The ASX 200 fell 52 points to 8539 (0.6%) as losses accelerated in the afternoon. Banks helped relatively firm with CBA losing only % with the Big Bank Basket down to $281.96 (-0.1%). MQG dropped 2.5% and insurers losing steam, SUN down 0.8% and IAG off 1.2%. Healthcare under pressure, CSL down 0.9% on US tariff moves, SIG fell 3.3% and TLX bucked the trend rising 5.6% on good US code news. REITS stumbled lower as yields rose, GMG down 2.6% and SGP off 1.5%. Industrials also eased back, TCL down 0.9% with BXB off 0.6% and SGH falling 1.1%. Retail a little better and tech easing back. In resources, gold miners got walloped as AUD bullion prices staggered lower, NST fell 3.4% with EVN off 7.0% and GMD down 5.6%. The big iron ore miners slipped, BHP down 1.0% and RIO down 0.6%. Lithium stocks better, PLS up 1.7% and LTR rising 5.6%. Oil and gas stocks a little better, coal too and uranium falling hard, PDN down 8.3% and BOE off 7.6%.

In corporate news, LIC crashed 37.3% on the recent court ruling. TLX jumped on Gozellix news.

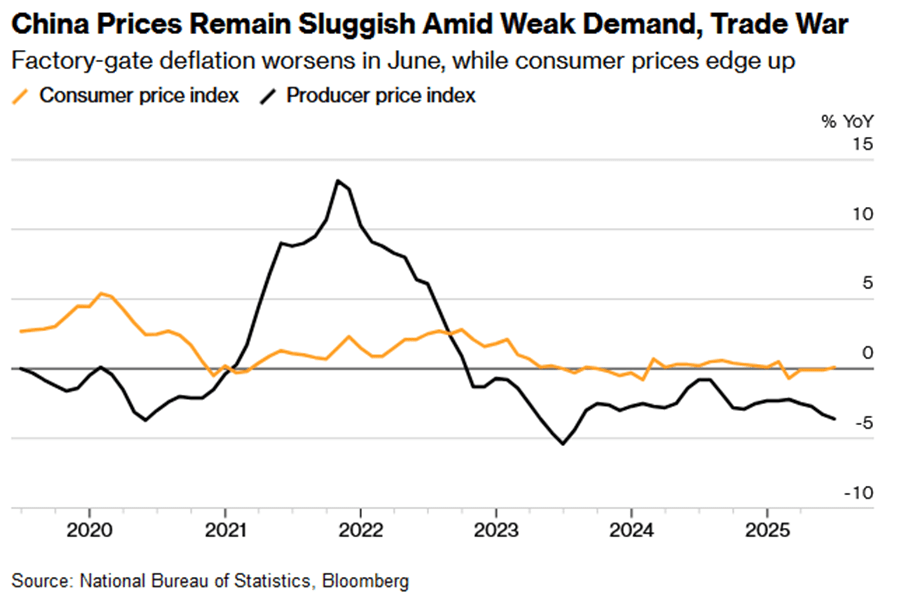

Nothing locally on the economic front. In China, PPI fell more than forecast. Asian markets mixed with five new IPOs listing today in HK. 10-year yields jumped to 4.34%.

HIGHLIGHTS

- Winners: VUL, MLX, SKC, SMR, LTR, TLX, EOS, CU6

- Losers: LIC, PNR, BMN, PDN, BOE, DYL, SLX, EVN

- Positive Sectors: Lithium. Utilities.

- Negative Sectors: Gold miners. REITs. Industrials. Healthcare.

- ASX 200 Hi 8573 Lo 8531.

- Big Bank Basket: Lower at $281.96 (-0.1%).

- All-Tech Index: Down 0.7%

- Gold: Falls to $5035

- Bitcoin: steady at US$108955

- 10-year yield jumps to 4.34%.

- AUD: Steady at 65.40c.

- Asian markets weaker. Japan up 0.2%, China up 0.1% and HK down 1.1%.

- Dow futures down 26, and Nasdaq futures down 39.

- European markets set to open flat

MARKET MOVERS

- VUL +8.4% lithium stocks bouncing.

- MLX +7.0% broker upgrade.

- LTR +5.6% lithium bounce.

- EOS +5.2% defensive.

- IEL +3.6% ceasing to be a substantial holder.

- TLX +5.6% Gozellix receives permanent HCPCS code.

- BOT +17.2% correction to yesterday’s presentation.

- AVH +7.9% no reason.

- LIC -37.2% changes to retirement parks.

- BMN -8.7% becoming a substantial shareholder.

- PDN -8.3% uranium price fall out.

- SLX -7.2% uranium price falls

- SM1 -13.9% milk pressured. A2M downgraded.

- SRL -14.6% placement weighs.

- AZY -6.7% placement weighs.

- Speculative Stock of the Day: PFE +100% sale of Texas Smackdown project.

ECONOMIC AND OTHER NEWS

- China’s producer prices fell the most in nearly two years. Factory deflation persisted into a 33rd month, with the producer price index falling 3.6% from a year earlier.

- The consumer price index unexpectedly increased 0.1% and ended a four-month falling streak.

- Apple bids for Formula 1 rights in US following success of Brad Pitt film.

- Musk’s Grok AI chatbot praises Adolf Hitler on X.

- Trump deal to leave EU facing higher tariffs than UK.

- Supreme Court allows Trump plan for mass government lay-offs to proceed.

- Macron urges Britain and France to move on from Brexit and work ‘side by side’ .

- Stephen Miran, chairman of Trump’s Council of Economic Advisers, told that the odds of tariffs leading to higher prices is a “rare event” like “pandemics or, or meteors or whatever.

- Musk tells Dean Ives to ‘shut up’!

And finally….

Clarence

XXX