The ASX 200 was up 11 at 8280 (0.1%), with some big movers hurting positive sentiments. ALL had an 8.9% fall on an earnings miss, and MQG slid 1.6% as ASIC looks at short selling reports. CBA reported a better-than-expected number and rose 0.8% with the Big Bank Basket up to $263.99 (+0.6%). NAB is rallying hard again. Insurers were better, SUN was up 0.9% with financials mixed, IFL toppled 15.8% as Bain pulled the plug, GQG saw some profit-taking, and XYZ and ZIP both showed a clean pair of heels. REITs remain under some pressure as yields hit 4.47% in the 10s. Healthcare slipped, CSL down 0.4% and SIG falling 2.3% with PME pushing higher again. Retail stocks slipped a little, APE down 2.4% on a broker downgrade, but JBH up 0.6%. ALL weighed on the sector. Tech stocks built on Tuesday’s gains, WTC down 0.6% and the All–Tech Index up 1.5%. Resources were a mixed bag. BHP and RIO were around 0.5% higher, FMG was moving 2.2% higher, gold miners were mixed, GMD up 3.5% and CYL up 6.4% with NEM down 2.0%. MIN rose 4.0%, and LTR continues to roar ahead in the lithium space, up another 6.1%. Oil and gas better, WDS up 3.4% as oil prices rose, and it signed a deal with Aramco in Louisiana. In corporate news, MYX is back from a trading pause as the US regulatory deadline draws close. On the economic front, wage growth came in at 3.4%, slightly higher than expected. Asian markets mixed, with Japan down 0.2%, HK up 1.7%, and China up 0.9%.

HIGHLIGHTS

- Winners: 360, NEU, CYL, XYZ, LTR, SX2, ZIP, AD8

- Losers: IFL, MYX, PNV, ALL, RPL, ADT, IEL

- Positive Sectors: Banks. Tech. Iron ore.

- Negative Sectors: Retail. REITs. Healthcare.

- ASX 200 Hi 8280 Lo 8247

- Big Bank Basket: Higher at $263.99(+0.6%)

- All-Tech Index: Up 1.5%

- Gold: Falls to $5005

- Bitcoin: Rises to US$103570

- 10-year yield rises to 4.49%.

- AUD: Rises to 64.65c

- Asian markets mixed, with Japan down 0.3%, HK up 1.7%, and China up 0.8%.

- Dow futures up 19 Nasdaq up 30

MARKET MOVERS

- 360 +9.5% kicks again on good results.

- LTR +6.1% shorts still covering.

- XYZ +6.3% recovery in progress.

- NEU +6.9% buy back update.

- DGT +4.8% solid bounce on tech buying.

- ZIP +5.3% rally continues.

- SLX +4.4% uranium play.

- AD8 +5.2% blast from the past.

- TBN +13.3% finalises checkerboard and progresses farmout process.

- 29M +6.5% bouncing back again.

- WDS +3.4% Aramco deal in Louisiana.

- MQG -1.6% faces fines over short selling reports.

- IFL -15.8% Bain pulls out. CC Capital left.

- ALL -8.9% earnings miss.

- PNV -9.6% bears are back.

- MYX -15.6% pause in trading. Deadline for US allegations close.

- AQZ -4.1% company presentation.

- Speculative Stock of the Day: CXO +35.6% – Finniss restart study presentation.

ECONOMIC AND OTHER NEWS

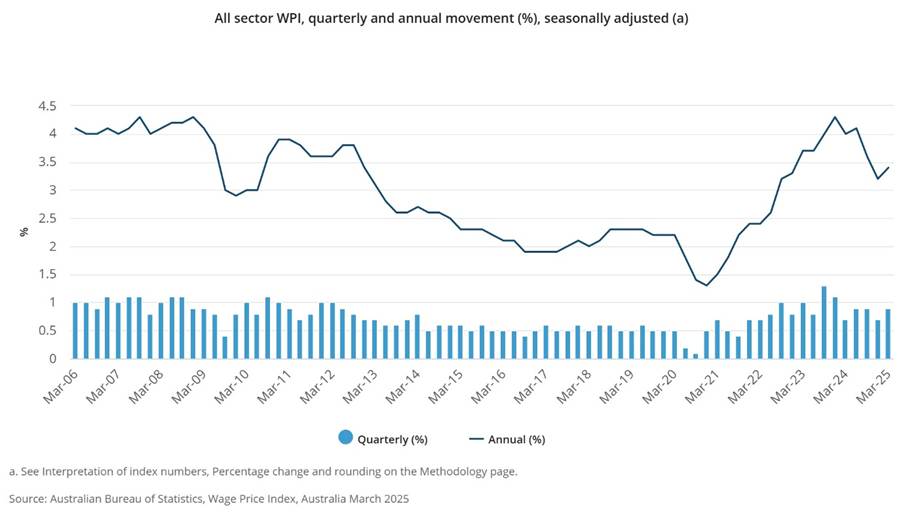

- The seasonally adjusted Wage Price Index (WPI) rose 0.9% this quarter.

- Over the twelve months to the March 2025 quarter, the WPI rose 3.4%.

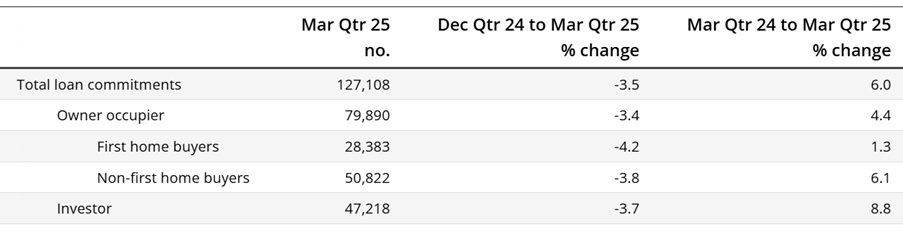

- The total number of new loan commitments for dwellings fell 3.5% in the March quarter 2025 while the value fell 1.6%.

- The number of new owner-occupier loan commitments for dwellings fell 3.4% in the quarter while the value fell 2.5%.

- The US Commerce Department issued guidance stating that the use of Huawei Technologies Co.’s Ascend artificial intelligence chips “anywhere in the world” violates the government’s export controls.

- EU set to impose much higher tariffs on Ukrainian imports.

- Macron open to stationing French nuclear weapons in other European nations.

- Trump administration terminates a further $450mn in grants to Harvard.

- European futures showing slightly weaker open.

And finally….

Clarence

XXXX