The ASX 200 jumped out of the box to finish up 29 points to 7997 (0.4%) as some caution crept in as the day wore on. CBA turned negative, not helping as NAB soared 1.7% and the Big Bank Basket fell to $260.16 (-0.2%). Financials were generally firm, AMP finding a few new friends up 2.5% and XYZ bouncing slightly. GQG fell 1.4% and PNI popped 2.7%. REITs were mixed, GMG rose 0.8%. Healthcare stocks back in favour, RMD up 2.4% and even CSL put on 1.0% with PME up 3.7%. TLX fell 6.6% on FDA news. Industrials were positive with WES up 1.4% and the tech space better, XRO up 1.9% and the Index up 1.3%. Retailers getting a boost with JBH up 1.5% and AX1 rising 1.7%. HVN also put on 2.4%. In resources, gold miners continued to see profit taking as bullion slipped further as risks cooled. NEM fell 1.3% with VAU down 2.3% and GMD falling 3.6%. Lithium stocks are under pressure again, with LTR down 4.4% and PLS falling 2.4%. BHP slid 1.1% with RIO unchanged. LYC led rare earth stocks higher on its quarterly, uranium stocks saw modest moves with STO up 2.2% and WDS gaining 1.8%. In corporate news, BVS slid 11.2% on a surprise CEO resignation. AGI rose 31.1% as minority shareholder bid 100c for remaining shares. Nothing on the economic front today. China making some noises about stimulus and protecting jobs. Asian markets firmed, Japan up 0.4%, China unchanged and HK up 0.1%. 10-year yields falling to 4.17%.

HIGHLIGHTS

- Winners: PYC, BRN, RSG, ILU, ASB, IEL, ALQ

- Losers: BVS, PNR, CU6, ADT, MAH, TLX, BXB

- Positive Sectors: Healthcare. Retail. Tech.

- Negative Sectors: Gold miners. Lithium. Iron ore.

- ASX 200 Hi 8052 Lo 7971 – Well off highs.

- Big Bank Basket: Falls to $260.16(-0.2%)

- All-Tech Index: Up 1.3%

- Gold: Slides to $5139

- Bitcoin: Steady at US$93966

- 10-year yield falling to 4.16%.

- AUD: Rallies to 64.00c

- Asian markets: Japan up 0.5%, China unchanged and HK up 0.1%.

- Dow futures down 138 Nasdaq down70

MARKET MOVERS

- ILU +5.2% rare earths attracting buyers.

- PYC +7.6% presentation of clinical proof of concept in lead program.

- LYC +3.3% quarterly report.

- DRO +3.7% Regal pushing it.

- ALQ +3.9% business update on tariffs.

- AMP +2.5% sentiment improves.

- AGI +31.1% Novomatic bids 100c.

- EOL +6.8% all-time high?

- MEI +7.1% shooting back up.

- 29M +3.3% insurance payout.

- DXB +5.5% FDA news.

- JHX +1.2% will not delist from ASX without vote.

- BXB -5.0% trading update.

- AIS -10.0% March quarterly.

- BVS -11.2% CEO exits.

- TLX -6.6% US regulator did not approve new drug.

- PNR -10.8% lower than expected output.

- Speculative Stock of the Day: TMB +23.1% significant gold mineralisation at Tambourah King.

ECONOMIC AND OTHER NEWS

- European futures set to open slightly higher with big earnings in focus this week.

- Trump claims 200 trade deals have been agreed but gives no details.

- US stocks underperform the rest of the world by the widest margin since 1993.

- Chinese officials reiterated their plan to strengthen support for employment and the economy.

- The government will “fully prepare contingency plans, and constantly improve the policy toolbox for stabilizing employment and the economy,” Zhao Chenxin, Vice Chairman of the National Development and Reform Commission, said.

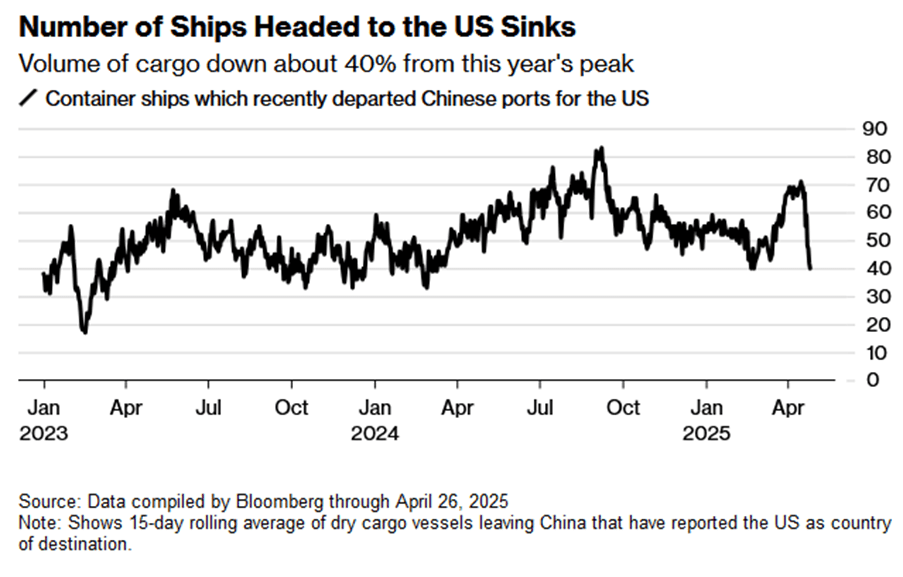

- Bookings plunge as importers hold off on shipping goods to America in hope of Beijing-Washington deal.

- New Danish Nuclear Power Fund Targets Raising €350m.92 Capital aims to invest in nuclear power vendors, companies that support the rollout of atomic energy and supply chain such as fuel, said two of the fund’s partners.

- China’s State Council approved 10 new reactors on Sunday in a vote of confidence for nuclear power to remain central to the nation’s clean energy. transition. The nation has 30 under construction, nearly half the global total, and is expected to leapfrog the US to become the world’s largest atomic energy generator by the end of the decade.

- China’s industrial profits returned to growth in the first quarter, official data showed on Sunday.

- Cumulative profits of China’s industrial firms rose 0.8% to 1.5 trillion yuan ($205.86 billion) in the first quarter from a year earlier, the National Bureau of Statistics (NBS) data showed, reversing a 0.3% decline in the first two months.

- Fully autonomous strike drones within technological reach, says German start-up.

- American students turn to UK as Trump takes aim at US universities.

And finally…..

A friend of mine has just got a job as a mime artist.

He kept that one quiet!

Clarence

XXXXX