ASX 200 down 2 to 8596 on a volatile day as banks saw selling and money move to BHP and other resources. CBA was down for another day, as its now four out of five down days closing off % with the Big Bank Basket down to $282.16% (-1.6%). ANZ outperformed up 0.5%. Financials under pressure across the board, MQG down 0.8% and insurers falling hard. QBE off 2.2% and SUN down 3.4%. Defensives generally on the nose, TLS down 1.2% and REA off 3.4% with WES falling 2.0% together with WOW and COL. Tech mixed as XRO fell again and WTC up 1.2% despite more front-page news! Healthcare mixed, CSL up 0.5% and PME racing 7.8% ahead on news of two contract wins. Resources were the stars today, at least BHP up 5.6% with RIO and FMG also up but more modestly, around 1.8%. Gold miners finding some friends, NEM up 1.4% and WAF up 1.3%. Lithium stocks better, PLS up 11.3% with LTR rising 5.0%, MIN up 7.8% with coal stocks also back in favour, WHC up 8.2%. Uranium stocks eased back. WDS and STO slightly better.

In corporate news, GLF rose 4.1% on its debit. VGN sinking 1.9% towards issue price. RPL ran 9.3% on $35m performance fee. On the economic front we had the trade balance numbers. Asian markets mixed, Japan unchanged, China up 0.6% and HK down 0.8%.

10-year yields rising to 4.18%

HIGHLIGHTS

- Winners: PLS, SMR, RPL, CHN, WHC, PME, MIN, FFM

- Losers: GEM, BOE, MSB, VAU, REA, SUN, HLS

- Positive Sectors: Lithium. Iron ore. Coal.

- Negative Sectors: Banks. Insurers. Defensives.

- ASX 200 Hi 8624 Lo 8543

- Big Bank Basket: lower at $282.16(-1.6%).

- All-Tech Index: Up 0.2%

- Gold: Rises to $5110

- Bitcoin: steady at US$109,355

- 10-year yield better at 4.18%.

- AUD: steady at 65.70c.

- Asian markets mixed, Japan down 0.2%, HK down 0.7% and China up 0.6%

- Dow futures up 45, and Nasdaq futures up 30.

- European markets set to open higher. UK Bond Market the focus.

MARKET MOVERS

- SMR +10.9%coal bounce.

- PLS +11.3% short squeeze on lithium bounce.

- RPL +9.3% performance fee.

- CHN +8.5% platinum pricing.

- PME +7.8% contract wins.

- MIN +7.8% iron ore and lithium.

- WHC +8.2% coal bounce.

- WIA +13.0% great drilling results.

- CRN +14.8% coal bounce.

- GEM -7.4% broker downgrades.

- BOE -5.9% change in substantial holding,

- VAU -3.6% production report.

- TLX -3.2% continuing to slip.

- JBH -3.0% cessation of securities

- REA -3.4% Research article.

- GQG -2.9% profit taking.

- EWC -17.1% profit taking.

- Speculative Stock of the Day: SFM +351% on an agreement to divest Eburnea project.

ECONOMIC AND OTHER NEWS

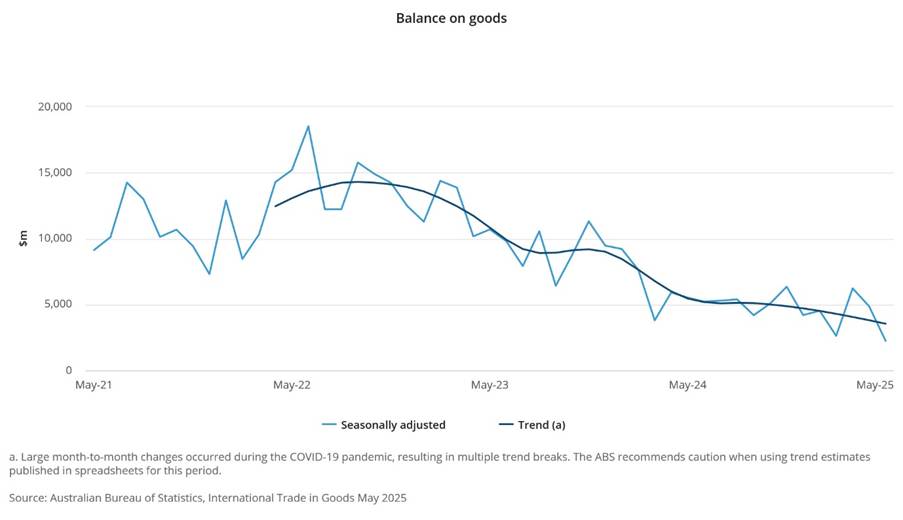

- Australian trade deficit. The seasonally adjusted balance on goods decreased $2,621m in May.

- OpenAI signs $30bn data centre deal with Oracle.

- China’s top leadership has vowed to crack down on “disorderly” price competition between businesses and curb outdated industrial capacity, Xinhua reported.

- China’s services activity slipped more than forecast to reach a nine-month low, a private survey showed.

- Non -Farm Payrolls tonight. 110k is the number.

And finally…..

I never thought orthopedic shoes would really work for me, but I stand corrected.

A huge thanks to the guy that just explained the word “plethora” to me. It means a lot.

Clarence

XXXXX