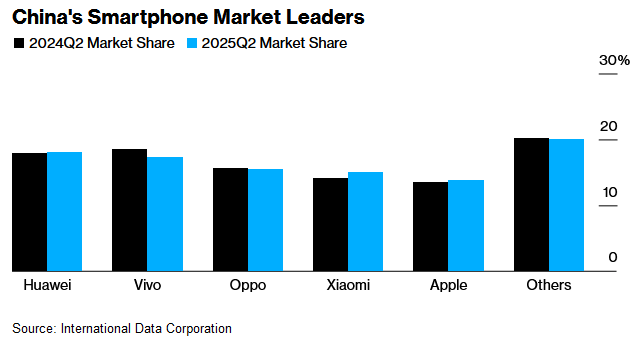

- Huawei took the top spot in China’s smartphone market for the first time in more than four years.

- BoE governor warns Trump’s trade war risks global economic harm.

- Baidu will deploy its Apollo Go autonomous vehicles on Uber outside the U.S. and mainland China. The first deployments are expected to happen in Asia and the Middle East later this year.

- European corporate earnings outlook worsens amid Trump tariff uncertainty.

And finally….

Clarence

XXXX