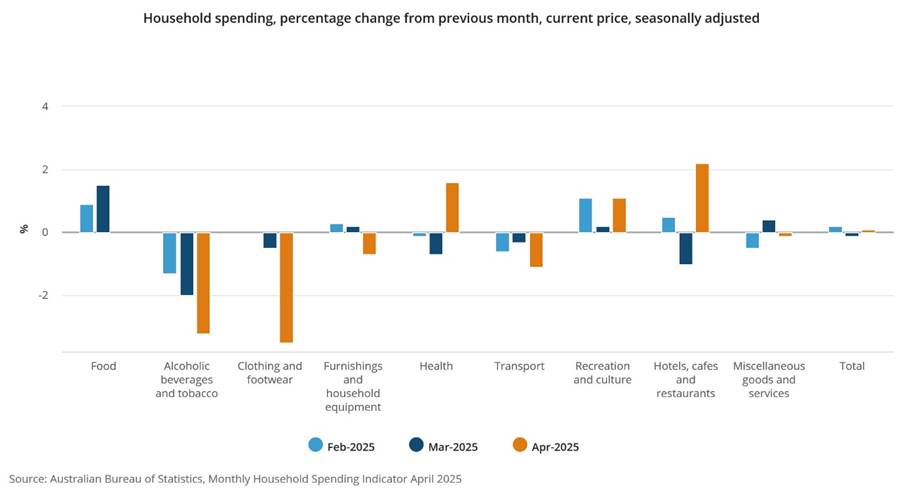

The ASX 200 tried hard to attack and sustain the all-time high but failed, dropping 3 points to 8539 (0.1%). Banks were flat as some profit taking crept in, CBA up 0.1% with the Big Bank Basket up to $282.74 (0.1%) insurers down slightly, QBE off 1.4% and financials finding sellers here. REITs mixed, GMG up 1.1% with GPT also firming. Industrials generally lower, CPU fell 1.2% with retailers giving back some of the gains, JBH down 2.0% and CTD off 1.1%. Tech better, the index up % with TNE and XRO making modest gains. In resources, the iron ore miners rose slightly, FMG the best up 1.5%, but the real action was in critical metals either rare earths, or lithium. LYC jumped 12.5% and ILU up 7.1% with MIN rallying 14.8%. PLS too doing well, up 12.5% as shorts moved to cover on Chinese reluctance to make a deal and rare earth exports not forthcoming. IPX soared 28.8% on a DoD deal for US$99m. Gold miners fell, GMD down 2.5% with EVN off 1.6% and CYL falling 3.5%. Uranium stocks flat, coal firmed, WHC up 1.8%. In corporate news, TYR fell 10.4% on news its CEO was leaving. CAT dropped 1.0% on an acquisition and PAC fell 5.0% on a media report on overvaluations. In economic news, Household spending rose 0.1% in April, the seasonally adjusted balance on goods decreased $1,479m in April.

Asian market mixed, Japan down 0.4% and HK up 0.6% China flat. 10-year yields lower at 4.24%.

HIGHLIGHTS

- Winners: IPX, MIN, LYC, PLS, CU6, IGO, ILU

- Losers: RDX, IEL, NGI, HLS, REG, CMM, PGC

- Positive Sectors: Lithium. Rare earth.

- Negative Sectors: Financials. Retail. Gold miners.

- ASX 200 Hi 8567 Lo 8527. Narrow range.

- Big Bank Basket: Higher at $282.74 (+0.1%). CBA record.

- All-Tech Index: Up 0.2%

- Gold: Falls to $5179

- Bitcoin: Steady at US$104684

- 10-year yield steady at 4.24%.

- AUD: rallies to 64.91c.

- Asian markets: Japan down 0.5%, HK up 0.4% and China unchanged.

- Dow futures are down 13, and Nasdaq futures down 33

MARKET MOVERS

- IPX +28.8% US DoD order.

- MIN +14.8% short covering and lithium bounce.

- LYC +12.5% rare earth exposure.

- PLS +12.5% short covering and lithium bounce.

- IGO +9.6% broker upgrade.

- ILU +7.1% rare earth exposure.

- 29M +14.6% decent bounce.

- CRN +13.8% rally continues on funding news.

- MTM +9.9% another positive day.

- MYX +9.4% scheme meeting going ahead. A contract is a contract?

- RDX -8.4% good volume.

- IEL -6.4% sell-off continues. Trump doesn’t help on Harvard.

- COS -10.3% trading update.

- TYR -10.4% CEO resigns.

- DTR -6.9% profit taking.

- IPO of the Day RXR +16.1% strong debut.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

- The seasonally adjusted balance on goods decreased $1,479m in April. Household spending rose 0.1% in April.

- The Caixin China services purchasing managers’ index rose to 51.1 from 50.7 the previous month. Employment in services grew while deflationary pressure persisted, with the rate of discounting reaching the steepest in eight months.

- Nintendo Switch 2 launched today.

- Japanese 30-year bond auction saw weakest demand since 2023.

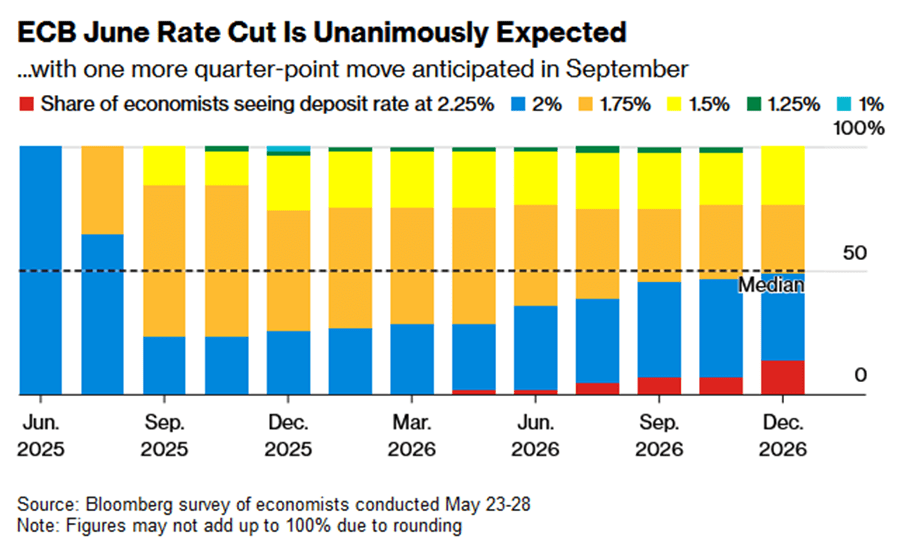

- The European Central Bank is set to lower interest rates for an eighth time.

- Trump bans citizens of 12 countries from entering the U.S. Also suspends entry of international students studying at Harvard.

- Trade war a bigger challenge for EM central banks than Covid, says IMF’s Gopinath.

- Apple and Alibaba’s AI rollout in China delayed by Trump trade war.

And finally…..

Clarence

XXXX