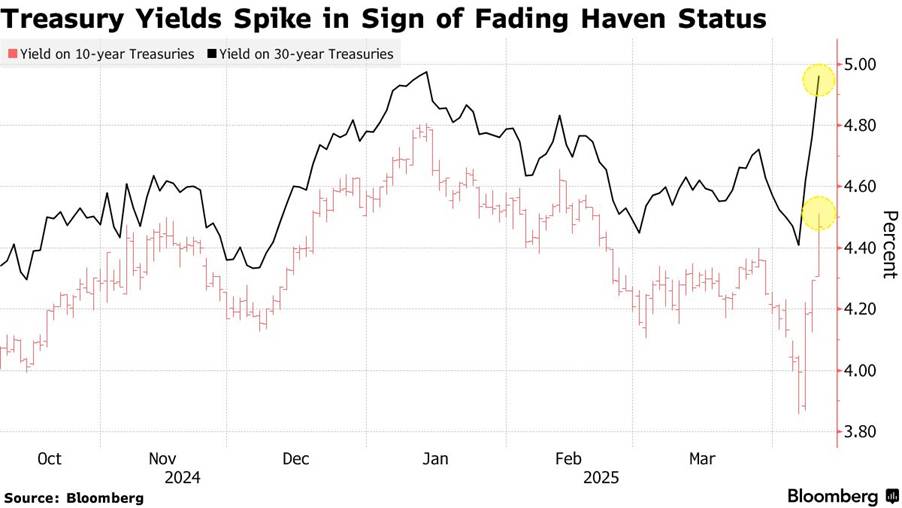

The ASX 200 fell another 135 points to 7375 (1.8%). At one point the market rallied to a drop of only 75 points as banks found defensive buyers. Resources were the point of pain as commodities fell on global growth and Chinese economic output. BHP fell % and FMG crashed % with LYC bucking the trend rising % as gold miners held relatively steady with bullion pushing higher. MIN fell 12.1% with PLS off 8.4% as NIC fell 14.1%. BSL continues to suffer, down 3.7%. Oil and gas stocks, dropped hard, STO down 5.7% and WDS off 3.7% with uranium under pressure again, PDN down 4.5% and DYL off 7.7%. Coal stocks fell too. Banks held up better, CBA up 0.5% with NAB down 0.7% and the Big Bank Basket down to $237.07 (-0.2%). Healthcare was hit, CSL down 5.0% on pharma taxes to come. COH also falling 2.6% with REITs down too. GMG off 1.6% and VCX falling 1.4%. Industrials were weaker across the board, WES fell 0.6%, WOW and COL eased with QAN down 4.0% and retail trying hard to hold the line. Tech stocks fell back to earth, WTC down 1.8% and XRO off 0.9% and the All-Tech Index down 1.9%. In corporate news, RPL fessed up to the FUM loss due to OPT and fell hard, down 11.9%. On the economic front the RBNZ cut rates by 25bps. Asian markets were volatile, Japan whacked again down 2.6% with China positive despite the 104% tariffs. HK down 0.6%. 10-year yields pushing up again. Long-dated yields are surging, whilst short-dated yields are falling. US 30-year now at 4.9%

HIGHLIGHTS

- Winners: TEA, HLS, BFL, CMW, BAP, A2M

- Losers: CIA, NIC, MIN, RPL, AAI, VUL

- Positive Sectors: Nothing.

- Negative Sectors: Everything.

- ASX 200 Hi 7474 Lo 7349 Closing near its low.

- Big Bank Basket: Falls to $237.07(-0.3%)

- All-Tech Index: Down 1.9%

- Gold: Rises to $5066

- Bitcoin: Falls to US$76376

- 10-year yield rises to 4.38%.

- AUD: Falls to 59.57c

- Asian markets: Japan down 4.2% with China up 0.1%. HK down 1.6%.

- Dow futures down 667 Nasdaq down 326

MARKET MOVERS

- HLS +4.5% defensive buyers.

- BAP +3.3% oversold.

- A2M +2.6% defensive Chinese exposure.

- RNU +14.3% small volume rise.

- CTT +5.7% change in substantial holding.

- NIC -14.1% commodities under pressure.

- MIN -12.1% dent load weighs.

- RPL -11.9% OPT exposure FUM falls.

- VUL -10.4% profit taking.

- MLX -9.3% tin falls.

- SLX -10.1% uranium falls.

- LRV -14.4% gold and antimony exposure.

- PMT -11.4% sinking into the ice.

- ASL -11.6% gather round presentation.

- Speculative Stock of the Day: OSX +93.8% European markets access granted.

ECONOMIC AND OTHER NEWS

- RBNZ cuts rates 25bps.

- India’s central bank (RBI) cut its policy rate by 25 basis points to 6%, marking its lowest level since September 2022 as growth concerns mount in the world’s fifth largest economy.

- The People’s Bank of China weakened the yuan’s daily reference rate for a fifth straight session on Wednesday, but moderated the pace of its adjustment.

- Chinese Premier Li Qiang said his country has ample policy tools to “fully offset” any negative external shocks.

- Trump says a tax on pharmaceuticals is coming soon.

- Temu and Shein hit with 90% tariffs.

- US tariffs cause car import pile-up at American ports.

- Shares of Chinese companies that are deeply embedded in US supply chains were among the worst hit during the morning sell-off. Shenzhou International Group Holdings, which gets 26 per cent of its revenue from Nike, fell 7.4 per cent.

- Trump revokes licences for BP and Shell projects in Venezuelan waters.

- Long bonds are being sold down hard. Not a good sign.

And finally….

If at first you don’t succeed, skydiving is not for you.

Clarence

XXXXX