The ASX 200 ended down 10 points at 8570 as the move out of banks to resources continued. Banks eased slightly with the Big Bank Basket down to $282.02 (-0.4%). ANZ the worst of the four with MQG up 0.2% and AMP rising 1.4%. BNPL XYZ and ZIP fell 2.8% on JP Morgan moves on charges, REITs firmed ever so slightly, GMG up 0.3% and industrials eased, CPU down 3.0% with QAN off 0.9%, SGH down 0.8% and ORG falling 0.9%. Retailer flat and tech slipping, XRO continuing to fall, WTC down 1.3%. Resources saw buyers again, BHP up 0.9% as iron ore closed on US$100 in Singapore. Lithium stocks rallied from a lacklustre open as shorts covered again. PLS up 6.5% and LTR rising 3.1%. MIN up 1.5% with feet in both camps. Gold miners too back in demand, NST rallied 1.7% with NEM up 1.7% and EVN rising 1.9%. Oil and gas firmed, and uranium powered ahead as shorts covered. BOE up 2.0% and PDN up 2.9%.

In corporate news, ASK on the end of a 165c bid. CCX fell 1.2% on a trading update, issues in US hurting. DRO jumped 17.0% on increased R&D spending, HSN rallied 10.9% on business update.

Nothing on the economic front locally but Chinese exports showed promise.

Asian markets firm but not spectacular. HK up 0.4%.

10-year yields up to 4.36%

HIGHLIGHTS

- Winners: DRO, EOS, HSN, MAQ, CU6, CHN, OBM

- Losers: LIC, S32, XYZ, NAN, SDR, JHX, LNW

- Positive Sectors: Iron ore. Gold. Lithium.

- Negative Sectors: Banks. Healthcare. Tech. Retail. Utilities.

- ASX 200 Hi 8594 Lo 8558.

- Big Bank Basket: Lower at $282.02 (-0.4%)

- All-Tech Index: Down 0.5%

- Gold: Higher at $5116

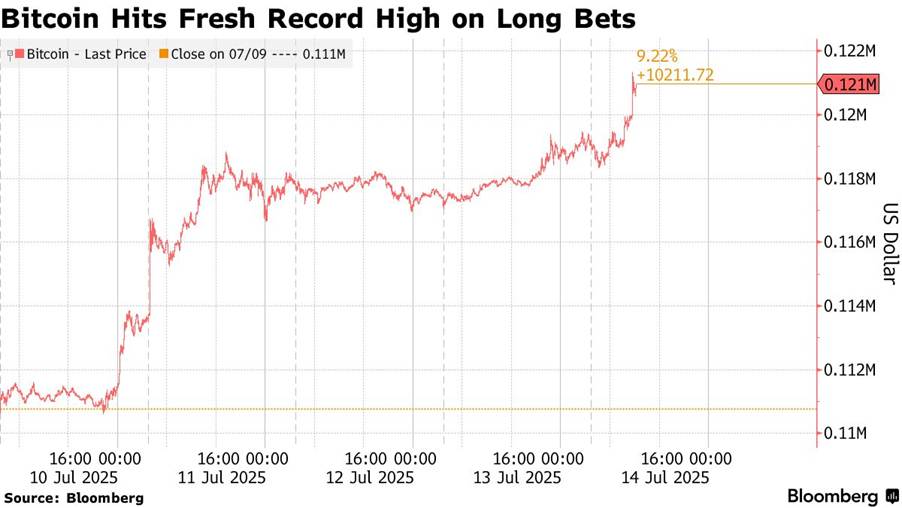

- Bitcoin: Kicks to new record US$121472

- 10-year yield rises to 4.36%.

- AUD: Steady at 65.60c.

- Asian markets mixed. Japan down 0.2%, China up 0.3% and HK up 0.4%.

- Dow futures down 269, and Nasdaq futures down 139.

- European markets set to open flat

MARKET MOVERS

- EOS +15.5% DRO +17% European rearmament.

- HSN +10.9% trading update

- MAQ +9.6% land option.

- CHN +8.8% Platinum prices.

- OBM +6.8% gold bounce.

- PLS +6.5% lithium recovery.

- ASK +5.8% bid at 165c.

- USL +28.8% delivers growth a drill results.

- SVL +16.7% silver exposure.

- SRL +15.2% investor webinar.

- XYZ -4.8% JP Morgan moves on data fees.

