Tags

The ASX 200 drove 60 points higher at a new record of 8630 (0.7%). Banks rallied with the Big Bank Basket up to $283.45 (). Other financials also in demand, MQG up 1.4% and ASX up 0.9% with insurers rising, QBE up 1.2% and MPL rallying 1.0%. REITs back in demand, GMG up 1.1% with SCG rising 0.5%. Healthcare too doing well, CSL leading the charge, up 3.8% with RMD up 0.7% and PME putting on 2.4%. Industrials firmed reversing yesterday’s losses, BXB up 0.9% and QAN rising 1.6%. Retail mixed, LOV up 2.0% but other slipping. Gaming stocks better, ALL up 1.2%. Tech sector a standout with WTC up 1.8% and XRO bouncing 1.1%. The All Tech Index up 1.8%. In resources, a mixed picture BHP, RIO and FMG all falling around 1% on iron ore slipping. Gold miners were better with NEM up 1.1% and NST up 1.5%. Lithium stocks depressed, PLS down 4.6% and MIN falling 1.0%. Uranium stocks doing well, PDN up 7.9% on a broker upgrade. Rare earth stocks also in demand. In corporate news, HUB rose to record highs on new FUM inflows. TYR fell 2.7% on RBA moves to cancel fees for consumers.

In economic news, Chinese GDP rose to 5.2% higher than expected and local consumer confidence rose. US CPI data tonight.

Asian markets mixed with Japan up 0.4%, HK up 0.8% and China flat..

10-year yields at 4.38%.

HIGHLIGHTS

- Winners: DRO, EOS, 360, PDN, LIC, HUB, CU6

- Losers: CMW, KCN, PLS, OBM, VUL, RSF, NUF

- Positive Sectors: Banks. Uranium. Gold miners. Healthcare. REITs

- Negative Sectors: Iron ore. Lithium.

- ASX 200 Hi 8633 Lo 8592.

- Big Bank Basket: Up to $283.45 (+0.5%)

- All-Tech Index: Up1.8%

- Gold: Higher at $5137

- Bitcoin: Slips from record US$117159

- 10-year yield rises to 4.37%.

- AUD: Steady at 65.49c.

- Asian markets mixed.

- Dow futures up 23, and Nasdaq futures up 124. Nvidia to gain.

- European markets set to open around 0.2% better.

MARKET MOVERS

- EOS +11.0% DRO +14.8% defence surges again.

- LIC +7.7% bounces back.

- 360 +8.0% tech rally.

- PDN +7.9% broker upgrade.

- DGT +5.1% bargain hunters.

- XYZ +5.0% bitcoin exposure.

- ELS +21.1% drone exposure.

- ASM +17.5% rare earth rally.

- MTM +15.8% option conversion.

- PLS -4.6% sellers back.

- MTS -2.0% ex-dividend.

- LTR -1.2% sellers resume.

- ADT -1.0% change of director’s interest.

- AIIDA -13.0% consolidation and US listing.

- Speculative Stock of the Day: DTR +26.3% accelerating Colosseum project.

ECONOMIC AND OTHER NEWS

- US CPI tonight. Powell in Trump’s sights.

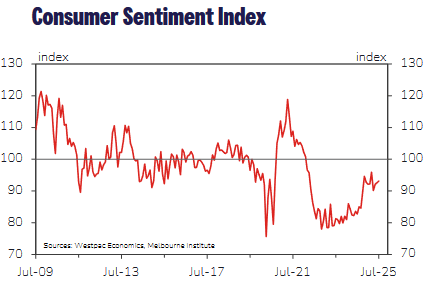

- The Westpac–Melbourne Institute Consumer Sentiment Index ticked 0.6% higher to 93.1 in July from 92.6 in June.

- Most consumers still expect interest rates to move lower from here.

- China’s economic growth exceeded expectations in the second quarter, but strong exports to markets outside the US masked deepening pressure caused by weak consumer demand at home.

- Retail sales increased 4.8% last month, worse than economists’ projection.

- Industrial output rose 6.8% in June from a year earlier, faster than the 5.6% expansion forecast by economists. Chinese Gross domestic product expanded 5.2% in April-June from a year earlier, after a gain of 5.4% in the first quarter.

- Japan’s benchmark 10-year government bond yield climbed to its highest level since 2008.

- Japan’s 30-year government bond yield also climbed to a record high on Tuesday

- Nvidia gets nod from Washington to resume sales of H20 China chip.

- US probes imports of drones and critical material in chips and solar panels.

- European futures set to open 0.2% higher.

And finally….

Clarence

XXXX