ASX 200 followed US futures down on Moody’s downgrade, off 49points at 8295 (0.6%). Banks tried to hold off the selling, but the Big Bank Basket rose to $267.97 (+0.3%). MQG fell 3.4% as it went Ex-dividend. Financials slid, ZIP off 6.2% and PPT down 2.9% with PNI off 2.4%. Insurers unchanged, REITs fell as bond yields pushed up a little to 4.51%. GMG down 0.6% and SCG off 0.3%. Industrials eased back too, CPU down 1.0% and WTC falling 2.1% with retail and travel stocks down. DMP fell 2.6% as CEO ANZ resigned. Resources pounded by lower commodity prices, BHP off 2.4%, RIO down 1.3% and FMG being crunched 4.9%. Lithium stocks depressed, PLS off 10.0% as the shorts came roaring back in LTR too off 16.6%. MIN fell 8.8% after announcing a new chair. Gold miners were better on haven buying, NST up 1.9% and NEM bouncing 2.5%. Coal stocks hit hard as NHC downgraded guidance, off 7.1% with WHC down 3.4%. Uranium stocks also seeing fallout, PDN down 4.1% and the oil and gas sector easing back too. In corporate news, MYX in a trading halt pending more information on the Cosette bid, EOS jumped 14.7% on a Euro contract, LLC down 0.4% after signing JV with the King. On the economic front, Chinese data mixed. Asian markets eased back in line with US futures.

HIGHLIGHTS

- Winners: MAH, QAL, CMM, RRL, PXA, EVN, AFG

- Losers: LTR, CU6, PLS, MIN, WA1, CIA, NHC

- Positive Sectors: Banks. Gold miners.

- Negative Sectors: Tech. Iron ore. Oil and gas. Coal. REITs

- ASX 200 Hi 8345 Lo 8284

- Big Bank Basket: Higher at $267.97 (+0.1%)

- All-Tech Index: Down 0.4%

- Gold: Rises to $5027

- Bitcoin: Steady at US$103049

- 10-year yield rises to 4.50%.

- AUD: Eases to 64.01c

- Asian markets slid, Japan off 0.7% with HK unchanged%, China down 0.3%

- Dow futures down 330 Nasdaq futures down 290.

MARKET MOVERS

- CMM +3.4% OBM +3.1% gold recovers.

- 360 +1.5% continues higher.

- OFX +16.4% ASX price query. Results due tomorrow.

- EOS +14.7% European contract win.

- GG8 +6.1% corporate presentation.

- ALX +0.4% Citi says could be a target.

- LTR -16.6% big volume, ASX query.

- PLS -9.9% lithium under pressure.

- MIN -8.8% new chair.

- NHC -7.1% coal downgrade.

- CIA -7.7% iron ore slips.

- DMP -2.6% CEO ANZ steps down.

- EIQ -25% trading halt pending announcement.

- APX -15.8% profit taking.

- 29M -9.1% resources under pressure.

- PMT -8.0% continues lower.

- Speculative Stock of the Day: XAM +54.9% Takeover offer at 8c.

ECONOMIC AND OTHER NEWS

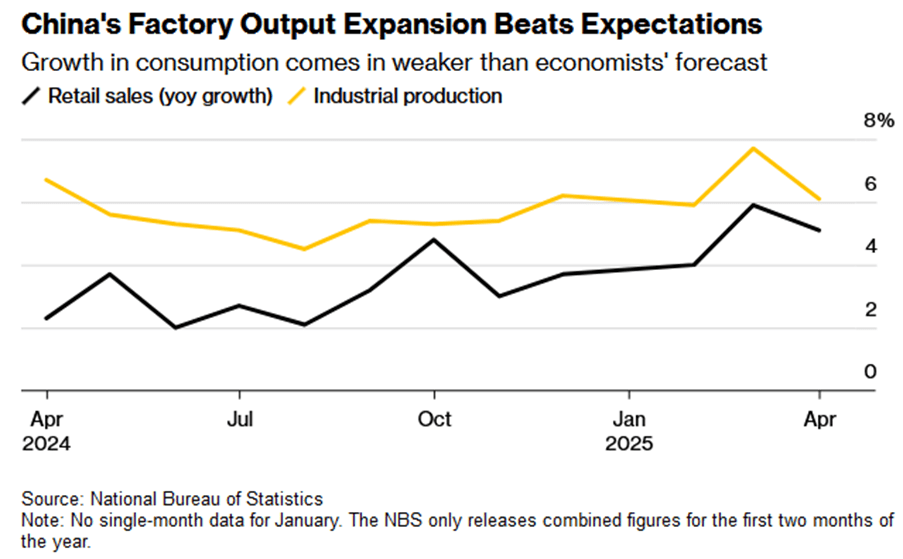

- Chinese Industrial output climbed 6.1% on year in April, slowing from the prior month but far exceeding the median estimate in a survey of analysts.

- Retail sales growth, a key gauge of consumption, also weakened from March to 5.1%, according to figures published by the National Bureau of Statistics on Monday, below economists’ projection.

- The urban jobless rate fell slightly to 5.1% in April, while growth in fixed-asset investment slowed to 4% in the first four months of the year. China’s new home prices dropped at a faster pace in April.

- On Monday, 10-year Treasury yields climbed four basis points to 4.52% and their 30-year equivalents rose about six basis points to 5.00%.

- Germany drops opposition to nuclear power in rapprochement with France .

- UBS deploys AI analyst clones as clients opt for research in video form.

- Scott Bessent warns of maximum tariffs as US takes tougher line on trade talks.

- Japan will not resort to tax cuts funded by additional debt issuance, Prime Minister Shigeru Ishiba said on Monday.

And finally…..

Clarence

XXXXX