- S32 -5.1% Mozambique issues.

- ILU -2.9% profit taking.

- LIC -9.2% selling resumes.

- ATH -20.0% ASX Please Explain.

- ATX -8.6% profit taking.

- BBT -9.3% trading update.

- Speculative Stock of the Day: BM1 +48% – Good volume – New float. New company formed to grow and develop Mt Ida Gold project in WA.

ECONOMIC AND OTHER NEWS

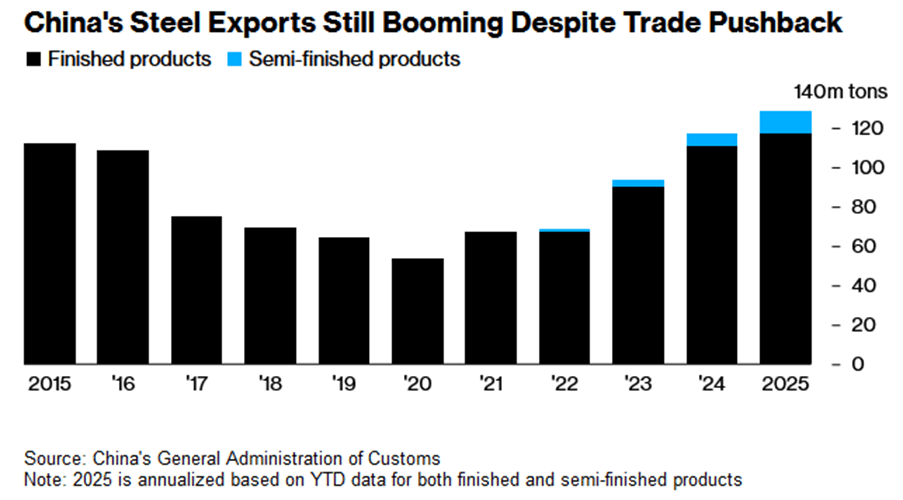

- Chinese Shipments of finished steel used in construction to cars and appliances reached 30.7 million tons for the three months from April to June. That’s up 11% from a year earlier and beats the previous quarterly peak during a flood of exports a decade ago.

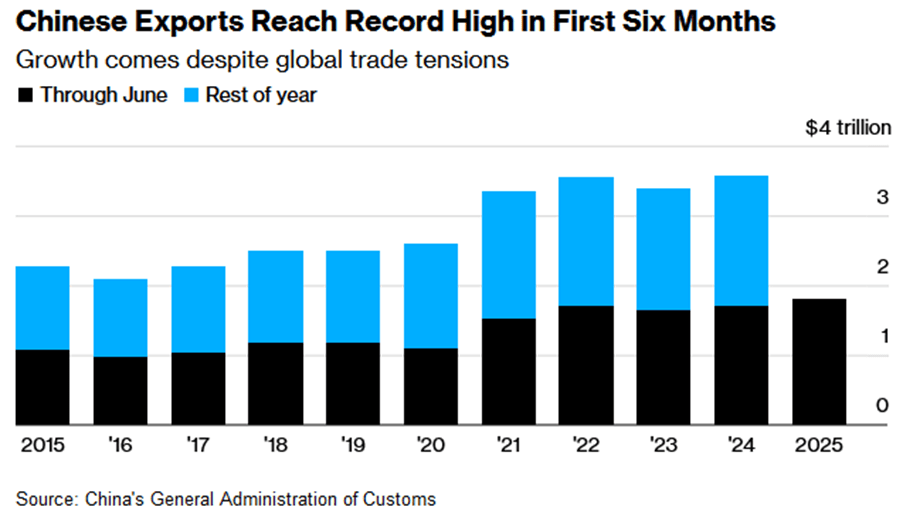

- China ended the first half of the year with a record trade surplus of about $586 billion after exports to the US began to stabilise. Exports rose 5.8% in June from a year earlier to $325bn. Imports rose 1.1% to grow for the first time since February.

- Bitcoin breached $120,000 for the first time.

- The token rose on the back of anticipation for what a Congressional committee dubbed “Crypto Week,” where lawmakers in the US Congress are expected to debate and possibly vote on key cryptocurrency legislation.

- FAA says Boeing fuel switches are safe following fatal Air India crash.

- Chinese biotech shares surge as Big Pharma looks to license cancer treatments.

- Trump has accepted an invitation to meet with King Charles in September.

And finally….

Clarence

XXXX