ASX 200 fell just 1 point to 8541 in quiet trade as banks came under some pressure. CBA sold down 1.2% as money flowed to other three, ANZ up 2.5% the big winner. The Big Bank Basket flat at $286.04 (0.4%). MQG drifted 1.0% lower, and financials steady, GQG up 2.2% and IFL up 5.2% on news CC Capital was still actively trying to stitch the takeover together. Insurers mixed, REITs better, SCG up 2.8% and VCX up 1.6% with industrials drifting around. SGH fell 2.9% on Boral CEOs retirement. JHX fell 2.2% and tech eased, WTC down 1.0% but XRO rallying 1.2%. Retail flat. In resources, the iron ore majors steadied, FMG up 0.7% and gold miners rallied, NEM up 2.0% and BGL up 3.9%. Oil and gas stocks becalmed with uranium mixed, PDN down 1.4% and DYL recovering some poise up 5.4%.In corporate news, FND were suspended for not filing reports on time. MSB jumped 11.2% after progress made on FDA. HMC fell 17.3% as energy transition head, Angela Karl stepped down.Nothing on the economic front today. Chinese Caixin PMI rose, and EU CPI tonight.Asian markets mixed, Japan down 1.4%, HK closed and China up 0.2%.10-Year Yield falling to 4.11%.

HIGHLIGHTS

- Winners: DRO, MSB, IEL, CU6, KCN, DYL, IFL

- Losers: HMC, AEF, AMA, GEN, HLS, LOV, BOE

- Positive Sectors: Gold miners.

- Negative Sectors: Banks. Industrials.

- ASX 200 Hi 8576 Lo 8541. Narrow range again.

- Big Bank Basket: Lower at $286.04 (-0.4%).

- All-Tech Index: down 0.4%

- Gold: Rises to $5062

- Bitcoin: Rises to US$106902

- 10-year yield steady at 4.11%.

- AUD: rises to 65.77c.

- Asian markets: Japan up 0.6%, HK closed and China up 0.3%.

- Dow futures down 61, and Nasdaq futures down 41.

- European markets set to open flat. EU inflation numbers.

MARKET MOVERS

- MSB +11.2% FDA news.

- DRO +12.3% defence back in fashion.

- IEL +9,5% dogs are barking.

- CU6 +8.0% NTA with commentary.

- IFL +5.2% CC Capital still active.

- RPL +5.1% nice move.

- PGC +2.7% change of director’s interest.

- PAR +23.0% secures US$27m to advance phase III OA Trial.

- EQR +19.5% retirement of director.

- STN +12.5% drilling results at Apollo Hill.

- HMC -17.3% energy transition team changes.

- AMA -4.8% cessation of securities.

- LOV -4.4% ceasing to be substantial shareholder.

- 29M -5.1% profit taking.

- Speculative Stock of the Day: NXS +64.2% to sell majority of assets.

ECONOMIC AND OTHER NEWS

- President Donald Trump threatened to proceed with ramping up tariffs on Japan as it takes so little of US rice exports.

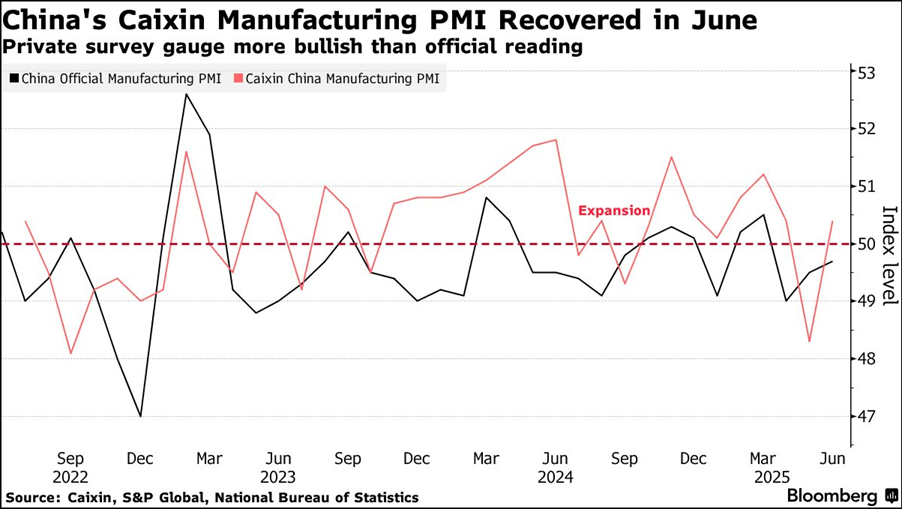

- China’s manufacturing activity rebounded in June, according to a private survey. The Caixin manufacturing purchasing managers index rose to 50.4 from 48.3 in May.

- Morgan Stanley expects Beijing to unveil a “modest” supplementary fiscal package of up to 1 trillion yuan ($140bn) in the late third or early fourth quarter.

- Zinc fell for a second day as a build-up in Chinese stockpiles pointed to tepid demand in the top consumer of the metal.

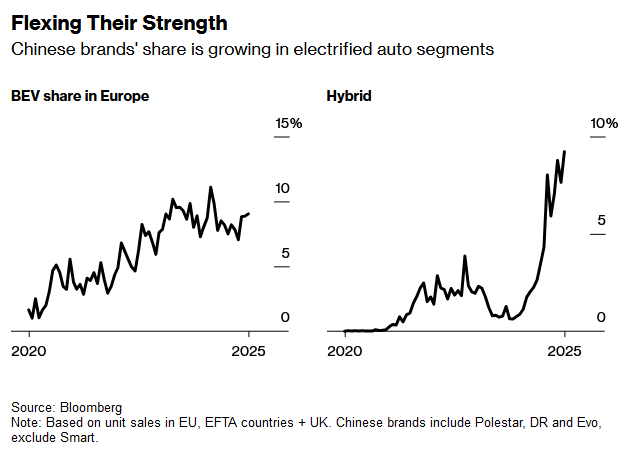

- Chinese automakers continued to expand their European foothold in May, capturing the highest share ever of hybrid–car sales and the biggest slice of the electric–vehicle market in 10 months.

- Senate races to pass Trump’s flagship tax bill as deadline looms.

- Google agrees deal to buy power from planned nuclear fusion plant.

- Musk unloaded Monday on the massive tax-and-spending legislation that Trump is pushing Republicans to quickly ram through Congress, labeling it a “DEBT SLAVERY bill.”

- European stocks to open flat.

And finally…

The whole salad dressing industry exists because people really just don’t like the taste of salad.

Clarence

XXXX