The ASX 200 limped along to close down 11 points at 8397 as a Japanese bond auction underwhelmed, and CPI came in a little hotter than expected. Blame eggs. Banks went a little squishy, with CBA falling 0.9% and the Big Bank Basket down to $271.48 (-0.9%). Insurers also fell with QBE off 1.6%. Other financials were mixed, XYZ rose 4.9% on better US consumer sentiment and bitcoin. REITs are better today, GMG is up 0.9%, and SCG is rising, Industrials started well but fizzled, WES is down 0.1%, and retail is falling slightly. Tech was better following US tech, and the All–Tech Index was up 1.3% with WTC up 0.4%. REA bounced 1.9% after its fall yesterday on ACCC News, and TLS slid 0.2% on some broker downgrades. Resources are under a little pressure, RIO off 0.9% and lithium stocks down, MIN downgraded guidance again, down 5.5% with gold miners a little mixed, NST off 0.8% and RMS up 1.1%. MAC rose 20.4% as it got the Harmony bid, uranium was a little mixed, BOE was off %, and LOT was up 5.1%. WDS jumped 3.2% on NW Shelf news, and finally, STO is up 1.9%. Coal stocks also rallied, WHC up 2.7%. In corporate news, WEB jumped 12.4% on much better than expected results, ALQ fell 7.6% after completing its capital raise, IFT disappointed, and FPH fell 4.8% despite a 43% jump in revenues. On the economic front, CPI was unchanged at 2.4%, the RBNZ cut rates again by 25bps. 10-year yields rose to 4.33%. Asian markets, as usual, mixed, Japan up 0.3%, China up 0.1% and HK down 0.8%

HIGHLIGHTS

- Winners: MAC, WEB, GDG, RUL, PGC, XYZ, CUV, TPW

- Losers: ALQ, PDI, IFT, MIN, LTR, FPH, IEL, JIN

- Positive Sectors: REITs. Tech. Oil and gas. Gold.

- Negative Sectors: Banks. Iron ore. Insurers.

- ASX 200 Hi 8453 Lo 8392.

- Big Bank Basket: Lower at $271.48 (-0.9%)

- All-Tech Index: Up 1.3%

- Gold: Steady at $5138

- Bitcoin: Eases to US$108516

- 10-year yield rises to 4.33%.

- AUD: Slips to 64.35c.

- Asian markets mixed Japan up 0.2%, China down 0.5%, and HK off 0.2%.

- Dow futures are down 42, and Nasdaq futures down 15. Nvidia in focus.

MARKET MOVERS

- MAC +20.4% takeover by Harmony.

- WEB +12.4% results beat low expectations.

- GDG +6.9% going well.

- XYZ +4.9% US consumer sentiment and crypto exposure.

- WDS +3.2% NW Shelp approval.

- SX2 +3.5% drilling results.

- RUL +6.7% buyback update.

- DTR +20.5% kicks after big move yesterday.

- 4DS +4.3% blessed are the chipmakers.

- JHX -2.0% debt blowout for AZEK deal.

- PDI -19.5% Argo and Bokoro permit update.

- ALQ -7.6% capital raising.

- IFT -6.0% results disappoint.

- MIN -5.5% yet another downgrade.

- LTR -5.5% lithium prices.

- BOC -11.1% copper ease perhaps.

- IMU -5.9% letter to shareholders.

- Speculative Stock of the Day: HIO +21.7% ASX please explain. Recent update citied.

ECONOMIC AND OTHER NEWS

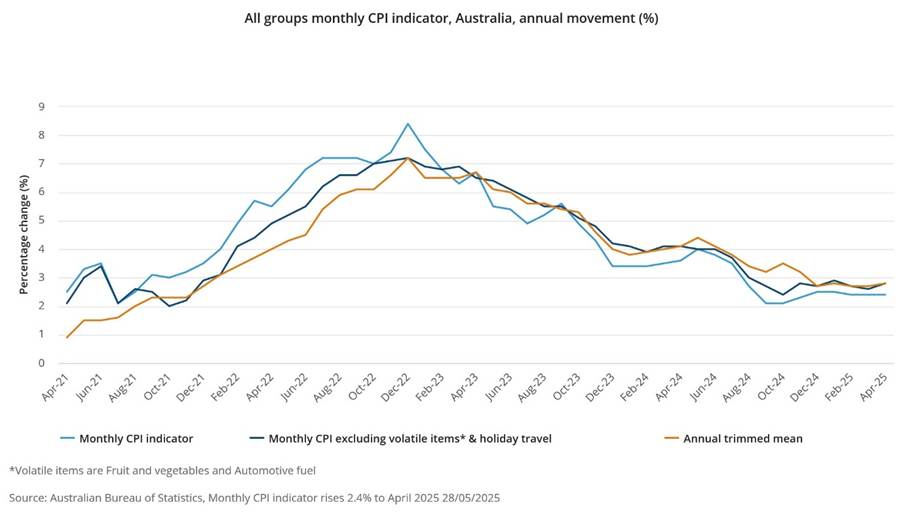

- Australian consumer inflation held steady in April as higher health and holiday costs offset a drop in petrol prices. Eggs up 19% in a year.

- Traders are predicting a 61% chance that the RBA’s cash rate will fall again in July to 3.6%, a close to 50% chance there will be another cut in August to 3.35%,

- The trimmed mean measure of core inflation increased by an annual rate of 2.8% in April from 2.7% in March. A measure excluding volatile items and holiday travel also picked up to 2.8% from 2.6%.

- State Street said that Australia’s latest inflation data will not prompt the Reserve Bank to deviate from its projected path for interest rates despite April’s annual rate of price rises coming in slightly higher than expected.

- The government has approved Woodside Energy’s bid to extend the life of its North West Shelf gas development until 2070.

- RBNZ cuts rates 25bps.

- Japanese yields resumed their move higher Wednesday as demand for 40-year government bonds reportedly dropped to its weakest level since November.

- Nvidia results tonight. Analysts expect Nvidia to post 66% revenue growth to US$43.28bn. The average analyst estimate is predicting growth in the current quarter of 53%, with similar a number expected for the full fiscal year, which ends in January.

- Musk criticises Trump’s ‘big, beautiful’ tax bill.

- SpaceX Starship rocket fails to deploy satellites and explodes on re-entry.

- Trump offers Canada free ‘Golden Dome’ protection if it gives up sovereignty.

- European market opening unchanged.

And finally…..

Clarence

XXX